Could revolut’s foray into cryptocurrency lead to the launch of its own token?

Revolut, the UK’s most valuable fintech, is reportedly looking to ramp up its prevalence in the world of cryptocurrency by launching its own token.

The company, which has attained a valuation of $33 billion, has made headway in offering cryptocurrency buying as a central part of its services. But now Revolut appears set to go one step further in creating and launching its own cryptographic token, according to two sources.

“It’s a ‘Revolut users earn a token’ type of thing, similar to Wirex and Nexo,” a source told CoinDesk, in reference to the WXT token and NEXO respectively.

The move is likely to see Revolut launching something that resembles an exchange token rather than a standalone stablecoin - indicating that we’re more likely to see something more similar to Binance’s BNB than Tether’s USDT, for instance.

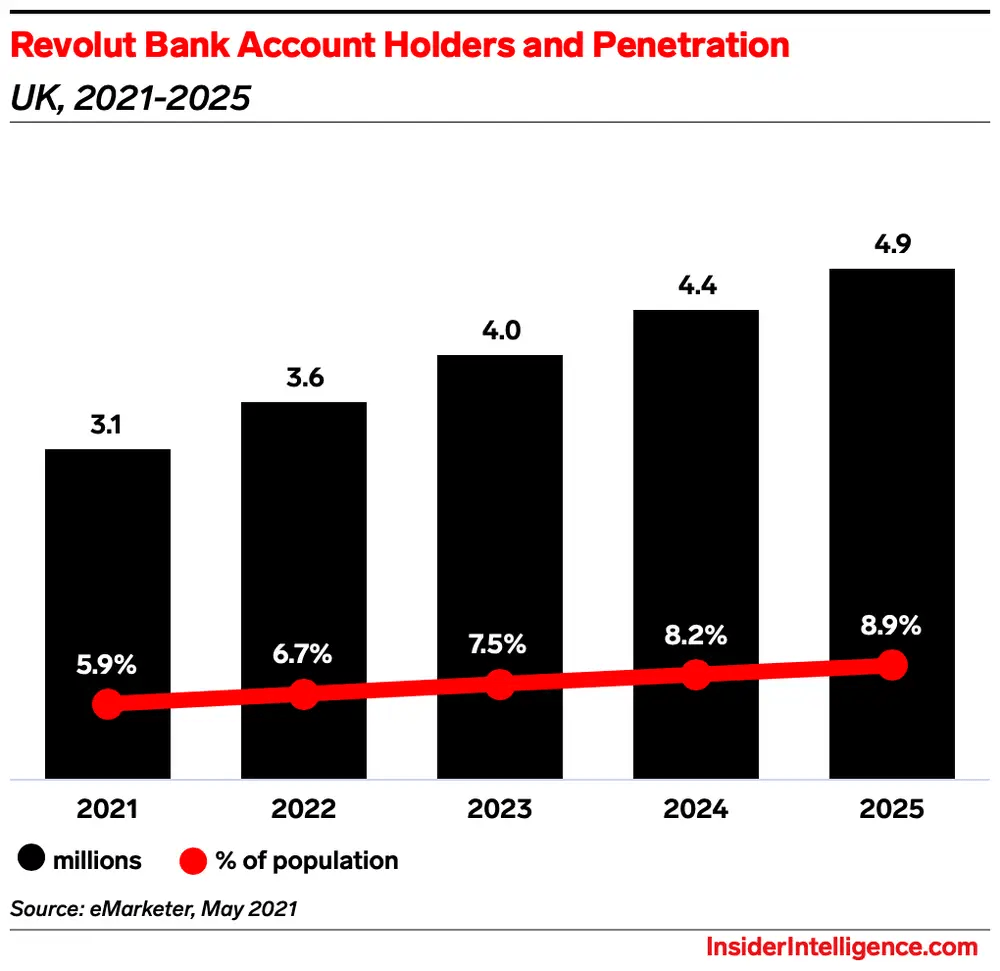

(Image: Insider)

As the data above shows, Revolut’s ambitions towards growth into the world of cryptocurrencies is forecast to be supplemented by broader levels of app adoption. By 2025, 8.9% of the UK population are expected to have opened a Revolut bank account, while today, the fintech company has over 16 million total users.

