Crypto crackdown to intensify as five US agencies join hands to form anti-crypto crime task force

- The new Darknet Marketplace and Digital Currency Crimes Task Force will be focused on the crimes conducted using crypto on the darknet.

- The five agencies include Homeland Security Investigations, Internal Revenue Services, Office for US Attorneys, Drug Enforcement Administration and Postal Inspection Services.

- Regulatory actions against crypto companies resulted in the market losing $114 billion this month, which has been recovered over the last week.

The crypto market is presently more vulnerable to regulatory actions than it is to crypto crashes, as has been experienced in the last few weeks. However, despite the bearish impact of the authorities on the crypto market, the regulatory bodies do not seem to be in the mood to back off.

US agencies form new anti-crypto crime task force

In an announcement on June 20, the Homeland Security Investigations, Internal Revenue Services, Office for US Attorneys, Drug Enforcement Administration and Postal Inspection Services came together to form a new task force.

Labeled as the Darknet Marketplace and Digital Currency Crimes Task Force, the team will be focusing on bringing an end to darknet drug vendors and cryptocurrency-enabled crimes. With the advent of cryptocurrencies, crime took a more sophisticated turn in technology-wise, making it harder to track and end such criminals.

In line with the same, Homeland Security Investigations (HSI) Arizona Special Agent in Charge Scott Brown stated,

“This task force will have impactful repercussions on those criminal operators who attempt to grow their businesses and launder the illicit proceeds through advancing technology. HSI looks forward to growing in this investigative space alongside our law enforcement partners”

Furthermore, different authorities handle different processes of such crimes and, over the years, have worked accordingly. However, since this task force mostly consists of all the major enforcement agencies of the United States, the process of bringing these crimes to an end will become significantly easier.

The regulatory crackdown has been at its peak over the last 12 months, with June 2023 taking the biggest blow due to regulatory actions. The Securities and Exchange Commission (SEC) brought charges against the two biggest cryptocurrency exchanges in the world, Binance and Coinbase. Additionally, a lawsuit was filed against them for allegedly violating securities laws.

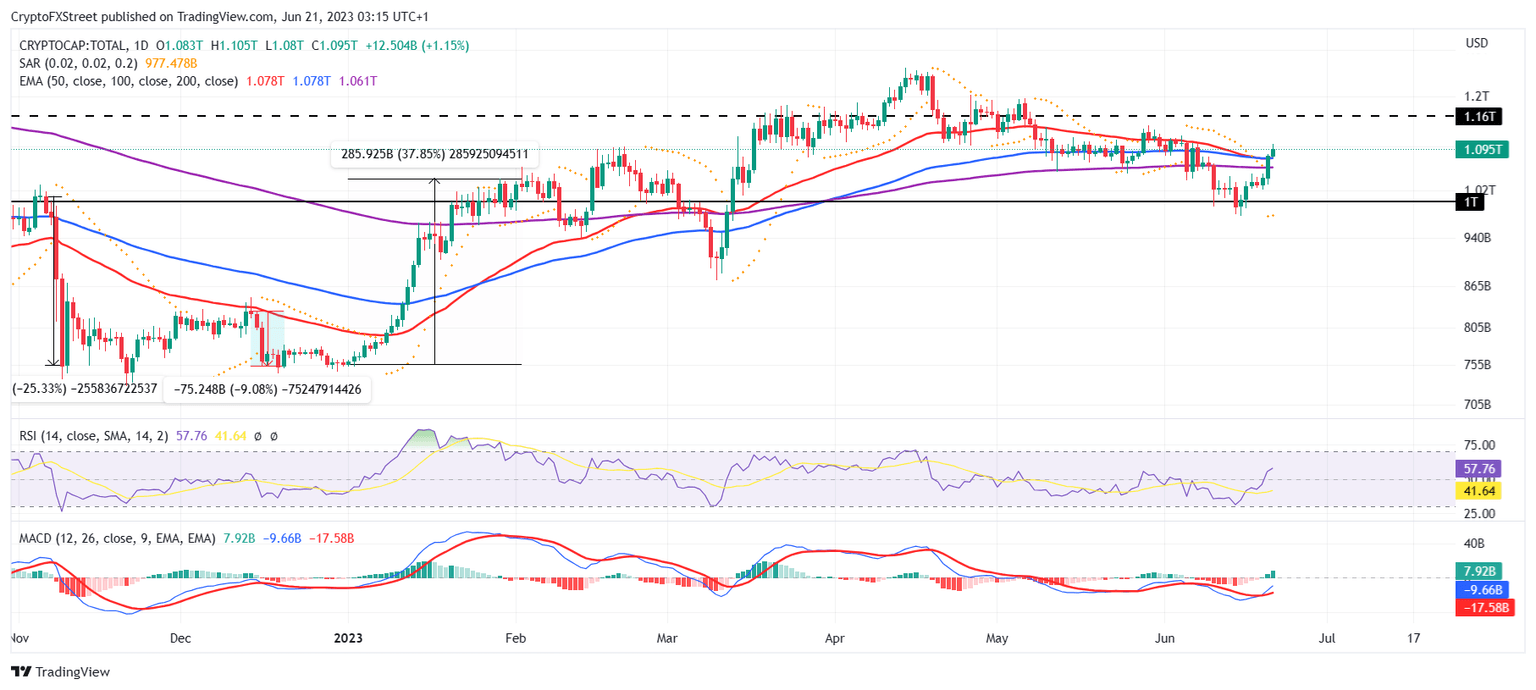

Consequently, the crypto market crashed by more than 10%, effectively wiping out over $114 billion. Although the market had experienced losses over the last seven days, it recovered quickly since investors' bullishness outweighed the bearish impact.

Crypto market capitalisation

Nevertheless, the crypto market remains vulnerable to such bearishness now that the agencies are forming a task force. However, since the task force will be pursuing criminal cases on the darknet and now securities violations, the impact may not be as terrible as the recent crash.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.