Countdown to Grayscale’s big BTC unlock: Five things to watch in Bitcoin this week

Bitcoin (BTC) starts a new week in familiar territory — crucial support is back, but bulls have not yet got their breakout. Could that soon change?

After reclaiming $33,000 on Friday, BTC/USD has held on to the trading corridor it had been in before last week’s brief volatility.

That involved a dip to $32,000 on the back of sudden short positions accumulating on exchange Bitfinex.

The impact was only temporary, however, and the weekend saw highs of $34,600 on Bitstamp.

Cointelegraph presents five factors to consider when eyeing what Bitcoin might do next.

Stocks boom as USD hits classic resistance

With stocks going upward as usual, there seems to be little in terms of friction that could cause problems for cryptocurrency gains.

While analysts are increasingly warning about a comedown in the future, the mood in equities remains firmly buoyant this week.

“There does seem to be a complacency that Goldilocks is not only alive and well, but that it’s getting stronger by the day,” Simon Ballard, chief economist at First Abu Dhabi Bank, told Bloomberg.

“Unfortunately, it has to be recognized that going forward, the longer that rates remain where they are, the more that we look toward tapering, the more severe and acute could be the reaction.”

The United States dollar, however, could provide more clues.

Taking a look at the U.S. dollar currency index (DXY), which measures USD strength against a basket of 20 trading partner currencies, the picture shows some familiar resistance is back in play.

Late last week, one analyst argued that DXY needed to rise from its current 92.2 to around 94 in order to see major resistance kick in, which would boost Bitcoin.

On Monday, however, DXY is still recovering from losses it incurred at the end of the week, also battling a zone that has kept it in check in the past.

Bitcoin’s inverse correlation to DXY has also been placed under the microscope recently, as BTC increasingly forges its own path within the macro environment.

U.S. dollar currency index (DXY) 1-day candle chart. Source: TradingView

Bitcoin price “doing all the right things”

Looking at the spot market, traders are bullish at the prospect of $33,000 returning and enduring after a brief bearish episode last week.

