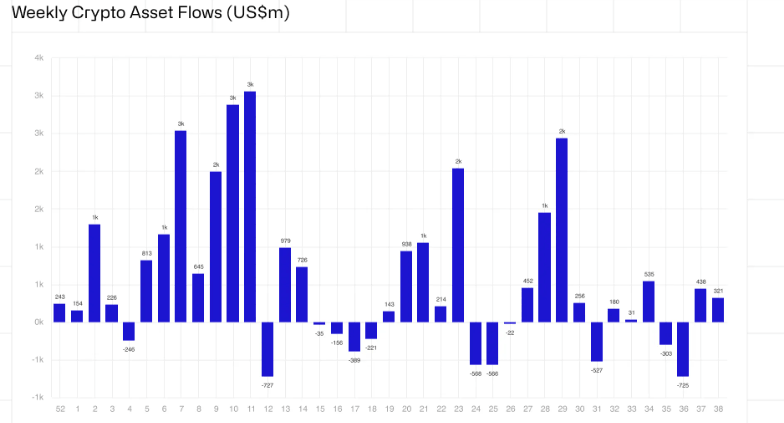

Crypto ETFs continue positive momentum with $321 million net inflows

- Digital asset products recorded a second week of inflows totaling $321 million, spurred by a 50 basis point rate cut.

- Bitcoin ETFs recorded the highest inflows, totaling $284 million.

- Ethereum ETFs posted $29 million in outflows, while Solana products witnessed inflows of $3.2 million.

Crypto exchange-traded funds (ETFs) witnessed a second consecutive week of inflows, totaling $321 million, per CoinShares weekly report on Monday. Bitcoin ETFs saw the largest share of inflows as expected, totaling $284 million, while Ethereum products stretched their outflows to five weeks of consecutive negative net outflows after shedding $29 million.

Bitcoin ETFs lead $321 million inflows following market rebound

According to the CoinShares report, crypto investment products recorded $321 million in inflows last week, fueled by a 50 basis point interest rate cut decision by the Federal Open Market Committee (FOMC) on Wednesday.

Following the rate cut decision, total assets under management jumped 9%, while total investment product volumes grew 9% week-on-week to $9.5 billion.

Weekly Crypto Asset Flow

Geographically, the US saw the highest inflows last week, totaling $277 million, while Switzerland recorded inflows of $63 million. On the contrary, Germany, Sweden, and Canada witnessed outflows of $9.5 million, $7.8 million, and $2.3 million, respectively.

Bitcoin ETFs continued to lead among asset classes, recording $284 million in inflows. Bitcoin trades just above $63,000 at the time of writing, rising over 22% since the Federal Reserve (Fed) rate cut decision on Wednesday.

According to Bitfinex data, Bitcoin remains just shy of an August 25th high of $65,200. The data further suggests a breach past August's resistance levels could propel BTC to new highs.

Conversely, reduced spot buying for Bitcoin could result in a price consolidation or a partial correction.

On the other hand, CryptoQuant's data suggests that long-term on-chain support levels indicate a positive outlook for BTC. The 7-day Simple Moving Average (SMA) of the fund flow ratio tapped 0.05, showing signs of a rebound.

Bitcoin Fund Flow

According to CryptoQuant, this rebound occurs after a bear market and the onset of a bull market, leading to significant surges in Bitcoin's price.

Meanwhile, Ethereum ETFs witnessed further outflows last week, totaling $29 million. Most of the outflows came from Grayscale's Ethereum Trust, and minimal inflows were from the newly issued ETFs.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi