CRO price sees bulls using their last ammunition to attack $0.16

- Crypto.com Coin price action sees bulls nearing the overbought level.

- CRO price could still be able to squeeze out 5%.

- Expect to see the risk of another rejection and bulls being flushed out of their position in the aftermath.

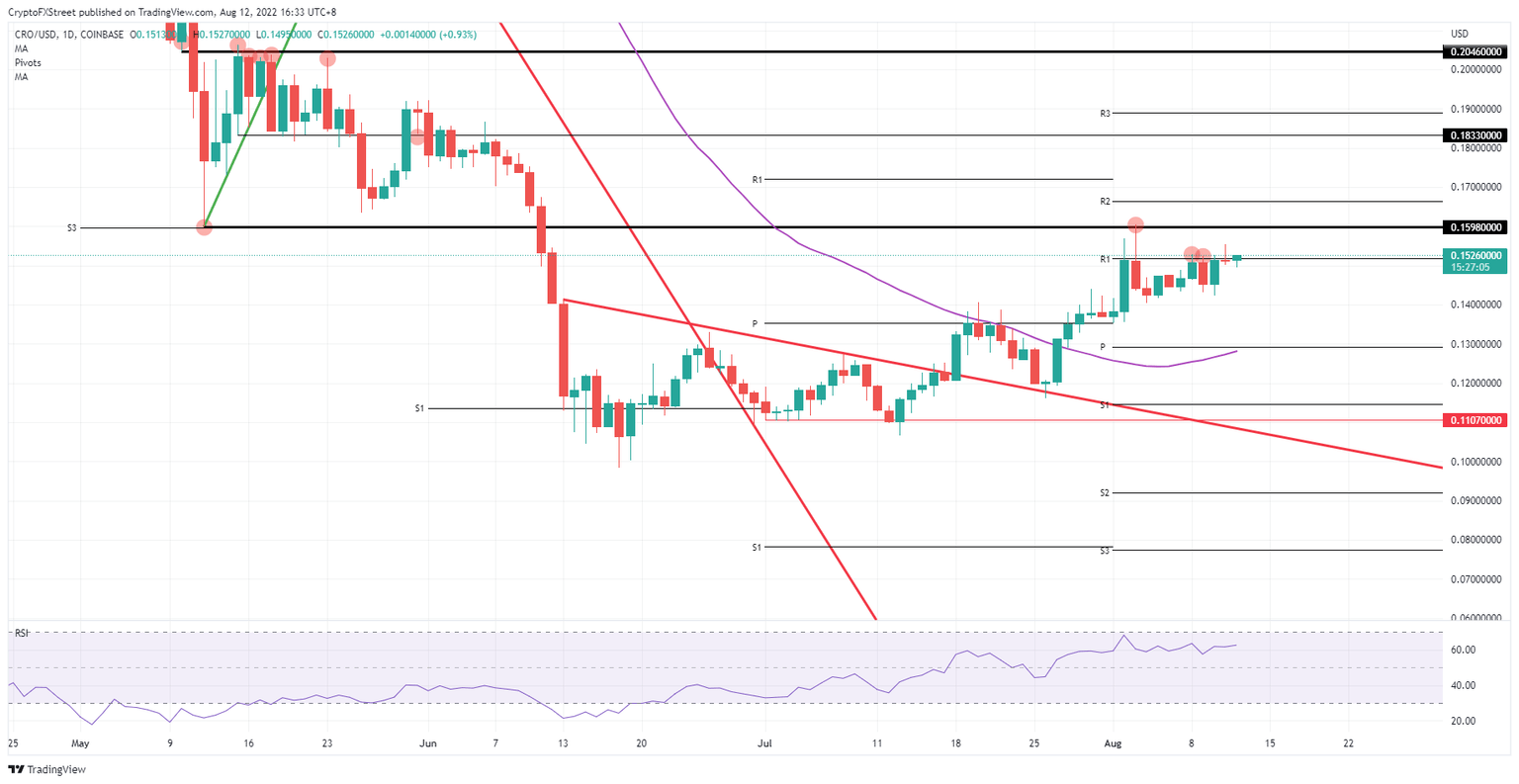

Crypto.com Coin (CRO) price action is looking to execute a bullish breakout above $0.16. Ignorant bulls will try to be part of that rally, but that could prove a big mistake as a few risks need to be taken into account to be sure that this rally still has legs. With a few elements set to offer resistance one possible outcome is for there to be a rebound off the $0.16 level leading to a pullback, where traders can then pick up some CRO at around $0.13.

CRO price set to make the same mistake twice

Crypto.com Coin price action has had a rough patch of trying to plant a flag above the monthly R1 this week. After several attempts, it took Thursday finally to be able to penetrate above it, although bulls failed to close above the level yet again. The ‘inverted hammer’ formation from Thursday only shows how largely bears are on watch and waiting for the right moment to go short.

CRO price also has a few other elements going against it besides the price action from this week, with the earlier rejection in the beginning of August against that $0.16, making it a good candidate for a double top rejection. To make matters worse, the Relative Strength Index is nearing the overbought area, which means that news buyers and new bulls will refrain from stepping in, seeing a limited profit horizon.

CRO/USD Daily chart

The best approach is to wait for signs of conviction, such as a daily close above $0.16 – to limit the risk of jumping in on a false break. The second scenario is to wait for the drop back to $0.13 and to scoop up some price action in CRO there. The overall target to the upside is set for $20, which would be a 27% return should bulls try to get in after the breakout above $0.16.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.