Cover Protocol shuts down as developers abandon project, COVER price crashes 25%

- Cover Protocol is shutting down as developers quit the project.

- The DeFi protocol suffered a major hack last year, leading to the team announcing the end of the insurance project.

- COVER price suffered a 25% crash since the announcement was made, as users were advised to withdraw funds as soon as possible

Decentralized finance insurance protocol Cover is closing its doors, as its core contributor announced on September 5 that it is the official end of the project. After the team reviewed the protocol’s path forward, the final decision was made to shut down after its launch around a year ago.

Embattled Cover faces unfavorable state of affairs

Cover Protocol allowed investors to lock up Cover tokens as collateral. In turn the users would be able to receive tokens as an insurance payout if the DeFi protocols they invested in were hacked or rug-pulled.

A few months after its launch, Cover encountered a minting hack that left its customers uncovered by its insurance policies. The hacker subsequently returned the stolen 4,350 ETH to the protocol, sending a warning message attached to the transaction suggesting that the firm take care of its business. The DeFi insurance firm redistributed the funds to its users but witnessed its token’s value fall by 96%.

Earlier this year, Yearn.Finance severed ties with Cover, adding to the unfavorable circumstance the insurance project was already facing.

A core contributor to Cover Protocol, DeFi Ted announced on September 5 that the project would be shutting down. The project leader also said that the team will disperse the remaining treasury funds to token holders as of block 1,316,680. He further explained that the core developers suddenly left the project and advised users to withdraw funds from Cover protocols immediately.

COVER fell over 25% after the announcement was made, as a huge spike a selling volume was witnessed, taking the token to a swing low of $203.

Cover price plummets as investors exit the dead protocol

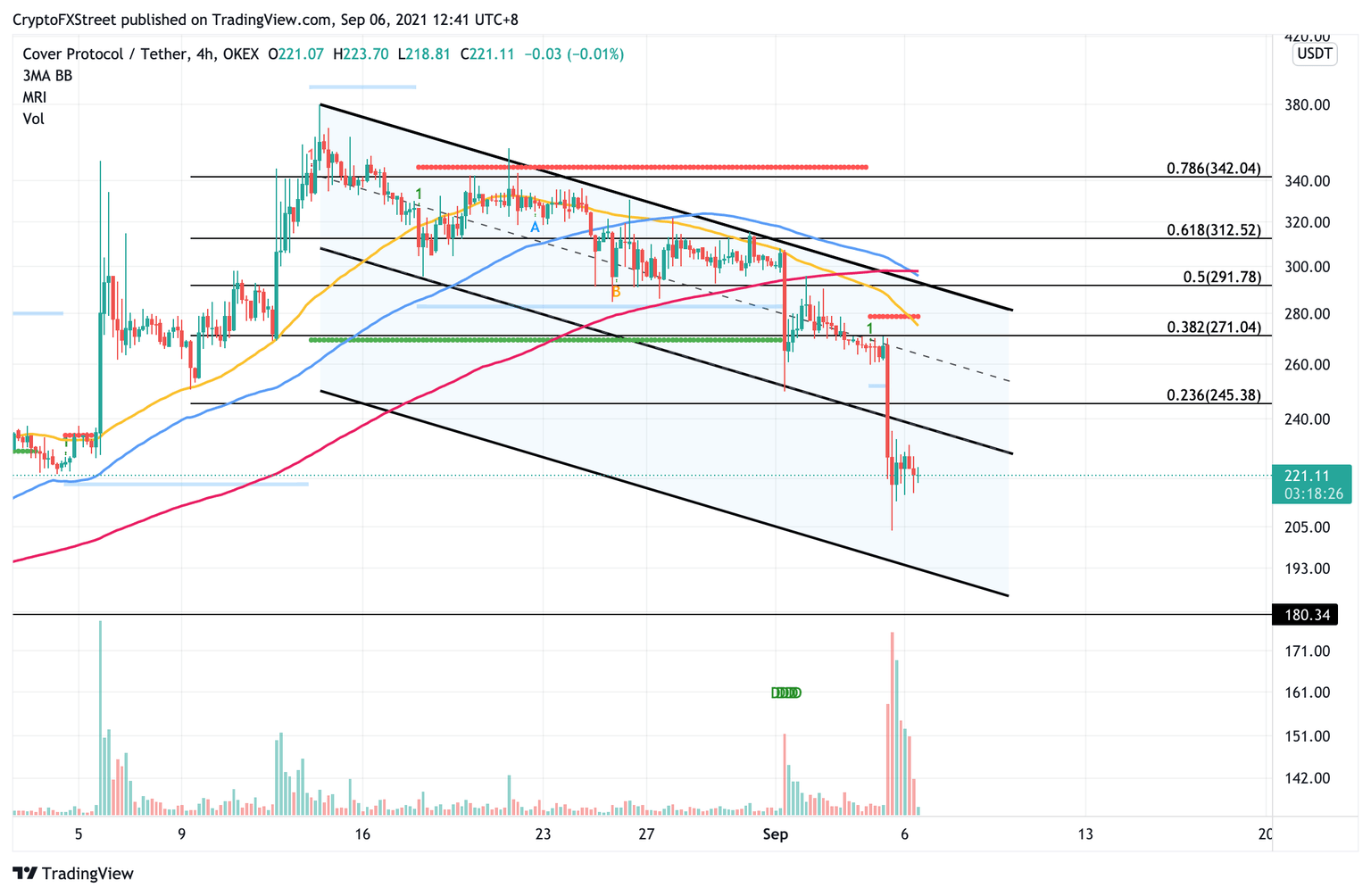

Cover price lost 25% of its value after the project revealed that it was shutting down. Selling volume skyrocketed as investors rushed to exit positions. COVER has continued to trend downward in a descending parallel channel pattern since August 14.

COVER eventually sliced below the lower boundary of the chart pattern on September 5, revealing its vulnerability for a 19% plunge. Although selling activity seemed to have reduced, Cover price could still be headed lower, given the extraordinary circumstances the project is facing.

COVER/USDT 4-hour chart

The next target for the bears is at the downside trend line of the lower parallel channel at $192. Further selling pressure could see COVER reach the July 22 low at $180 before falling further.

There seems to be little hope for Cover price. Should it miraculously recover, resistance will emerge at $235, at the lower boundary of the governing technical pattern, which acted as support for COVER for nearly a month.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.