Bitcoin (BTC $30,213) begins a new week barely clinging to $30,000 as a “bearish divergence” sets the tone.

After a quiet weekend, BTC price action faces a potential pullback period within its broader bullish trend, traders say.

What could be on the menu for the market this week?

After a relative period of calm, external triggers are back for risk assets, with a slew of United States macroeconomic data releases combined with multiple speeches from Federal Reserve officials.

Add to that some interesting dynamics around U.S. BTC buying now in play, and the recipe for volatility is there.

Cointelegraph looks at these factors and more in the weekly rundown of what might move markets in the coming days.

Limp $30,000 support gets traders hungry for BTC price dip

Bitcoin may have closed the week at just over $30,000, confirmed by data from Cointelegraph Markets Pro and TradingView, but its strength now looks less convincing.

A dip into the $20,000 zone immediately afterward set the tone for traders, who believe that a retracement period could enter before upside resumes.

BTC/USD 1-hour chart. Source: TradingView

“Will be looking for trend continuation so another higher low between current price & $28K,” trader Skew explained in his short-term forecast.

Else obvious weakness leads to a break in the 1W structure (Equal high & LL below $25K).

BTC/USD annotated chart. Source: Skew/Twitter

Fellow trader Jelle eyed a warning sign on weekly timeframes.

“Bitcoin locked in a weekly bearish divergence overnight,” he told Twitter followers about relative strength index (RSI) behavior after the candle close.

Time to play defense for a while. The bull market is coming, but pullbacks are part of the game. Bidding lower, let’s see.

BTC/USD annotated chart with RSI. Source: Jelle/Twitter

For Crypto Tony, the downside could be limited to $29,500, this complementing a previous trip to new yearly highs the week prior.

“Sweep of $29,500 makes sense to me as the bulls just seem weaker and weaker right now. We have a sweep of the liquidity above us, so now it is time to grab the liquidity below us If you are not yet in a position, be sure to wait for this test and reclaim,” he summarized.

A further post zoomed out to predict up to 40% higher for BTC/USD in 2023, this nonetheless to be followed by a “bigger correction.”

BTC/USD annotated chart. Source: Crypto Tony/Twitter

Eight Fed speakers accompany major macro data week

Macro commentators have their work cut out this week as the Consumer Price Index (CPI) leads U.S. economic data prints.

Due on July 12, CPI showing inflation dropping will go some way to lessening a still-hawkish Fed.

Markets almost unanimously agree that interest rates will rise again after last month’s pause, with trend-beating data apt to spark some last-minute uncertainty.

CPI will be followed by Producer Price Index (PPI) a day later, while a total of eight Fed officials will deliver remarks on the economy and policy.

“Volatility is set to return to markets this week,” financial commentary resource, The Kobeissi Letter, forecast while summarizing the calendar.

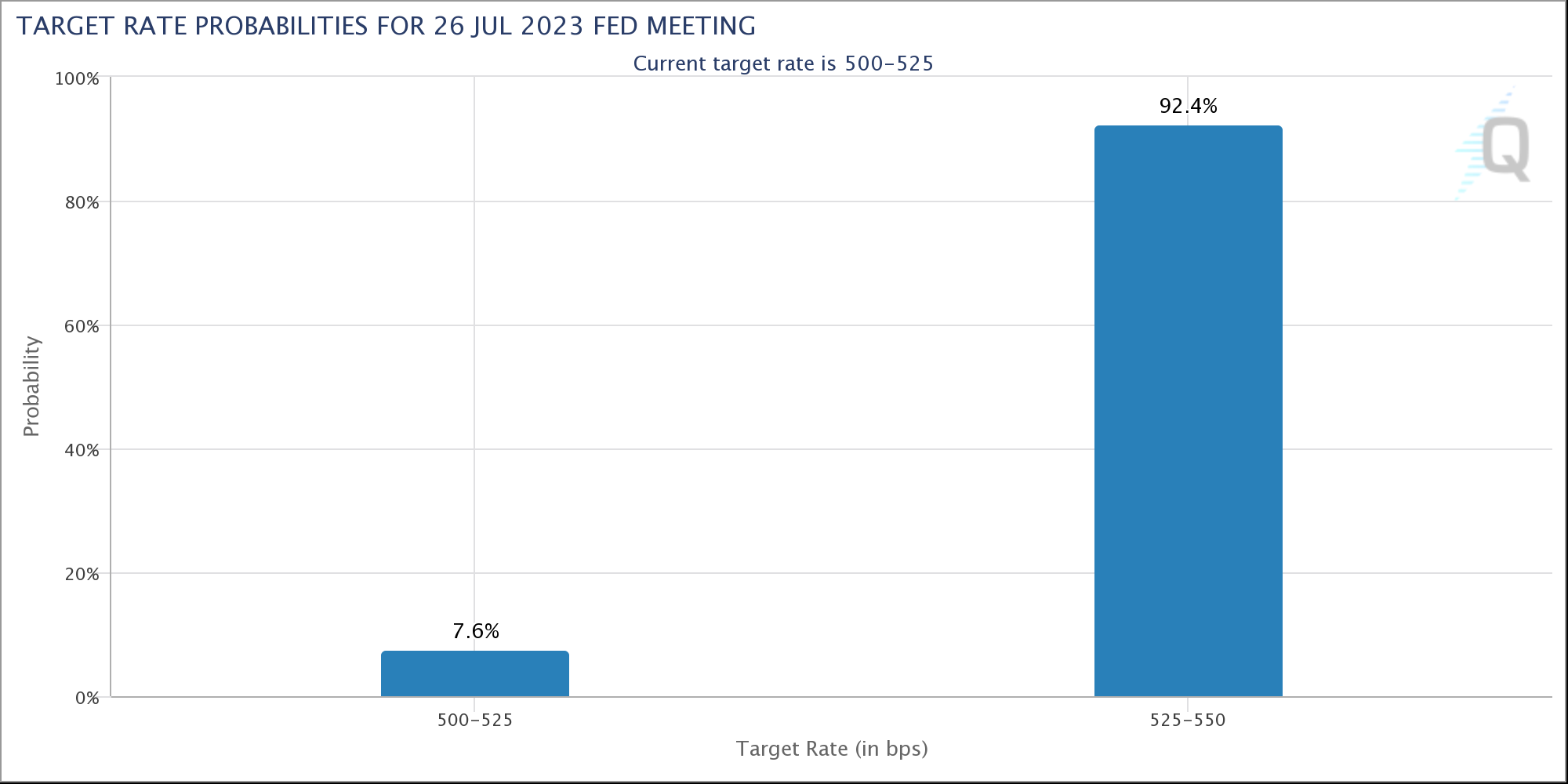

The latest data from CME Group’s FedWatch Tool put rate hike odds at 92% at the time of writing, slightly down from last week’s 95% figure.

Fed target rate probabilities chart. Source: CME Group

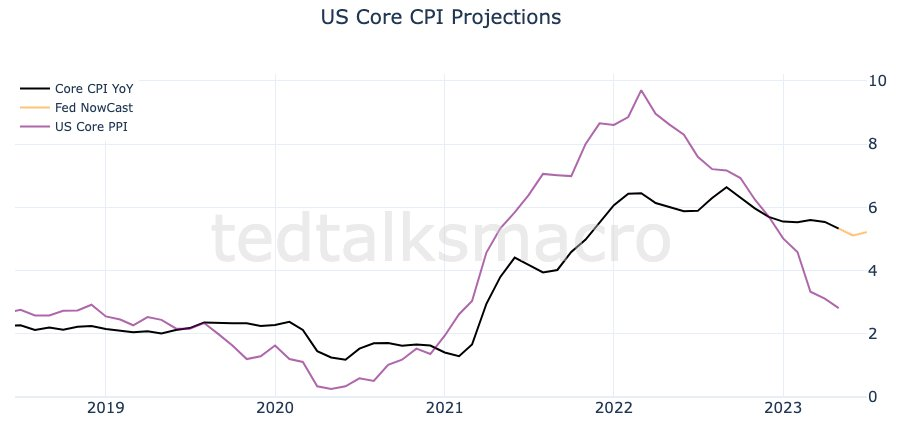

Continuing, financial commentator Tedtalksmacro argued that core CPI would be the figure to watch for the Fed.

“Headline is expected to fall to 3.20% YoY, which would make for the lowest print since March 2021. The Cleveland Fed, University of Michigan + Truflation all anticipating a similar number,” he noted in part of a Twitter thread.

Core CPI is expected to tick lower to 5.1% YoY, the lowest level since November 2021. Core remains the concern for the market, and I'd anticipate the market gives it more weight in it's reaction on Wednesday.

U.S. core CPI projections chart. Source: Tedtalksmacro/Twitter

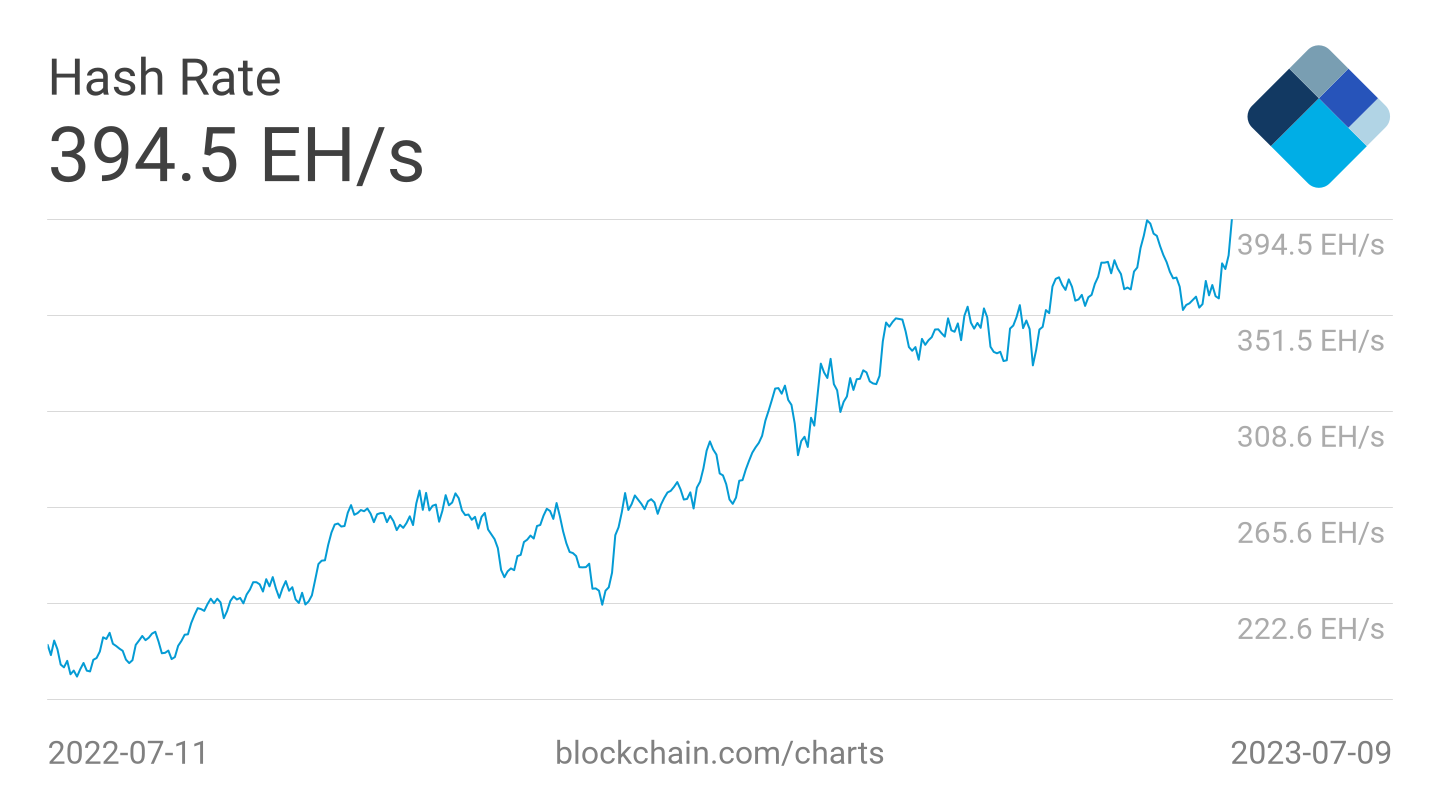

Bitcoin mining difficulty following hash rate to fresh record high

In a refreshing turnaround, Bitcoin network fundamentals are gearing up to hit new all-time highs in the coming days.

The latest estimates from BTC.com predict that network difficulty will jump by more than 5% — its largest single upward adjustment since late March.

Bitcoin network fundamentals overview (screenshot). Source: BTC.com

Given stagnant price action, this is significant, speaking to ongoing competition in the mining sector and increasing belief in future profitability. In doing so, the difficulty will cancel out its previous dip to hit new record highs of around 53.2 trillion.

A similar story concerns hash rate, which by some estimations, crossed the 400 exahashes per second (EH/s) mark for the first time in recent days.

Bitcoin estimated total hash rate chart. Source: Blockchain.com

BTC price remains more than 50% below its 2021 peak, lending additional weight to the classic adage, “price follows hash rate.”

Commenting on what might come, Blockware mining analyst Joe Burnett suggested that Bitcoin would return to finish what it started after the 2020 breakout to pass its all-time highs three years earlier.

“During the 2017 bull run, there was no national mining ban that put half of the entire network hashrate out of business, and there were also no fake coins being sold by FTX, BlockFi, and Celsius,” he reasoned.

Most are not ready for the next parabolic run.

BTC supply shock “inevitable”

The recent filings for Bitcoin spot price exchange-traded funds (ETFs) in the U.S. has kickstarted a buying spree.

As Cointelegraph reported over the weekend, U.S. activity is back trending higher, vying with Asia when it comes to BTC supply ownership.

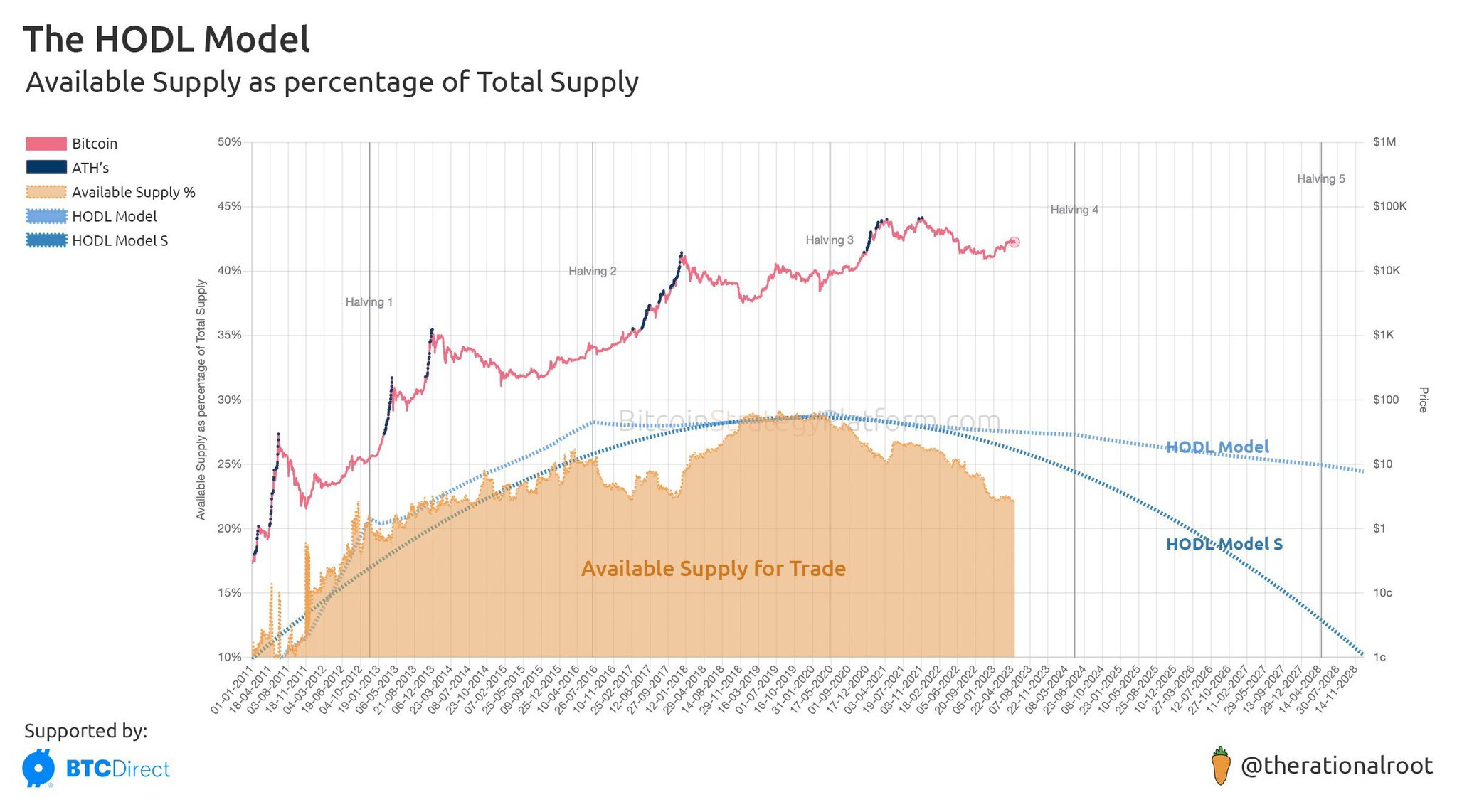

The implications for the dwindling supply become clear over longer periods, analysis argues, with just 7.5% of Bitcoin’s immutable 21 million coins left to mine.

“During this Bitcoin cycle, differently from the 3 previous cycles. the amount of Bitcoin available to trade decreased over time,” commentator Alessandro Ottaviani argued this weekend.

If the trend continues, a supply shock is inevitable. It is only a matter of time, we just don’t know when. Being Bitcoiners, we can wait, because if we are Bitcoiners our Time Preference is low.

Ottaviani uploaded a chart known as the “HODL Model” — a popular tool mapping supply availability versus price performance into the future.

Bitcoin HODL Model chart. Source: Alessandro Ottaviani/Twitter

On the topic of ETFs, notably that of the largest global asset manager, BlackRock, Ottaviani added that the mainstream narrative was already switching to condoning Bitcoin instead of bashing it.

Big fish step up exposure

It is not just miners showing “confidence” when it comes to future Bitcoin profitability.

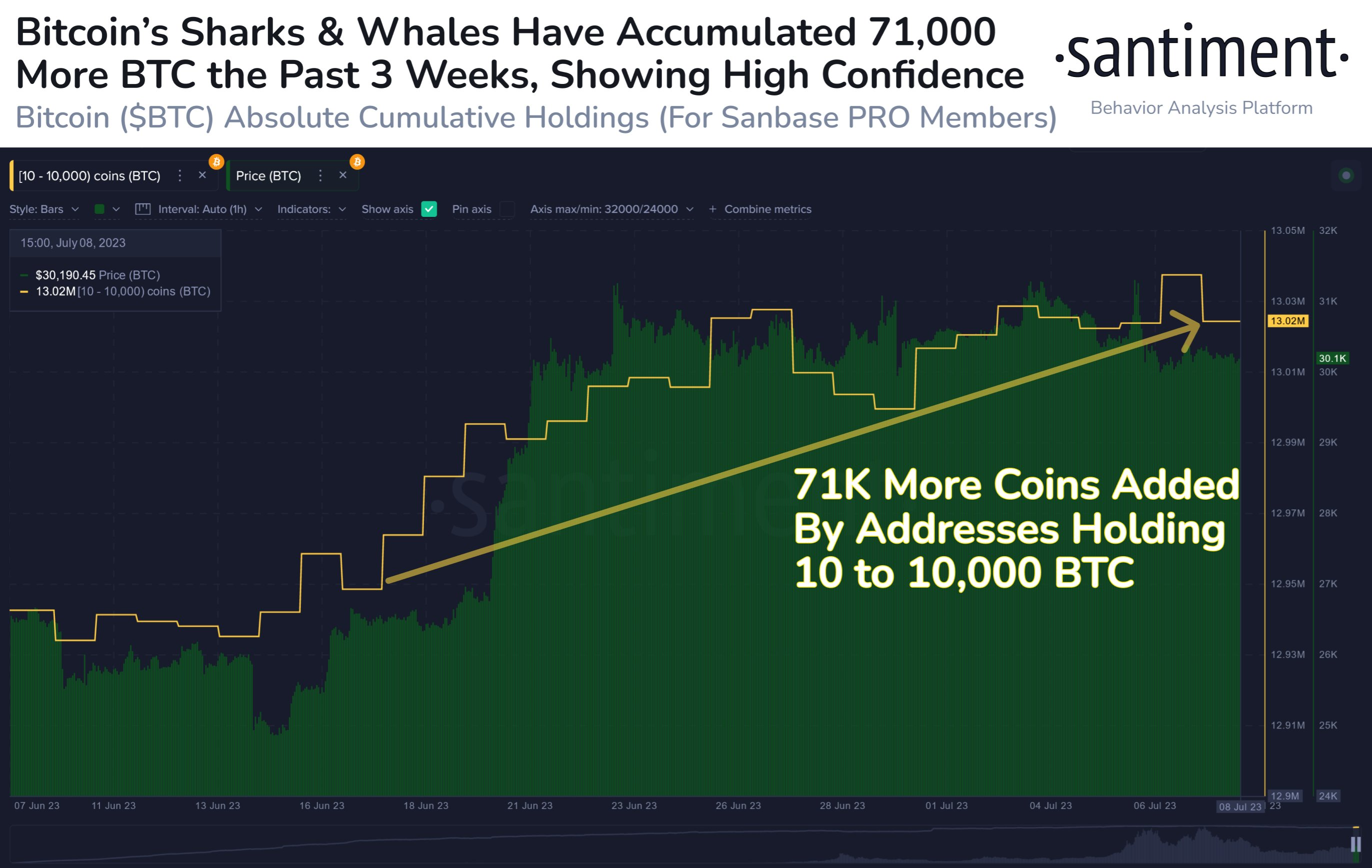

As noted by research firm Santiment this weekend, the largest-volume Bitcoin investor cohorts are keenly buying, even amid stagnant BTC price conditions.

Since mid-June, so-called sharks and whales — entities with between 10 and 10,000 BTC — have increased their exposure by over 70,000 BTC.

“Bitcoin’s sharks and whales aren’t showing any signs of slowing down, even with prices beginning to get ‘boring’ in this $30k to $31k range,” Santiment commented.

Since June 17th, 10 to 10k $BTC addresses have accumulated 71k more coins, equating to $2.15 billion.

