Cosmos Price Prediction: ATOM sets the stage for 20% move

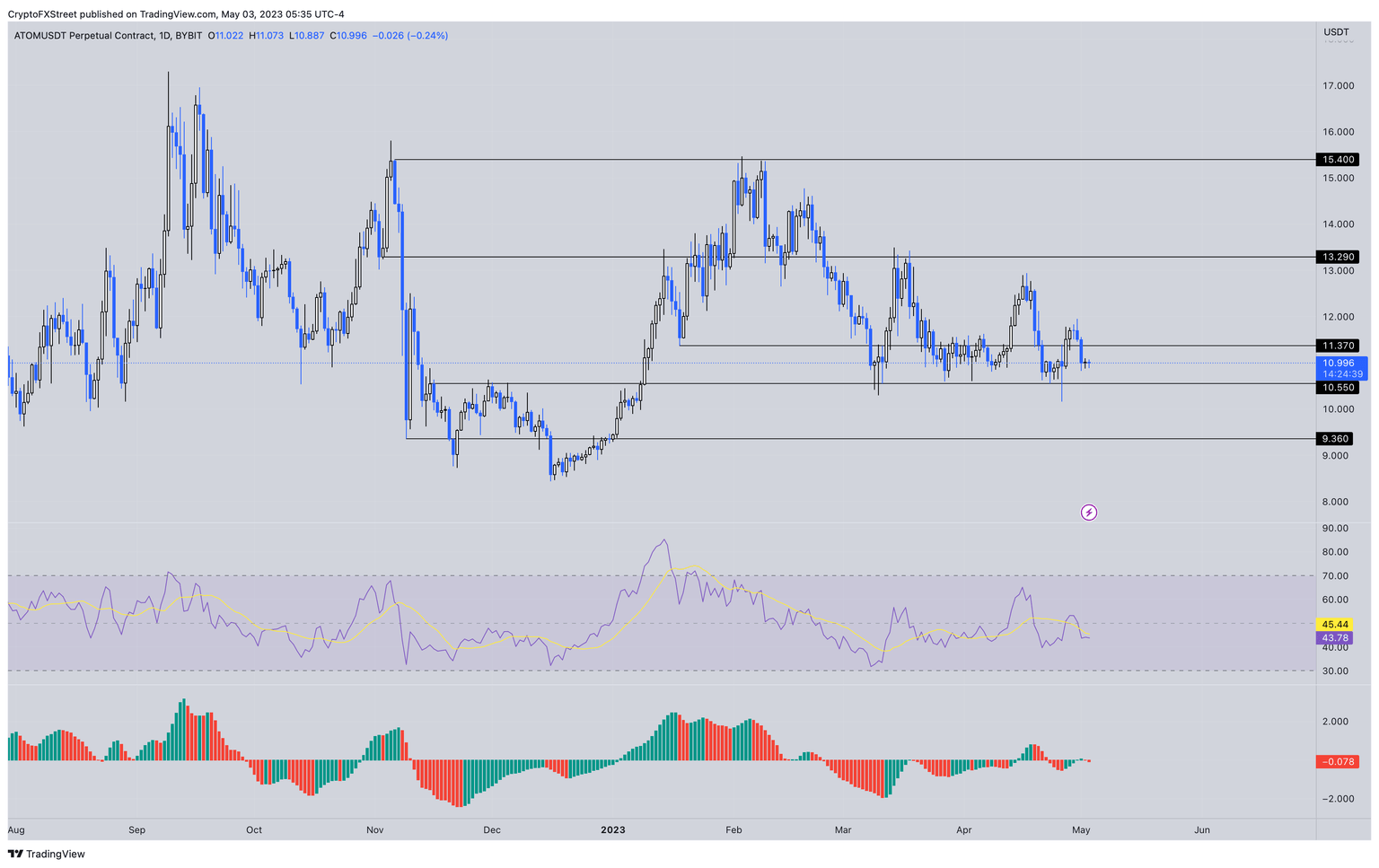

- Cosmos price continues to lose momentum with each bounce off the $10.55 support level.

- A continuation of the range tightening is likely to result in a volatile breakout to $13.29 and $15.44.

- If ATOM shatters the $10.55 support floor, it could trigger a crash to the $9.36 level.

Cosmos price approaches a long-standing support level for the fourth time in the last two months. With each bounce, ATOM has consolidated tighter, signaling that a breakout could catalyze a volatile move.

Also read: Cosmos Price Forecast: Things could get worse for ATOM before they get better

Cosmos price approaches critical levels

Cosmos price bounced off the $10.55 support level on May 11 and triggered a 26% rally. Following this, ATOM rallied 22% and 13% on the following two occasions it tagged the aforementioned foothold.

As Cosmos price revisits this level again, investors can expect cryptocurrencies, in general, to kick-start a new uptrend. If this move comes to pass, ATOM will likely target the $13.29 hurdle. A successful flip of this blockade into a support level could see the altcoin retest the $15.44 resistance level.

These two levels would require Cosmos price to rally 20% and 40%, respectively.

The confirmation of an uptrend can be seen in the Relative Strength Index (RSI) and the Awesome Oscillator (AO), both of which are hovering below the mean line. A flip of their respective mean levels on the daily chart would be a buy signal.

ATOM/USDT 1-day chart

On the other hand, if Bitcoin price suffers a negative impact due to the macroeconomic events, Cosmos price could tank as well. If ATOM slides lower and flips the $10.55 support level into a resistance barrier, it will invalidate the bullish thesis.

In such a case, Cosmos price could shed 11% and tag the next foothold at $9.36.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.