Could Ethereum beat the bear market as supply falls post Merge?

- Ethereum supply drops after the transition from proof-of-work to proof-of-stake, known as the Merge.

- Ethereum’s deflation rate is at 0.0001% annually, otherwise ETH supply would have increased at a rate of nearly 3.6%.

- Ethereum suffered a 30% decline in the first week of November, analysts identify looming risk of further price drop.

Ethereum (ETH) is seeing a fall in supply as a result of the Merge which supporters argue make it a sound investment and could help it weather the crypto winter currently devastating the DeFi market.

Ethereum’s successful transition from proof-of-work to proof-of-stake during the Merge, resulted in a decline of over 400 ETH in 55 days, and ETH’s deflation rate is currently 0.001% annually.

Could this be enough to prevent its price collapse in the current bear market? Despite the fall in supply analysts say Ethereum price is at risk of further decline due to a bearish outlook on the asset. In addition, broader crypto market woes persist after Binance canceled its deal to buy rival cryptocurrency exchange FTX leading to further chaos erupting in the crypto market.

Also read: Breaking: USD Tether alleged depeg in the aftermath of FTT collapse

Ethereum officially turned deflationary in crypto bear market

Ethereum has turned deflationary in less than two months post Merge. If Ethereum had not turned deflationary, its total supply would have increased by 650,000 ETH, worth $762 million. The altcoin’s energy consumption is down 99.9%.

Ethereum took 55 days post Merge to turn deflationary. A reduction in Ethereum’s supply is expected to directly influence the asset’s price andEthereum holders expect a rally in the long-term.

Ethereum turns deflationary 55 days post Merge

Ethereum’s energy consumption has reduced by 99.9% and supply is down 4,039 ETH since Merge, based on data from ultrasound.money. Despite the chaos in the crypto market, Ethereum’s total issuance is net negative in the bear market.

Ethereum turns ‘ultra sound’, but what does this mean?

Ethereum community coined the term “ultra sound” to describe the altcoin’s supply and price potential, post Merge. In an inflationary world, the term ‘sound money’ was coined as a reference to Bitcoin, with its capped supply.

Ethereum’s potential to become a deflationary asset, post the introduction of a fee-burning mechanism with the EIP-1559 upgrade in the London hard fork. The community then took the term a step further and “ultra sound money” was coined.

I woke up to a blood bath and everyone is depressed.

— korpi (@korpi87) November 9, 2022

But it will be fine. Eventually.

Today let's celebrate small wins.$ETH is finally ultra sound!

The way it happened is probably not what we wanted to experience but it is what it is. pic.twitter.com/wk9YUQSQLT

Ethereum Merge progress on track despite chaos in crypto

Ethereum price declined 9% overnight, in response to the crypto market crash. Binance announced the cancellation of its FTX acquisition after the US financial regulator Securities and Exchange Commission’s (SEC) began an investigation into Bahamas-based FTX.

Binance argued that Samuel Bankman-Fried’s FTX’s issues are “beyond our control or ability to help.” After Binance called off the deal cryptocurrencies witnessed a steep decline. Crypto market capitalization is down from $1 trillion to $870 billion.

As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of https://t.co/FQ3MIG381f.

— Binance (@binance) November 9, 2022

Ethereum whales scooped up ETH at discounted prices

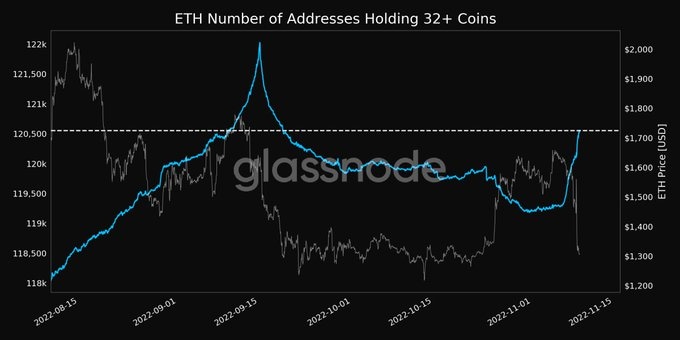

Ethereum price has plummeted 30% since the first week of November 2022. Large wallet investors scooped up the altcoin at discounted prices. Crypto data aggregator Glassnode identified an increase in addresses holding more than 32 ETH, which hit a one-month high of 120,544.

Ethereum wallet addresses bought ETH during recent market volatility

Recent market volatility was caused by a collapse in FTX’s native token FTT and due to investors pulling their money out of the FTX exchange itself. FTX is the third-largest exchange by volume.

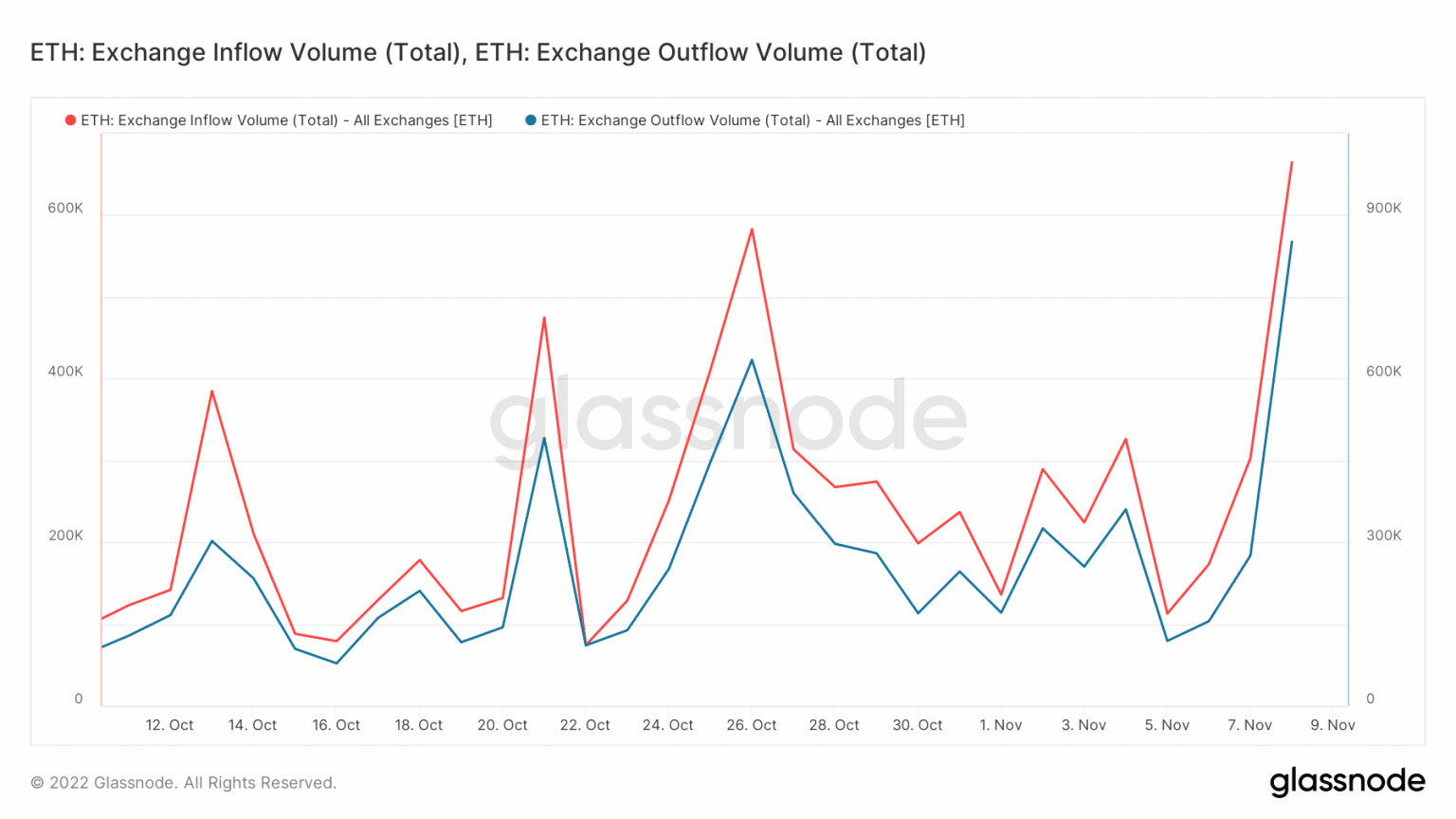

Ethereum holders appear to be staking to take advantage of opportunities in the next cycle, rather than just buying the dip post the Merge. Ethereum exchange flows confirmed healthy accumulation despite the recent correction in the altcoin. Outflows of Ethereum from exchanges – a sign investors are storing the altcoin for the long-term – continue to outweigh inflows, despite the bear market.

Ethereum exchange flows amidst market volatility

Ethereum price declines amidst massive market volatility

Ethereum price nosedived despite successful completion of the Merge. Ethereum remained correlated with Bitcoin and tech stocks, plummeting 30% in the first week of November 2022. Analysts have pictured a bearish outlook on the second largest cryptocurrency by market capitalization.

Justin Bennett, crypto analyst and trader, identified two critical support levels in Ethereum’s price chart. Ethereum price declined below $1,275 and $1,240, flipping support levels into resistance. Ethereum’s march 2020 trend line is at $1,275 and the second key horizontal level is $1,240.

ETHUSD price chart

Analysts at FXStreet believe a sweep-the-lows event is underway. Experts identified the $1,080 level as the downside target for Ethereum price. If the altcoin recoups its losses and breaks past resistance to hit $1,276, the bearish thesis will be invalidated.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.