Bitcoin shark and whale data annotated chart. Source: Santiment/Twitter

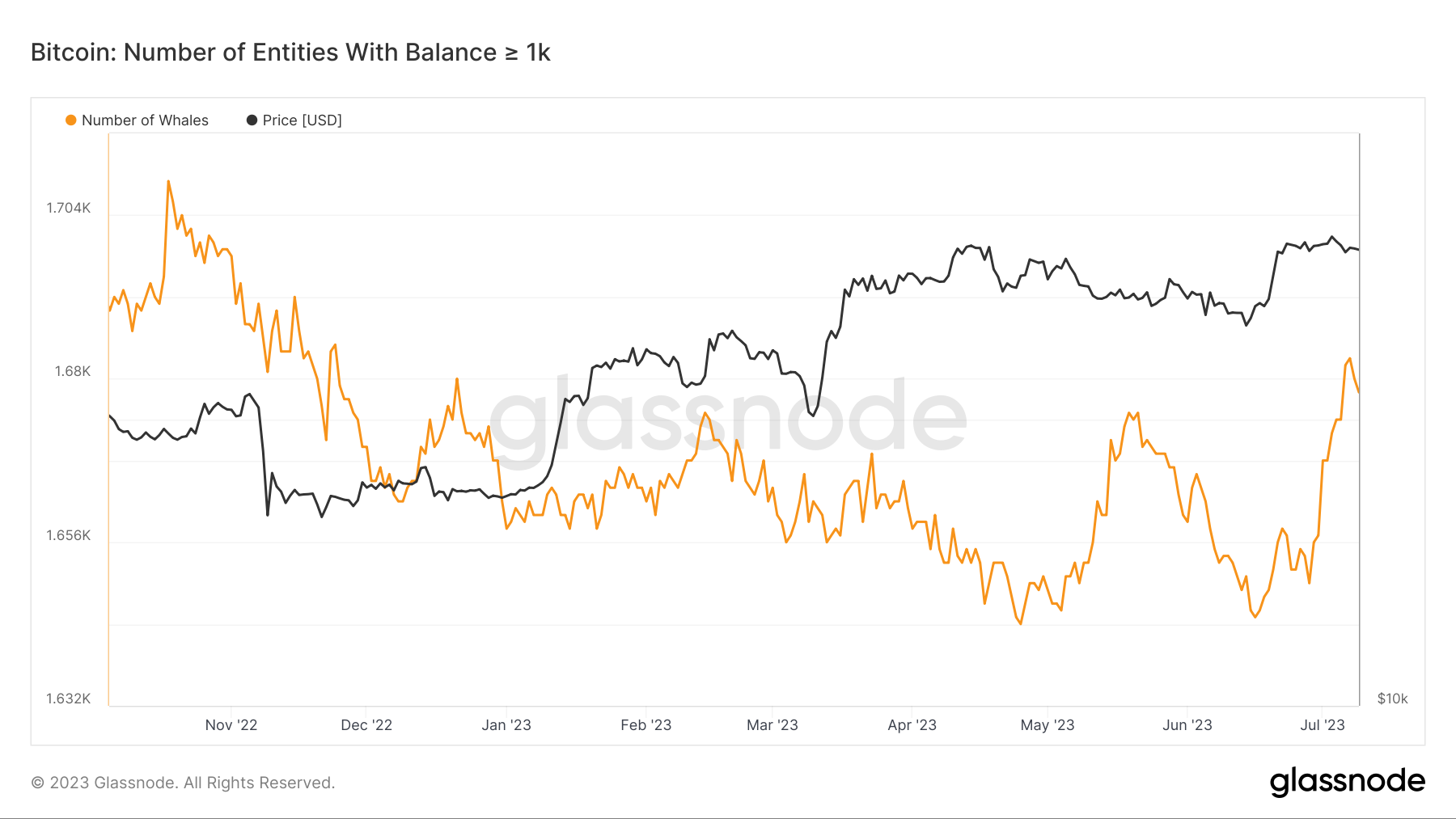

Separate data from on-chain analytics firm Glassnode shows whale numbers — those with at least 1,000 BTC — at eight-month highs.

Bitcoin whale entities chart. Source: Glassnode

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.