Currently, Revolut has avoided commenting on the speculation, although the company’s push towards becoming a key player in the world of cryptocurrencies suggests that there may be some substance to the story.

Building towards cryptocurrency adoption

Revolut’s enthusiasm towards cryptocurrency, and, specifically, Bitcoin, can’t be underestimated. Recently, the company announced that it would be paying for a WeWork membership in Dallas via BTC. Revolut has also confirmed that it had secured a US broker-dealer licence in recent weeks, enabling the company to expand into American retail capital markets - moving into direct competition with Robinhood in the process.

Revolut has already made moves akin to their major US rivals in Robinhood and PayPal by enabling users to buy and hold cryptocurrencies within its fintech banking app. However, as things stand, the platform doesn’t share the same levels of functionality that users can experience in buying and trading within cryptocurrency exchanges. The development of Revolut’s own token has the potential to change this.

In a June earnings call, Revolut claimed that crypto services amounted to around 20% of the company’s revenue. In offering exposure to over 50 tokens at present, cryptocurrency has a strong foothold on Revolut’s entire repertoire of investing services, with the platform seeing around 150 million transactions per month.

As a means of ramping up its cryptocurrency incentives for customers, Revolut has slashed fees for customers in the US across various products.

The firm’s customers in the United States now have the ability to trade up to $200,000 in various cryptocurrencies each month commission-free. Prior to this, the limits stood at just $200 per month.

In a bid to appeal directly to their new US market Revolut has also provided users with the ability to withdraw a certain amount of money per month, send as many as 10 international remittances monthly, and create up to five accounts for their children free of charge.

“We had a very quiet opening,” Ron Oliveira, CEO of Revolut in the US told The Block. “Now it’s about where are we going from here. What we’ve discovered is that we have the deepest and widest offering of any fintech in the United States today.”

Could revolut compete with robinhood?

With the company’s advantageous investing structure, is it possible that Revolut can make a name for itself when it comes to US cryptocurrency investing? To answer this, let’s take a deeper look at the fintech’s financial pedigree.

Although the Covid-19 pandemic has acted as an inadvertent catalyst for digital transformation, Revolut saw slower growth in terms of revenue and mounting losses across 2020 as the health crisis impacted payment volumes. However, the company’s aforementioned dependence on cryptocurrencies paved the way for a significant financial boost.

