Could whale activity in AAVE, APE, COMP, IMX and LDO lead to a steep correction or a new rally?

- Whale transactions valued at greater than $10 million have emerged across altcoins AAVE, APE, COMP, IMX and LDO among others.

- Large wallet investors are contributing to the rise in price volatility in these altcoins, signaling incoming correction.

- Bitcoin remained range-bound at the open of the Asian trading session, DeFi tokens continued battling the CRV-triggered crisis.

Bitcoin price was range-bound below the psychological barrier at $30,000 at the start of the Asian trading session. The Curve-exploit related DeFi crisis fueled volatility in AAVE and COMP among other tokens.

Whale activity, typically considered bullish for assets, has climbed. Several transactions valued at $10 million or higher have emerged. However, given the state of Bitcoin and the DeFi ecosystem, a pullback or correction is likely in these tokens.

Also read: AAVE community to vote on proposal that could determine future of CRV and DeFi as we know it

Whales make moves en masse in AAVE, APE, COMP, IMX and LDO

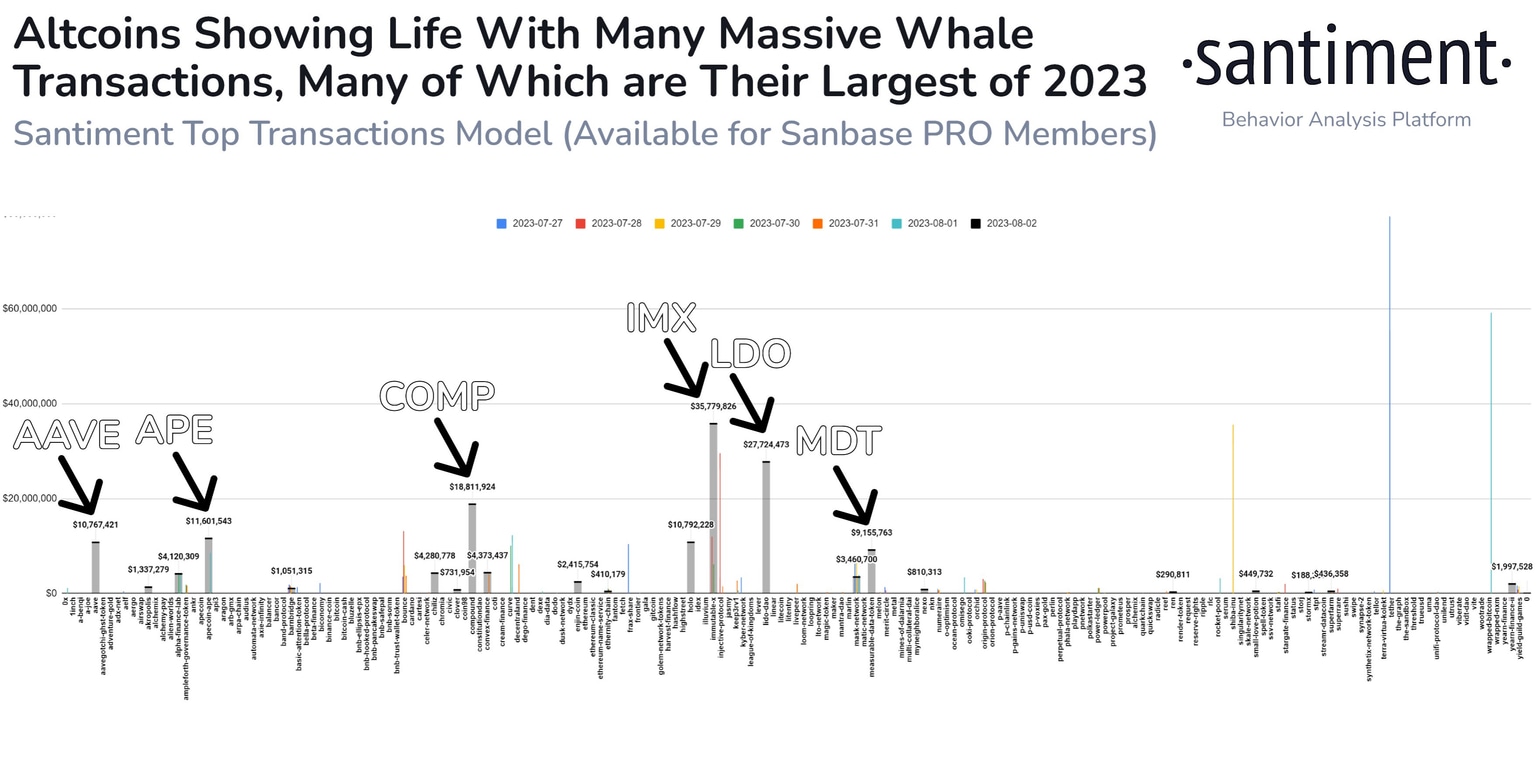

Analysts at crypto intelligence tracker Santiment have observed a notable increase in large wallet transactions, valued at $10 million or higher across various altcoins on Thursday. While investors are bored awaiting volatility in large market capitalization assets like Bitcoin and Ethereum, altcoins have emerged as a volatile alternative.

Whale activity is typically associated with a rise in prices, however, profit-taking by investors is likely to increase pressure on altcoins. AAVE (AAVE), ApeCoin (APE), Compound (COMP), Immutable (IMX), LidoDAO (LDO) and Measurable Data Token (MDT) are the altcoins with rising activity.

Altcoins with massive whale activity

The Santiment Top Transactions Model recorded significant activity in these altcoins. Traders hunting for volatility are watching these altcoins for profit-taking opportunities, since some whale moves are the largest ones seen in 2023.

Amidst the brewing crisis in DeFi, where experts compare Curve Finance founder Michael Egorov’s behavior to typical observations made in traditional finance, massive whale activity in tokens like AAVE and COMP can be considered indicative of an upcoming decline. Find out more about the Curve Finance exploit here, as well as the founder’s attempts to shore up liquidity and protect CRV token’s price from further downfall here.

Why whale activity in altcoins is key to Bitcoin’s next move

It can be argued that whales are likely scooping up these altcoins at lower prices in the ongoing correction, however the key is to look for fresh capital inflow to cryptocurrencies. Demand from market participants is likely to determine the price trend of Bitcoin and altcoins in the near future.

Curve Finance founder Michael Egorov’s efforts to shore up liquidity for CRV have ushered capital into DeFi tokens and DEX tokens, however the whale activity in altcoins could be a game changer for alternative cryptocurrencies.

Market participants are closely watching Bitcoin’s next move, which is currently challenging to predict with the price below the $30,000 level.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.