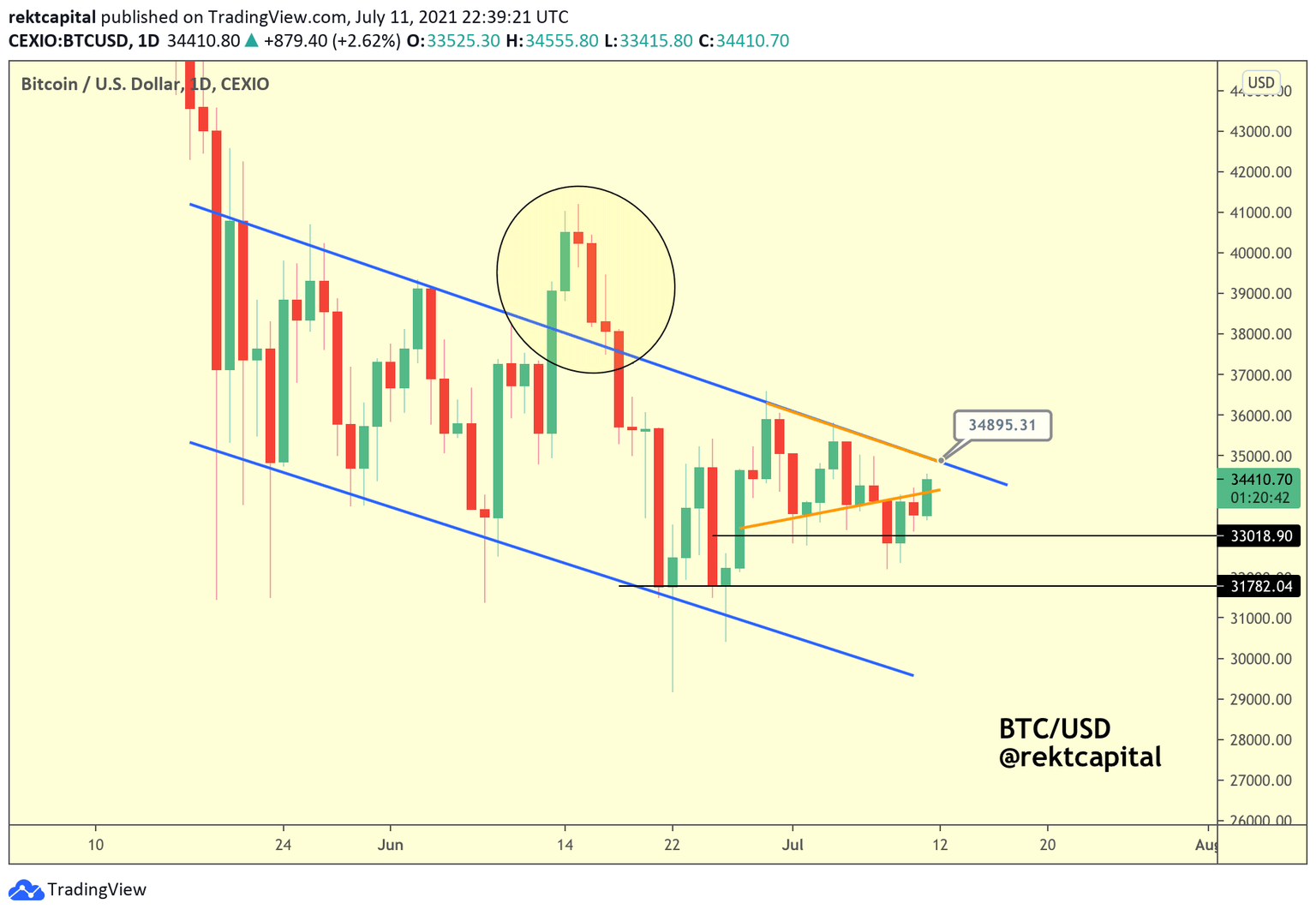

After “reaffirming” the level, trader and analyst Rekt Capital explained on Sunday that BTC/USD is back at the lower end of an established range.

“BTC is breaking back above the orange trendline,” he said in a subsequent update alongside a chart showing the current landscape.

“$BTC is doing all the right things to reclaim this trendline as support. Reclaim the trend line as support and that’ll be great progress towards challenging for a breakout from this blue wedging structure.”

BTC/USD scenario as of July 12. Source: Rekt Capital/Twitter

Monday has continued the trend, with Bitcoin trading at around $34,350 at the time of writing.

“Bitcoin is trying to rally and close an 8th week in a row above 34k with a long wick down. Lots of demand still,” fellow trader Scott Melker added.

Last week, targets of up to $39,000 were in for Bitcoin should bulls manage to attack $35,500 resistance and continue, something that in the event failed to occur.

Fundamentals sustain their comeback

If last week’s price action disappointed, under the hood, Bitcoin has been working on a more important turnaround.

Data from monitoring resources on Monday shows that both network difficulty and the hash rate are stabilizing and that, therefore, the worst of the recent mining turbulence could be firmly over.

After its record drop earlier in July, difficulty was previously on track to beat even its latest performance and shed another 28% or more.

In the intervening period, however, a recovery has started to take place. Now, the next difficulty adjustment should only see a 10% drop should price action remain near current levels.

“Blocks coming in at a rapid phase — next difficulty adjustment is now estimated at ~ -7.5% but it seems to me like hash rate is coming back pretty quickly at the moment,” angel investor Klaus Lovgreen summarized on the day.

Bitcoin network difficulty chart. Source: Blockchain.com

The changes are testament to the power of the Bitcoin network to balance itself without any external assistance — regardless of the circumstances, difficulty adjusts to take into account any given eventuality.

The estimated hash rate remains only modestly above its recent lows of 83 exahashes per second (EH/s), but even here, stability and a slow return to the norm are visible.

As Cointelegraph reported, both metrics are expected to make fresh gains as mining power returns to Bitcoin after relocating out of China. The timeframe for this to happen, by contrast, is anyone’s guess.

Grayscale unlocks 40,000 BTC

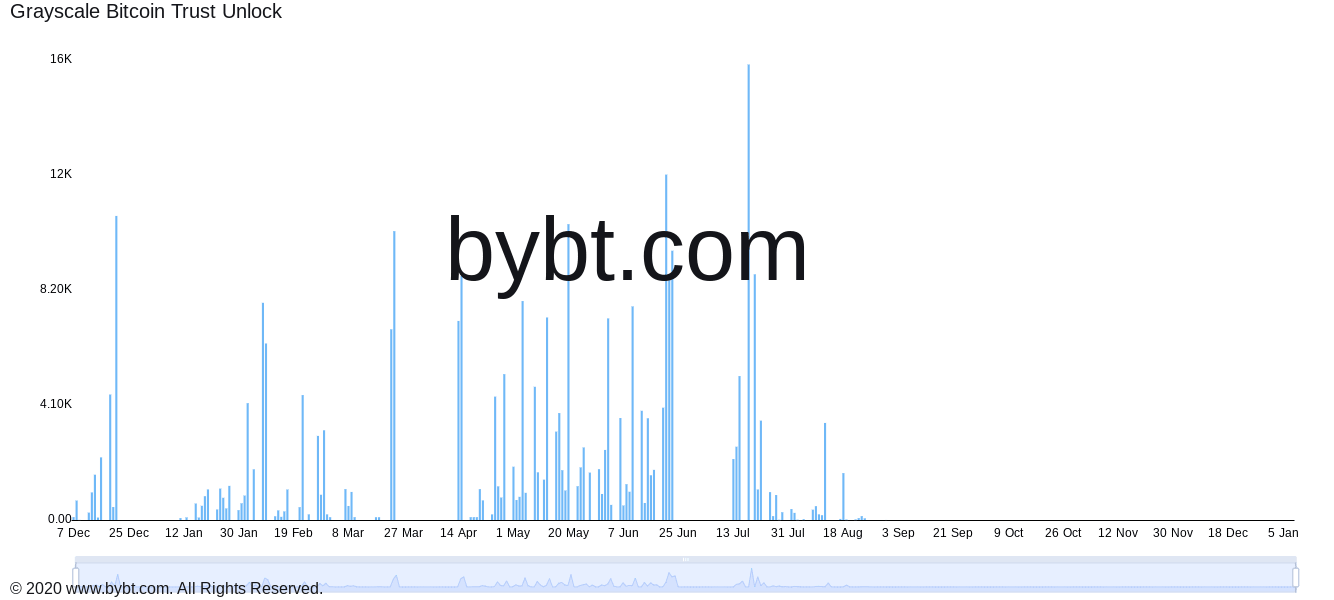

An event that is on every Bitcoin market participant’s radar this month is the multiple unlockings of BTC at institutional giant Grayscale.

As Cointelegraph explained, the Grayscale Bitcoin Fund (GBTC) is due to release in excess of 40,000 BTC in the coming weeks, this having been subject to a six-month lock-up period.

Opinions differ about its market impact. Some are concerned that selling pressure will increase (only to then become practically zero after the unlockings are over), while others argue that spot markets will be broadly unaffected.

Sunday, July 18, is of particular interest, with that day’s unlocking worth just over 16,000 BTC.

“When GBTC shares unlock and get sold, the GBTC Premium drops (share price drops relative to the BTC in the trust),” statistician Willy Woo commented last week.

“Investors now have more incentive to by GBTC shares rather than BTC, it diverts some of the buying pressure on BTC spot markets. This is bearish.”

GBTC unlocking schedule chart. Source: Bybt

Bullish price metric nears “launch zone”

In need of some reliable “hopium” for the week ahead? Bitcoin market analytics has the answer.

On Monday, attention was turning to a nifty indicator from on-chain data service CryptoQuant, which has historically caught every major BTC price run in the past two years.

Dubbed the Taker Buy Sell Volume/Ratio, it tracks exchange data to produce as a guide for when to hodl and when is a good opportunity to take profit during a local market cycle.

Right now, the Ratio appears to be forecasting another BTC/USD surge, leading to a classic “take profit” point.

Analyst Cole Garner has even highlighted what to expect should history repeat itself. He noted, however, that the trigger phase — where the Ratio touches the upper green channel — has “not happened yet.”

“Buy signal incoming,” he nonetheless commented.

Bitcoin Taker Buy Sell Volume/Ratio annotated chart. Source: Cole Garner/Twitter

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.