Cronos Price Prediction: CRO holders need to exercise caution as bears take the wheel

- Cronos price got hit hard during the European open.

- CRO tanked 5% in just a few hours and broke substantial support.

- Currently holding steady, CRO could be set up for a repeat of Thursday, where the US session eked out gains after all.

Cronos (CRO) price sold off this Friday around the time Europe began trading. With a violent drop of over 5%, bulls got caught by surprise. Although the situation looks grim, a turnaround into the US session could happen again with Cronos price back up around $0.08 near Friday’s close.

Cronos price has the RSI on its side for a turnaround

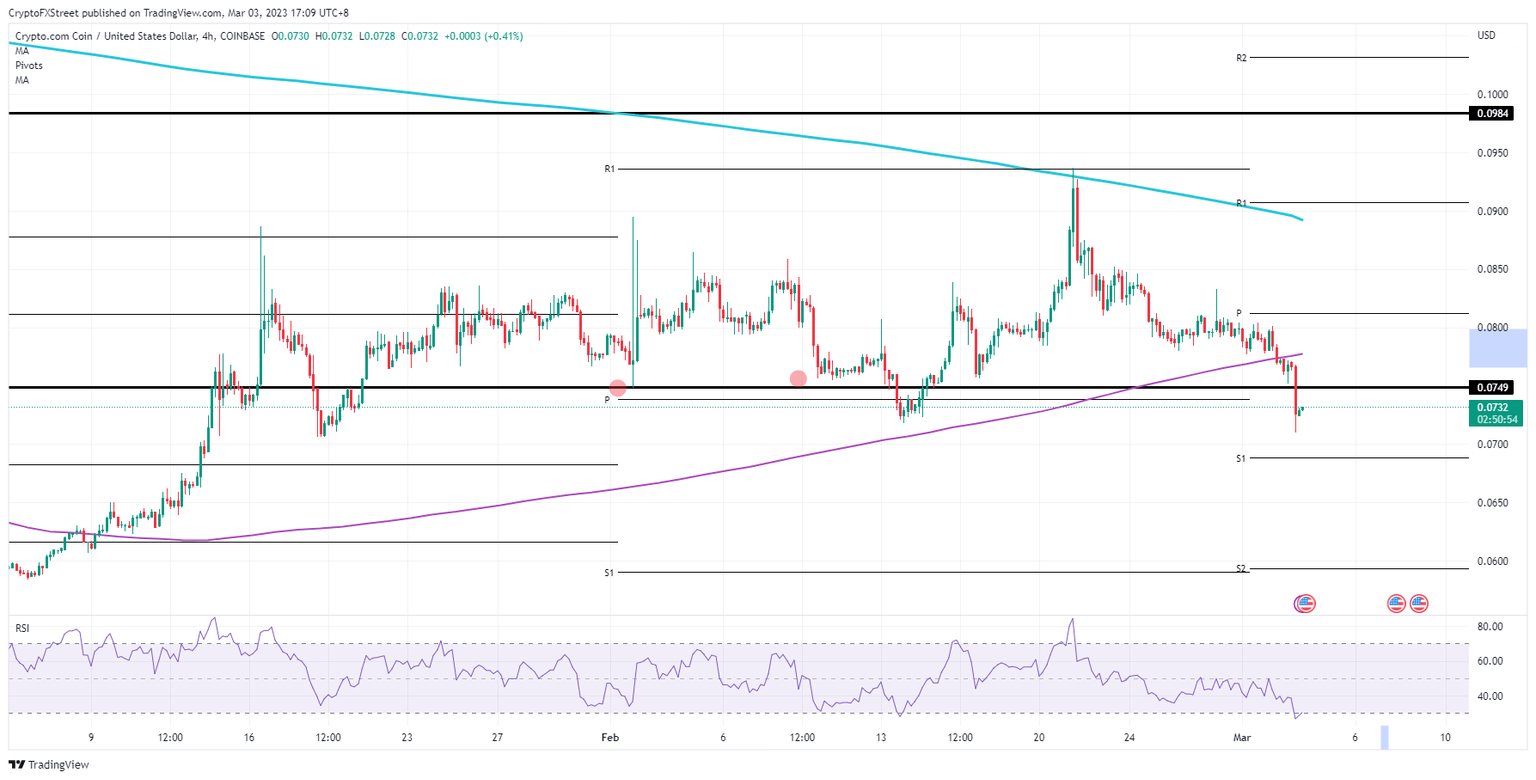

Cronos price has seen markets trading in a quite choppy manner these past 48 hours as altcoins are taking cover during the European and Asian trading hours, while during US trading hours they are bouncing higher. A similar pattern is underway for this Friday as Cronos price tanked during European hours. A bounce back up with the Relative Strength Index (RSI) currently oversold looks pretty good.

CRO would thus be able to erase that 5% loss and even might catch up with gains. Vital will be a break above $0.075. Once bulls can manage that, expect to see $0.08 in the cards when bulls are able to catch that 55-day Simple Moving Average as well and book a 4% profit for the day.

CRO/USD 4H-chart

A very big risk comes with that bounce back toward $0.075. Should bears use that level to push against any bullish recovery, a firm rejection could result in a dead-cat bounce and see bears earn even more losses. The CRO price target by the US closing bell will be around $0.07 most likely with the monthly S1 support underpinning the price action.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.