Cronos surges 20% on inclusion in Trump Media's Blue Chip ETF

- Trump Media plans to launch a Blue Chip ETF that will hold Cronos alongside other top cryptocurrencies.

- Crypto.com partnered with the Dubai Land Department to explore digital asset payments and tokenization in the country's real estate industry.

- CRO is up over 20% in the past 24 hours but faces at the $0.100 psychological level.

Crypto.com's native token Cronos (CRO) saw double-digit gains on Tuesday following Trump Media and Technology Group's (DJT) filing with the Securities & Exchange Commission (SEC) to launch a Blue Chip exchange-traded fund (ETF). The ETF aims to hold Cronos alongside Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and XRP.

CRO rallies following Trump Media Group's ETF filing, partnership with Dubai Land Department

Trump Media Group filed an S-1 registration statement with the SEC on Tuesday, seeking to launch a Blue Chip ETF that intends to hold five digital assets, including Bitcoin, Ethereum, Solana, Cronos and XRP. The fund aims to allocate 70% of its assets to Bitcoin, 15% to Ethereum, 8% to Solana, 5% to Cronos and 2% to XRP.

Yorkville America Digital will serve as the sponsor for the ETF, while Foris DAX Trust Company will serve as the custodian of the different cryptocurrencies it plans to hold.

The company previously announced a partnership with Crypto.com earlier in the year to launch a series of ETFs focused on holding US-native cryptocurrencies.

Meanwhile, Dubai's Land Department (DLD) stated on Sunday that it partnered with Crypto.com after signing a Memorandum of Cooperation with the exchange to explore a blockchain-based framework for real estate tokenization.

Likewise, the exchange revealed on Monday that the TON Foundation has become a client of Crypto.com Custody, allowing it to provide custody solutions for assets on the TON blockchain.

CRO jumps 20% but faces resistance at $0.100

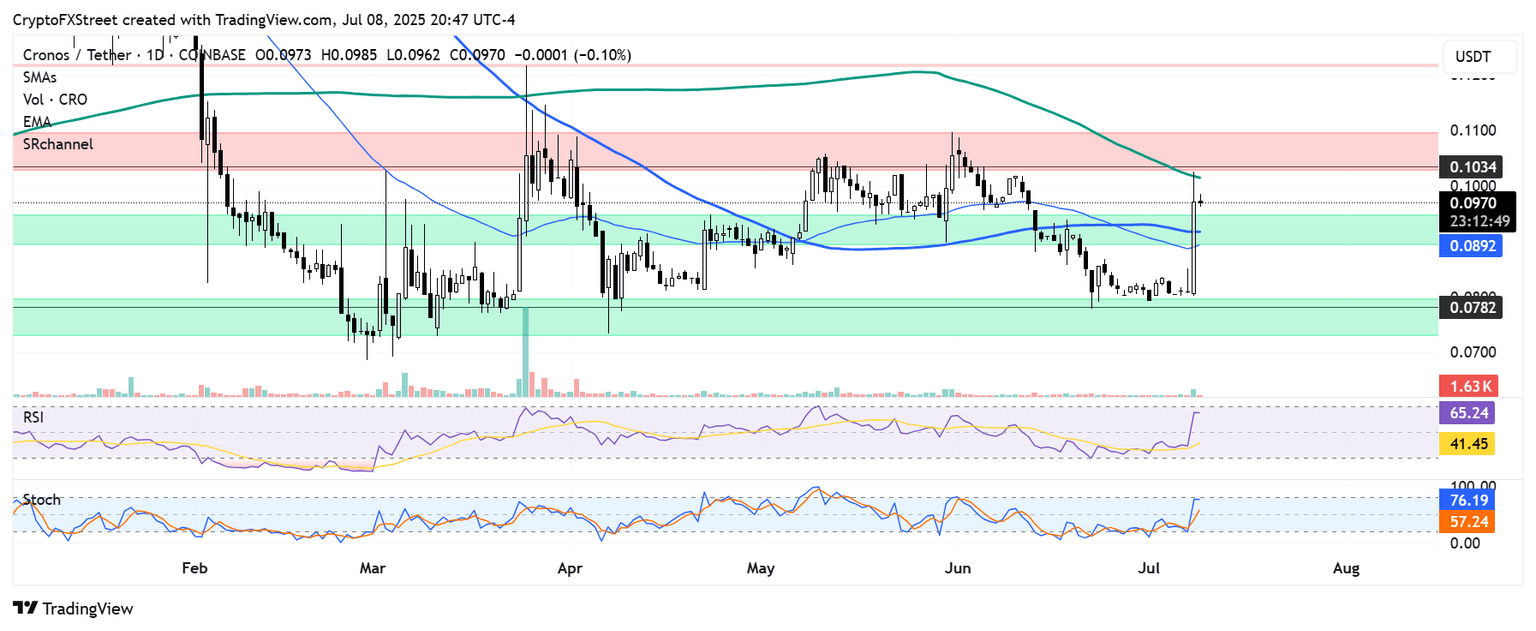

CRO surged over 20% in the past 24 hours following the developments before seeing a rejection near the $0.100 psychological level, strengthened by the 200-day Simple Moving Average (SMA). A move above $0.100 could see it tackle the $0.110 resistance.

CRO/USDT daily chart

On the downside, the Crypto.com native token could find support in the range between $0.089 and $0.094.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are above their neutral levels, indicating a dominant bullish momentum.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi