- Bitcoin price is expected to flip $30,000 as a support floor as expectations of a mid-cycle rally emerge.

- BTC has surpassed USD as the preferred investment option due to the concerns surrounding US debt.

- Tether reduced its bank deposits by more than 90% owing to the banking crisis.

Bitcoin price has been fluctuating for the last couple of weeks as the macroeconomic market continues to face challenges. Faith in the US Dollar (USD) continues to wane, and concerns surrounding the impact of the debt ceiling standoff will play an important role in BTC's rise going forward.

Read more - Banks deemed investing indirectly in Bitcoin as faith in USD continues to decline

Confidence in Bitcoin grows amid depreciating macroeconomic conditions

Earlier this week, billionaire investor and hedge fund manager Paul Tudor Jones in an interview with CNBC, stated,

"I'm going to always stick with Bitcoin.

While the statement in itself does not inflict any kind of impact on the price action, it speaks to the larger narrative of crypto being a bubble.

As the founder of one of the biggest investment firms in the United States, Jones’ opinion falls in line with many other institutions that have more faith in Bitcoin than the US Dollar right now. Beyond just investment firms, banks themselves are betting on the digital currency as the banking crisis continues to instill fear among citizens.

As reported last month, the Bank of America and Fidelity Management recently purchased over $85 million worth of MicroStrategy's MSTR shares.

Another recent entry in this club is the issuer of the biggest stablecoin in the world - Tether - which has reduced its bank deposits from $5.3 billion to $481 million in Q1 this year to reduce its bank-risk exposure.

In exchange, the USDT issuer added Gold and Bitcoin to its asset reserves for the first time. These investments account for about 4% and 1.8% of its entire reserves, worth nearly $3.2 billion and $1.45 billion, respectively.

This is because people believe that the best way to circumvent the potential damages from a financial crisis is by leaning in on an inflation hedge asset. Plus, Bitcoin already has earned its safe-haven status since it could offset any potential losses it may bear owing to the macroeconomic conditions, thanks to its rising correlation with Gold.

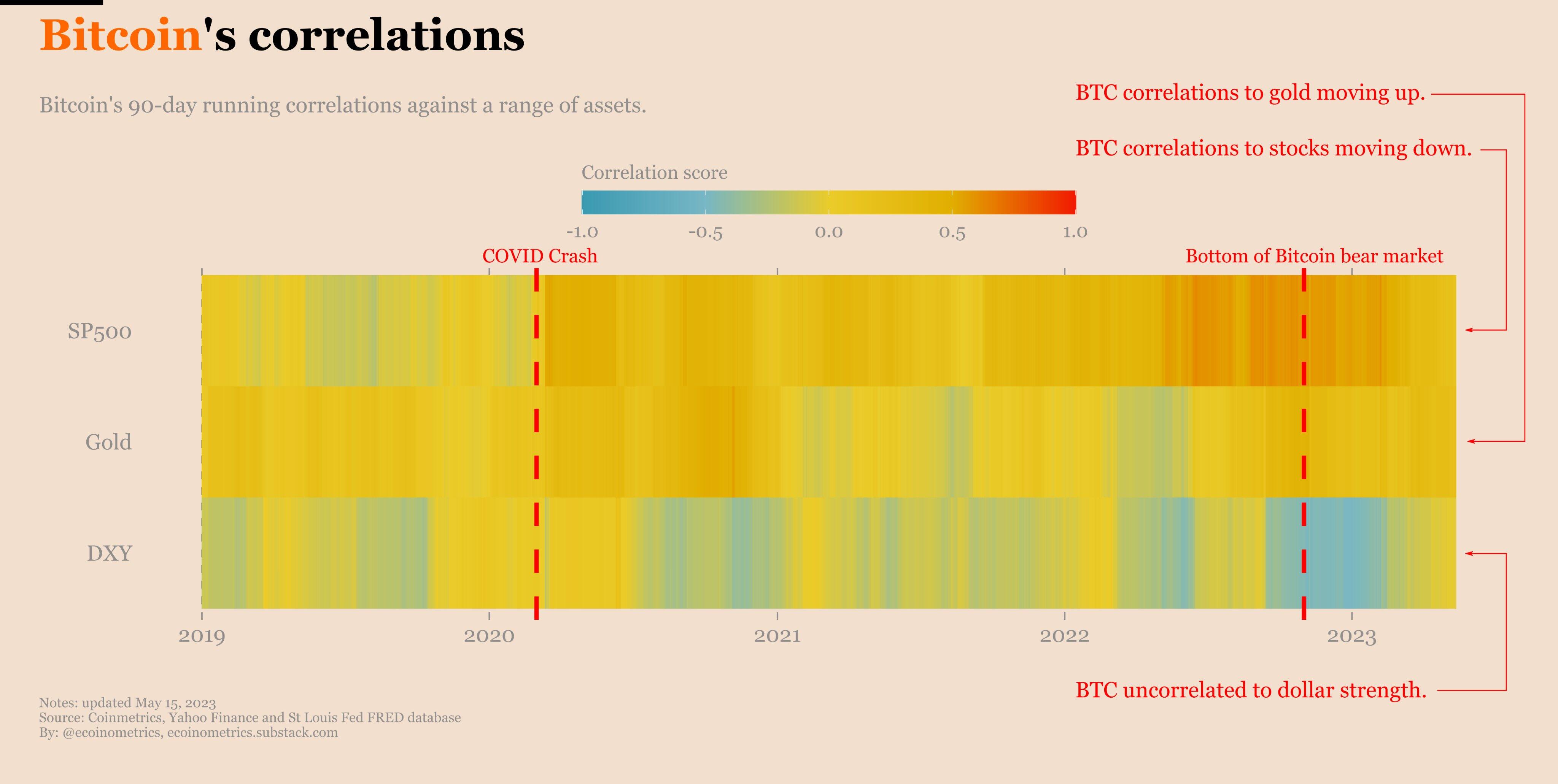

As noted in the image below, following the Bitcoin bear market bottom from November 2022, Gold's correlation with BTC has increased. At the same time, its correlation with the stock markets has declined in the last few weeks, while it stands completely uncorrelated with the Dollar Index (DXY).

Bitcoin correlation with Gold on the rise

All these instances are signs that Bitcoin price may witness a rise over the next few months.

Bitcoin price has immense potential

Going forward, Bitcoin price might make it back above the June 2022 high of $30,000, which also marks a key psychological level. The chances of such a rally are high since the digital asset is still in high demand.

According to a survey from Bloomberg, BTC has surpassed USD as the preferred asset for investment. This is due to the concerns surrounding the US national debt, as raising the debt ceiling continues to be a matter of discussion.

NEW: #Bitcoin flips USD as preferred asset if the US defaults on debt - Bloomberg pic.twitter.com/RpjNYXRLCz

— Bitcoin Archive (@BTC_Archive) May 15, 2023

This would be a boon for Bitcoin price, which has increased by more than 66% since the beginning of the year and is potentially preparing for a bull market in 2024. According to popular trader Inmortal, the rest of 2023 is set to note a mid-cycle rally.

This makes $32,000 and $37,800 the next major targets as they coincide with the 23.6% and 38.2% Fibonacci Retracement of $67,300 to $20,288.

BTC/USD 1-day chart

However, some resistance from bearish broader market cues could impact the potential of Bitcoin price to reach these targets.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.