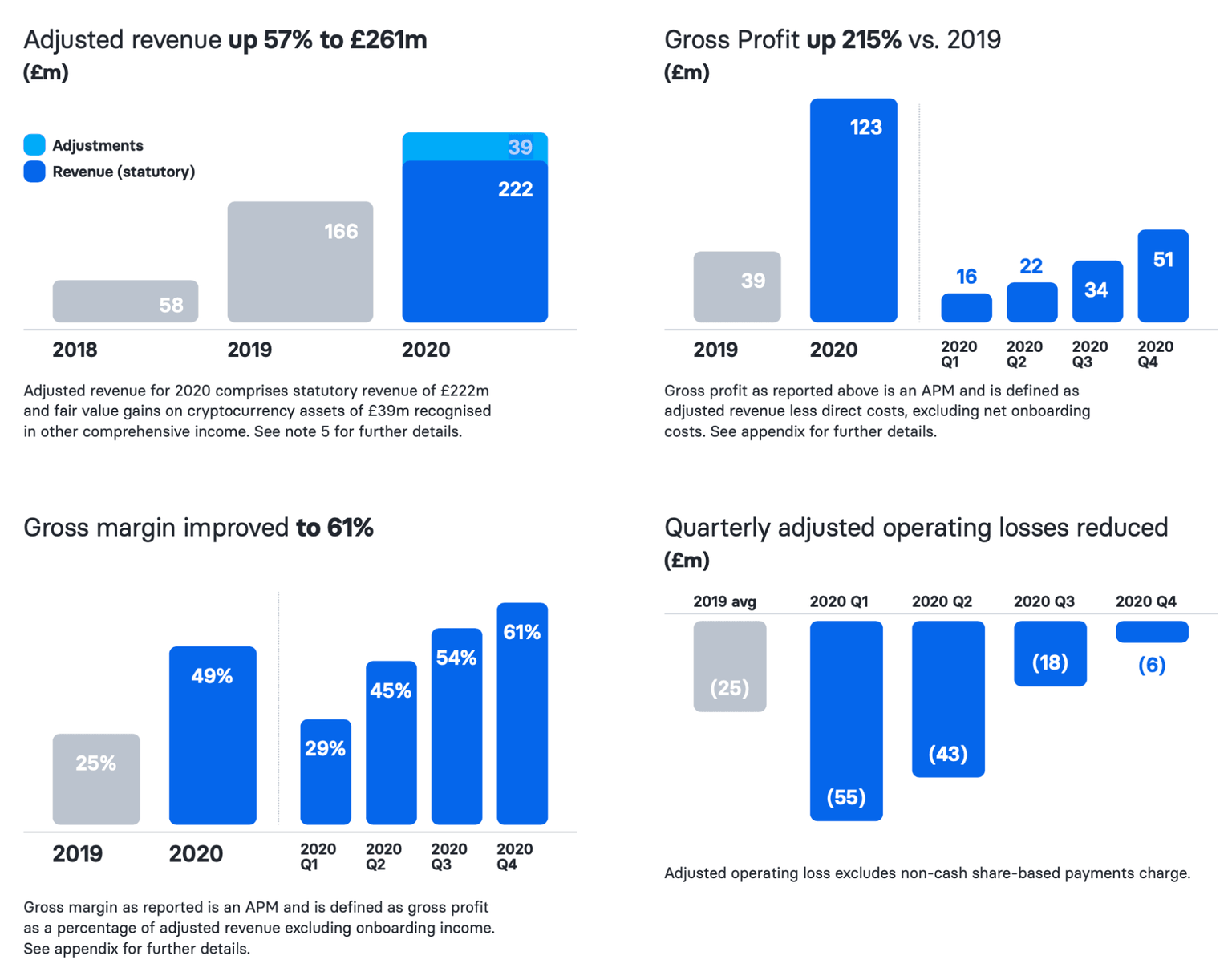

Revolut attained some $310.5 million in revenue in 2020, representing a 34% increase from the year prior. However, the company’s adjusted revenue for intangible assets like cryptocurrency weighed in at an impressive 57% higher than 2019.

(Image: TechCrunch)

As we can see from the data above, there’s plenty to be optimistic about at Revolut. The company continues to grow its revenues whilst significantly reducing its quarterly operating losses across 2020.

Maxim Manturov, head of investment research at Freedom Finance Europe believes that Revolut’s adaptability is a key asset to the company which has helped to secure seismic growth in a remarkably short space of time.

“Founded in 2015, Revolut has grown into one of Europe's dominant consumer financial technology companies, constantly adding new features,” Manturov said. “The app started out as a way to avoid currency conversion fees when travelling but quickly added banking, trading and crypto features among dozens of products. It now has over 16 million customers, and it makes sense that the company would try to increase its appeal by introducing commission-free trading, given the rather 'hot' market for those kinds of apps. It's likely that the company will also use a business model similar to Robinhood's PFOF-based one to make money.”

In going into direct competition with Robinhood, another example of a fintech that’s experienced rapid growth after being established in the mid-2010s - in this case 2013, Revolut is taking on a modern heavyweight of investing.

Although Revolut has become widely popular across Europe for its financial services, Robinhood, with its market cap of $33 billion at the time of writing, is pound for pound very similar in stature to its new rival.

For Revolut to successfully break into a market that’s been dominated in recent years by Robinhood, the firm will need to demonstrate more of the adaptability that’s seen it achieve wild success in the span of six years. However, for a firm that’s already become the UK’s most valuable fintech at a valuation of $33 billion, anything is possible for Revolut and its ambitious team.

Author

Dmytro Spilka

Solvid

Dmytro is a tech, blockchain and crypto writer based in London. Founder and CEO at Solvid. Founder of Pridicto, an AI-powered web analytics SaaS.