Crisis in the United States - Banks down, Investors out - but Bitcoin price rises to $28,500

- PacWest Bancorp, Western Alliance Bank and Metropolitan Bank all crashed by more than 20%, and their stocks had to be halted.

- Year to date, about $2 trillion has been wiped out of the US banking sector.

- Bitcoin price is trading above $28,500, and NUPL suggests that only 30% of the market cap is experiencing profits.

The banking crisis that first hit the United States of America in Q1 this year is seemingly beginning to take shape again. The last time this happened, Bitcoin price had a good time, and by the looks of it, the conditions are certainly pointing towards a similar outcome this time around.

The US banking crisis continues

Over the last 24 hours, many regional bank stocks crashed in just a couple of minutes during the day, and as a result, their trading had to be halted. The ones that topped the list were PacWest Bancorp, which plunged by 29%, followed by Western Alliance Bank, plummeting by 25%, along with Metropolitan Bank, which declined by about 24%.

But as terrible as the condition of the market is at the moment, the year-to-date shrinking of these stocks’ value is far more terrible. Notable financial commentator, The Kobeissi Letter, brought these banks to light, tweeting,

1. HomeStreet, $HMST: -75%

2. PacWest, $PACW: -71%

3. Metropolitan Bank, $MCB: -64%

4. Zions Bank, $ZION: -51%

5. Western Alliance, $WAL: -47%

6. KeyCorp, $KEY: -45%

7. HarborOne, $HONE: -39%

8. Valley National, $VLY: -35%

9. Truist, $TFC: -33%

10. Citizens Financial, $CFG: -32%

All in all, since January 1, the US banking sector has erased nearly $2 trillion, including the losses from the collapse of the Silicon Valley Bank, Signature Bank, Silvergate Bank and the First Republic Bank.

The commentator also discussed why the Federal Deposit Insurance Corporation (FDIC) is refraining from making any move. The Kobeissi Letter speculated that the regulators do not want to public to perceive their actions as “bailouts” after what happened in 2008…This option is perceived as “safer,” but this is a short-term viewpoint.”

They further added that the entire US banking system could end up being controlled by the top 15 banks eventually. The top banks already control 75% of all US deposits, and this figure could shoot up to 90%.

Put simply, the adverse development in the US banking sector puts Bitcoin in a favorable position.

Bitcoin price rises, but crypto struggles

Bitcoin price rose by more than 2% on May 2 to close above $28,500 as some US banks struggled. Furthermore, if the banking crisis continues, there would be room for further growth. This would be akin to the Q1 banking crisis when BTC noted a near 40% rally, thanks to its decoupling from the US stock market.

BTC/USD 1-day chart

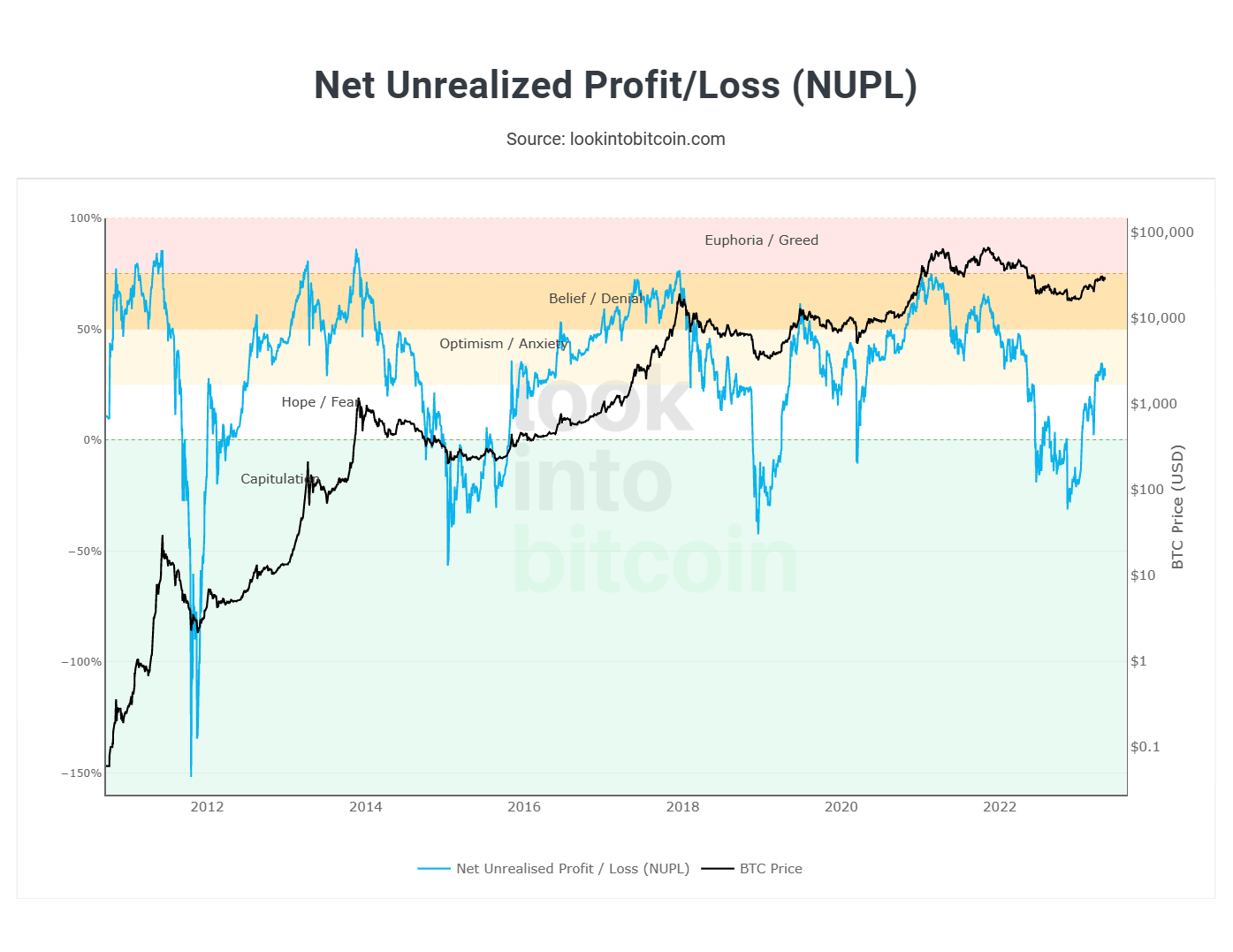

Additionally, the Net Unrealised Profit/Loss indicator (NUPL) suggests that only 30% of the market cap is experiencing profits at the moment. The indicator’s presence in the optimism zone further dictates that there is more to come for the cryptocurrency since nearly 70% of the market cap is yet to realize gains.

Bitcoin NUPL

However, the lack of regulatory clarity is still an issue, as it is apparently driving investors away from the US. According to the founder of Blockworks, Jason Yanowitz,

Just got off the phone with a killer founder.

— Yano (@JasonYanowitz) May 2, 2023

He said it's no longer worth the risk to build a crypto business in the United States so he's pivoting.

Slowly but surely we're killing innovation and pushing our best entrepreneurs offshore.

Instances of the same presently exist as Coinbase earlier this week launched its international derivatives exchange for users in eligible jurisdictions outside the US. Syndica - a web3 cloud infrastructure developer - also opened an entity in Dubai this year owing to the regulatory uncertainty in the country.

If such situations continue developing in the country, the crypto market will eventually take a hit, which would not be favorable for Bitcoin or the altcoins.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.