- Bitcoin and Ethereum prices plummeted by 2.5% over the past hour as liquidation across exchanges crossed $120 million.

- $114 million in long positions in Bitcoin and Ethereum were liquidated, fueling a bearish narrative among investors.

- Analysts predict Bitcoin price will drop below $39,000 support, and Ethereum struggles to move past resistance at $3,043.

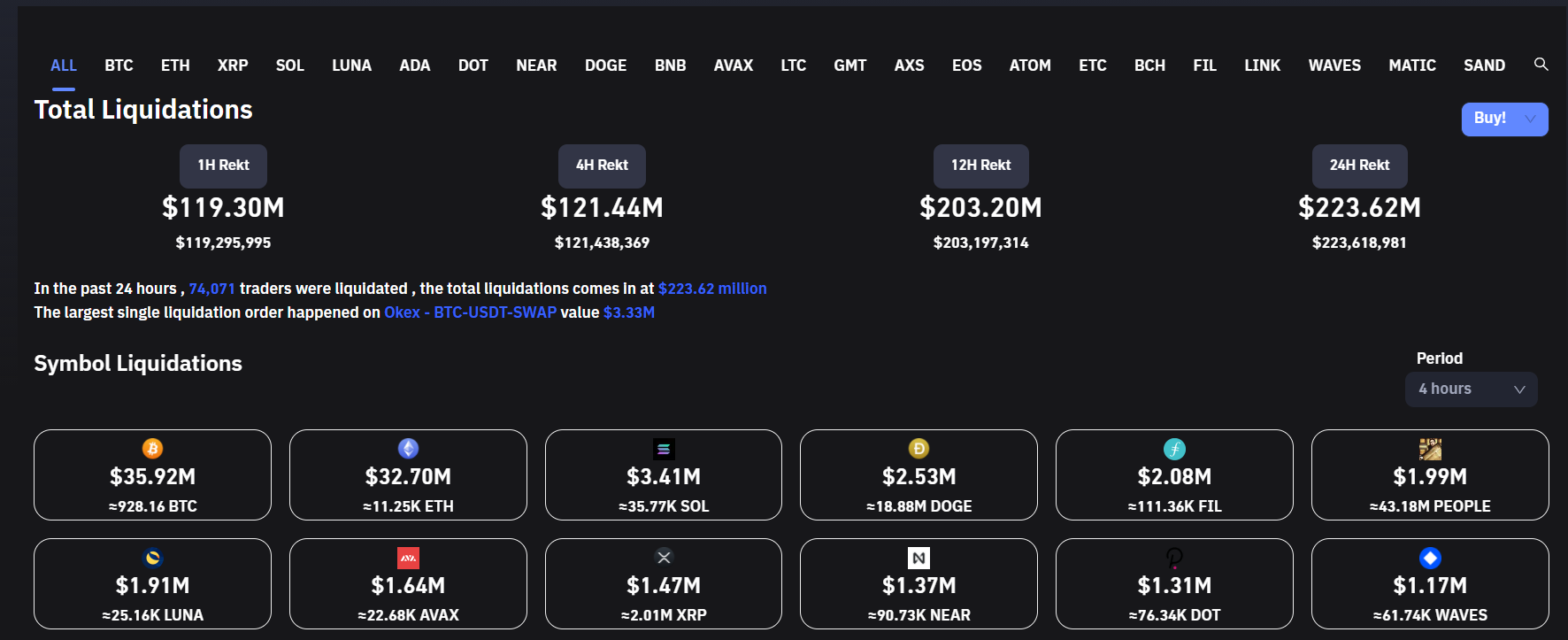

Bitcoin and Ethereum prices struggle to move past resistance as the crypto market downturn forces $120 million in liquidations. 95% of the liquidations are in long positions in Bitcoin and Ethereum.

Bitcoin and Ethereum prices prepare for drop with mass liquidation

Bitcoin and Ethereum prices witnessed a 4% drop overnight as $120 million in BTC and ETH positions were liquidated within an hour. Based on data from Coinglass, a crypto data analytics firm, 95% of the liquidations occurred in long orders.

Total liquidations over the past hour

Within a one-hour time frame, the Bitcoin price dropped below support at $39,000. Proponents have identified a sharp selloff in the Asian trading session on Monday as the key driver for the round of liquidations. Bitcoin and Ethereum prices posted a 4% drop, and the outlook among investors has turned bearish.

Altcoins like Cardano, Solana and Ethereum witnessed a sudden drop in their price, alongside liquidation in the Bitcoin and Ethereum market. A majority of the liquidation was in long positions, a total of $107 million, and another $3.91 million in short positions were liquidated.

Analysts have predicted a drop in Bitcoin and Ethereum prices. Crypto analysts at @TrendRidersTR believe Bitcoin’s weekly close was below the rider band, and the bearish momentum dot, a higher low was formed. This is a strong argument for bears as traders continue aggressive profit-taking and the trend remains indecisive.

$BTC Weekly close was bad, a full body candle below rider band and a bearish momentum dot, however it is still a higher low.

— Trend Rider (@TrendRidersTR) April 18, 2022

Strong arguments for bulls and bears. I will be focusing on low timeframe trades and agressive profit taking while the trend is undecisive. pic.twitter.com/gxZQibyVDO

@CryptoFaibik, a leading crypto analyst, believes Bitcoin bulls have fiercely defended the $39,000 support; however, losing this level could push BTC to the weekly EMA100 at $36,800.

So far $BTC Bulls Defending the 39k Crucial Support..!!

— Captain Faibik (@CryptoFaibik) April 18, 2022

If Bulls lost the 39k Support, Next Stop would be Weekly EMA100 (36.8k)#Crypto #Bitcoin #BTC #BTCUSD pic.twitter.com/BPuCLbvI6O

@ShardiB2, a crypto analyst and trader, believes Ethereum price could drop further as resistance at $3,043 poses a challenge for the altcoin.

$ETH

— Don't Follow ShardETH B If You Hate Money $ (@ShardiB2) April 16, 2022

Resistance continuing to present a problem here pic.twitter.com/RVD8Q1QIyh

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top gainers Virtuals Protocol, Floki, Hyperliquid: Altcoins extend gains alongside Bitcoin

The cryptocurrency market sustains a market-wide bullish outlook at the time of writing on Tuesday, led by Bitcoin (BTC) and select altcoins, including Virtuals Protocol (VIRTUAL), Floki, and Hyperliquid (HYPE).

Token unlocks over $625 million this week across major projects SUI, OP, SOL, AVAX and DOGE

According to Wu Blockchain, 11 altcoins with one-time tokens unlock more than $5 million each in the next seven days. The total value of cliff and linear unlocked tokens exceeds $625 million.

TRUMP meme coin on-chain activity surged following dinner announcement: Kaiko

Kaiko Research published a report on Monday highlighting the significant impact of TRUMP's team dinner announcement on the meme coin sector. The announcement triggered a surge in on-chain activity and trading volumes, with TRUMP accounting for nearly 50% of all meme coin trading volume.

Coinbase launches new Bitcoin Yield Fund, offering investors 4–8% annual returns

Coinbase has launched a Bitcoin Yield Fund, aiming to offer non-U.S. investors sustainable 4–8% returns paid directly in Bitcoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.