Cosmos struggles against $30 resistance, ATOM at risk of another dip

- Cosmos price has made some positive gains over the past two days, but not enough to break out above some key resistance levels.

- ATOM is caught between a strong resistance and support zone, isolating price action to a tight trading range.

- The future outlook remains bullish, but some near-term selling pressure may return.

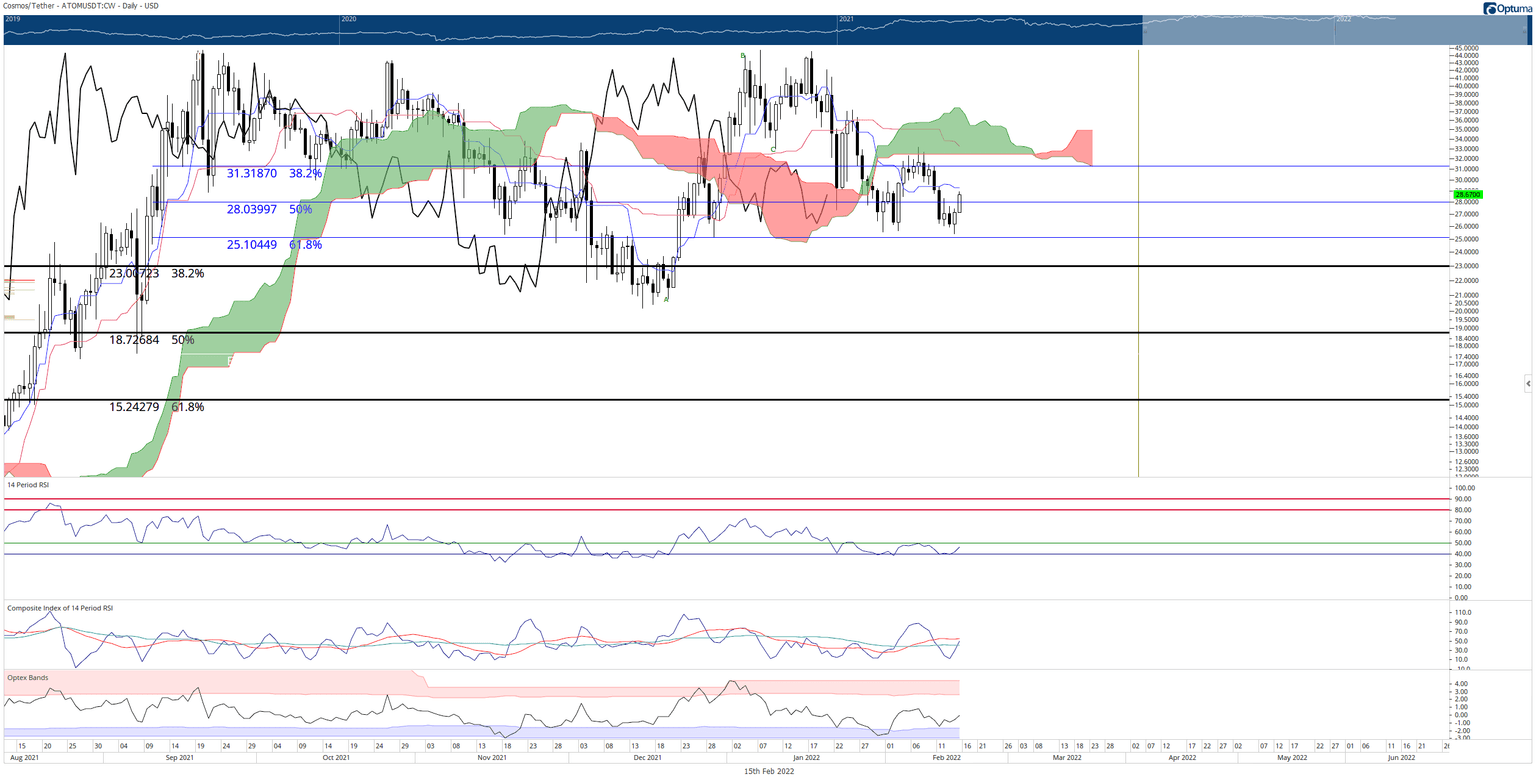

Cosmos price is facing some difficulties returning to the $30 level. It fell below the daily Tenkan-Sen on February 10 and has not regained a close above that level. Additionally, ATOM moved and closed below the 50% Fibonacci retracement, creating further bearish pressure.

Cosmos price must close a daily candlestick at or above $30 to prevent further losses

Cosmos price opened below three critical price levels: the 50% Fibonacci retracement at $28, the daily Tenkan-Sen at $29.25, and the psychological price of $30. ATOM is currently above the 50% Fibonacci retracement but is struggling to maintain momentum above that price level.

While the majority of the cryptocurrency market has shown some positioning towards bullish breakouts or at least setting up for a potential breakout, Cosmos price has yet to display that behavior. ATOM has the additional problem of additional resistance zones above the $30 level. Nearly every $1 increment above $30, Cosmos price faces a new resistance level:

$31.25 – 38.2% Fibonacci retracement

$32.50 – bottom of the daily Ichimoku Cloud (Senkou Span B)

$33.50 – daily Kijun-Sen

$35.00– top of the Ichimoku Cloud (Senkou Span A)

ATOM/USDT Daily Ichimoku Kinko Hyo Chart

However, if Cosmos price can achieve a breakout above the Ichimoku Cloud, then there is no more Ichimoku resistance on the daily chart preventing it from testing its all-time high near the $45 price level.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.