CRO price skyrockets after Staple Center is renamed Crypto.com Arena

- Crypto.com (CRO) soared more than 50% after winning the naming rights to Staples Center in a $700 million contract.

- CRO has completed a 50% Fibonacci retracement at the $0.6612 level.

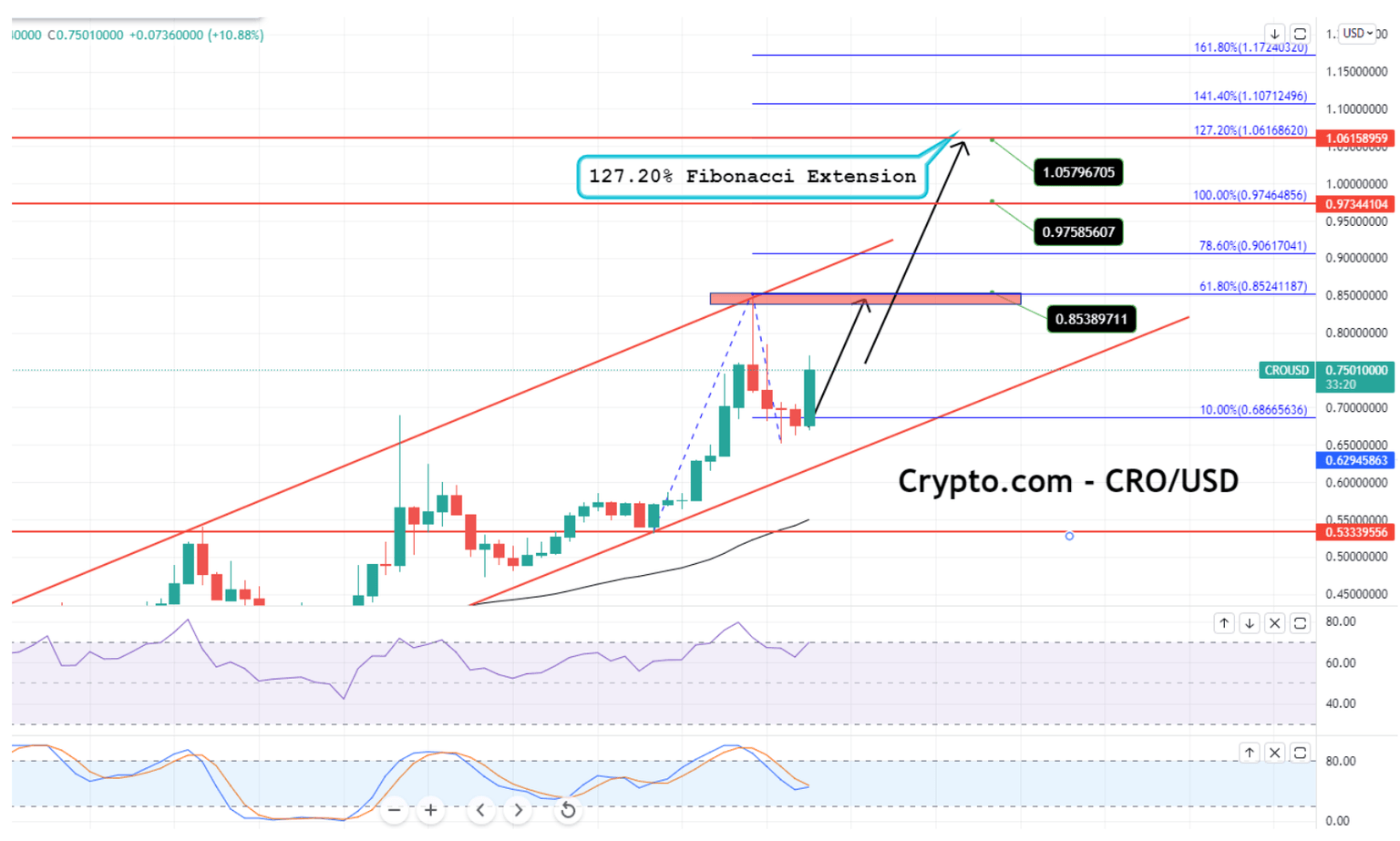

- Breakout of an all-time high of $0.085 can open a further upward trend until the 100% and 127.20% Fibonacci extension levels.

Crypto.com (CRO) is gaining traction as it unveils new features and grows its worldwide marketing campaigns and collaborations. CRO soared more than 50% after winning the naming rights to Staples Center in a $700 million contract, reaching a new all-time high of $0.85. Still, bulls have started to take profits as the coin entered the overbought zone.

CRO price prediction - 50% Fibonacci set to trigger a bounce-off

Crypto.com (CRO) plunged dramatically after setting an all-time high of $0.85. In the 4 hour timeframe, CRO price has completed a 50% Fibonacci retracement at the $0.66 level. The closing of a Doji candle above the $0.66 level is a supporting weakness in the selling bias.

The recent 4-hour candle seems to close as a bullish engulfing, which is indicative of a bullish reversal. With that being said, the odds of an uptrend continuation remain pretty solid, especially above $0.66 (50% Fibo level).

CRO price immediate resistance stays at the $0.76 level (23.6% Fibo level). A break above this hurdle could trigger an additional round of buying until the $0.85 level.

Crypto.com (CRO) 4-hour timeframe - 50% Fibonacci Retracement

Moreover, CRO price has formed an upward channel that’s extending strong support at the $0.62 level. Taking a look at the leading technical indicators such as Stochastic RSI and RSI are holding at 44.52 and 69.53, respectively. One is signaling a bearish trend, while the RSI is demonstrating a bullish bias.

The 50-day EMA is currently near the $0.55 level. Since the current market price of CRO is above EMA, the bullish bias dominates the market. Thus, the bullish breakout of a previously placed all-time high of $0.085 can open a further upward trend until 100% and 127.20% Fibonacci extension levels at $0.91 and $1.06, respectively.

Crypto.com (CRO) 4-hour timeframe - 127.20% Fibonacci Extension Pattern

It is worth noting that a rejection from the $0.66 level could open further room for selling until the 61.8% Fibonacci retracement level at $0.62. Breaching this support level might extend the correction towards $0.52.

Author

FXStreet Team

FXStreet