- SUI farming led to heavy borrowing of the TUSD pair, resulting in the stablecoin being depegged.

- Recently, CZ threatened Tron founder Justin Sun against farming SUI on the Binance launch pool.

- Sui mainnet is scheduled to launch on May 3, but no information regarding SUI’s listing has come forward yet.

At the moment, the market is kinder to the cryptocurrencies that are witnessing some or other kind of hype and trend. PEPE reinforced the notion that the only qualifying factor for a hit crypto at the moment is demand, as fundamentals do not seem to matter.

SUI farming ignites TUSD use

Sui is an upcoming layer-1 blockchain that is being developed to support the growth of DeFi and GameFi markets by offering instant finality for transactions. Noted to be the native token of this blockchain, SUI is currently undergoing farming, which is kind of similar to an Initial Coin Offering (ICO).

Sui has stated its goal as "to cater to the next billion users in web3" and is attempting to tick all the right boxes to achieve this goal. For the same reason, the blockchain made use of the same programming language, Rust that Solana uses, which currently is one of the fastest blockchains in the market.

At the moment, TUSD is being used to farm SUI, and as a result, TUSD has become one of the most in-demand tokens right now. Its pair with USDT also became the most liquid pair on Binance, with a $200 million injection of order book liquidity at the 1% level.

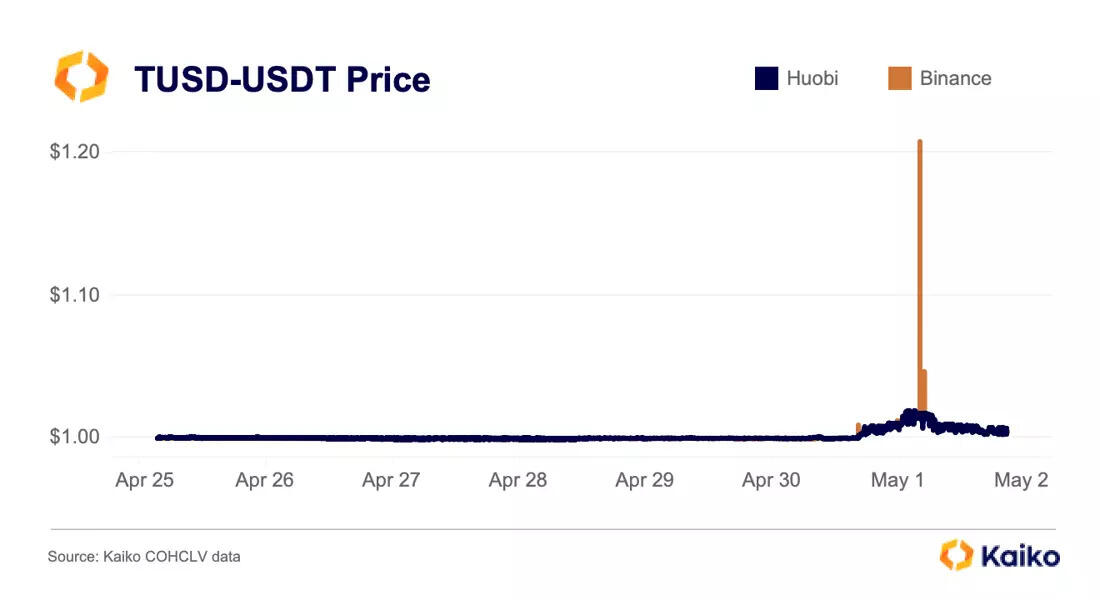

Consequently, TUSD began to depeg, hitting the high of $1.2 against USDT's $1 peg. Furthermore, thanks to Binance's promotion of the stablecoin by making BTC/TUSD a zero-fee pair, TUSD has become one of the most highly traded tokens despite being relatively unknown.

TUSD/USDT price

But in addition to just retail demand, the stablecoin also caught investors' eyes after the recent Changpeng Zhao (CZ)-Justin Sun issue. The Tron founder was warned by the Binance CEO not to farm any SUI with his TUSD deposits.

The comments came after it was discovered that Sun had transferred over 56 million TUSD from his wallet to Binance, where the SUI launch pool is being hosted by staking BNB or TUSD. In response, CZ stated,

"Our team told Justin, if he uses any of these to grab the LaunchPool Sui token, we will "take action against it". SMH.Binance LaunchPool are meant as air drops for our retail users, not just for a few whales. On the bright side, blockchains are transparent…

Sun justified this, claiming that he was simply acting as a market maker for TUSD and adding more supply to improve liquidity and settle pending orders.

经查,作为TUSD的合作做市商TRON DAO Venture过去数小时已经累计完成4000万美元的交易量,对于保持TUSD的价格稳定起到了作用,确实因部分同事不了解该资金用途,使用部分资金参与了交易所活动,我们已第一时间联络交易所,对于交易所活动资金进行全额退款,对此错误我们深表歉意!望周知!

— H.E. Justin Sun 孙宇晨 (@justinsuntron) May 1, 2023

The launch of the Sui mainnet is scheduled for May 3rd, however, as of yet, there has been no information disclosed about its corresponding token. The token would have gone unnoticed had CZ and Sun not exchanged words over it, as SUI is now fielding a lot of interest over social channels.

A situation similar to the viral "PEPE" meme phenomenon is highly unlikely to occur in the crypto market. This is primarily because the meme lacks the widespread appeal and enthusiastic following that dog and frog memes have garnered.

Furthermore, the recent cryptocurrency market downturn served as a reminder of the inherent volatility and unpredictability of the industry. Therefore, the occurrence of another extreme market event could potentially reinforce the reputation of the crypto market as a fleeting, immature fad bubble.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.