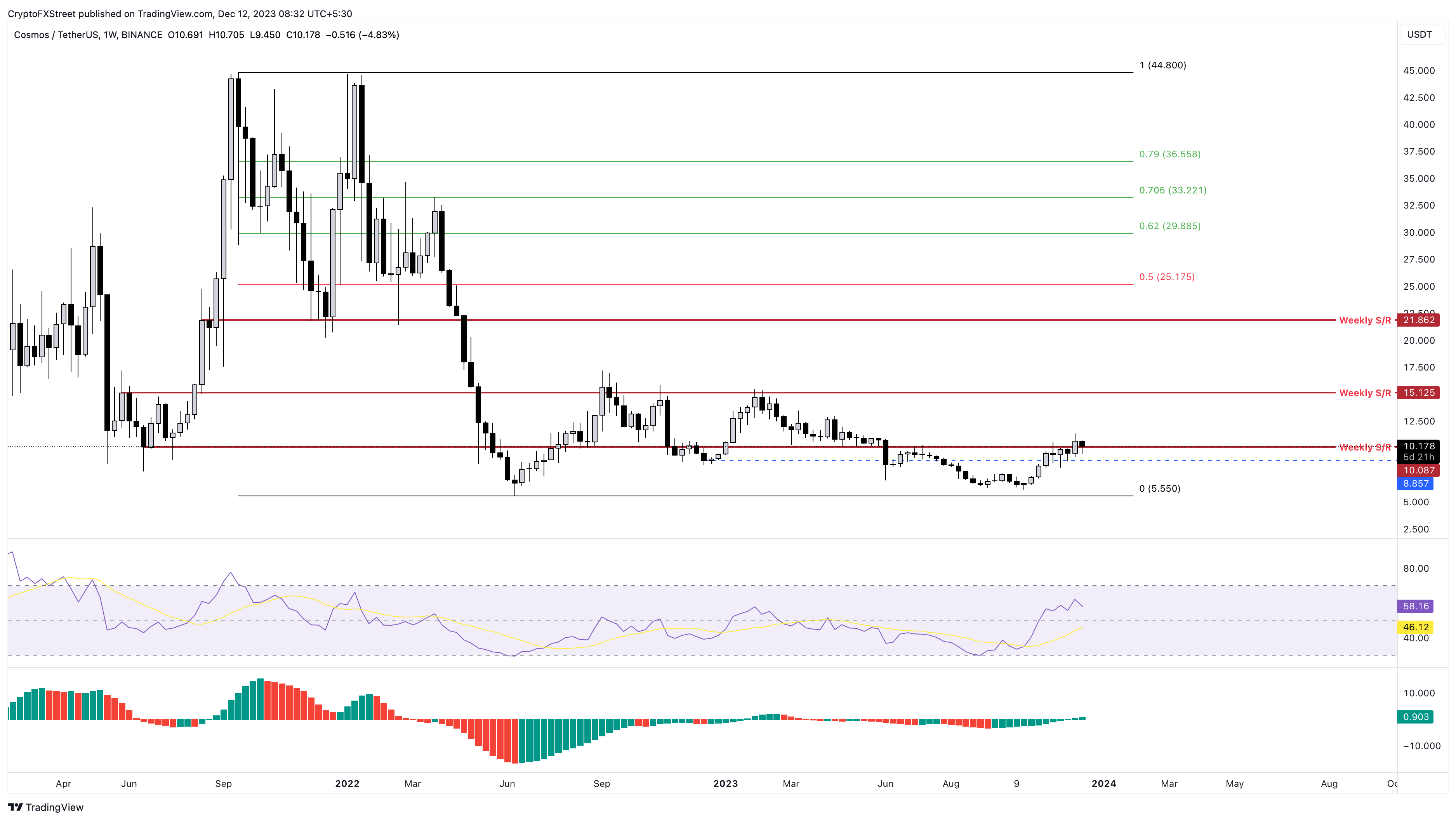

- Cosmos price currently retests $10.08, a recently flipped hurdle into a support floor.

- A successful bounce here could kickstart a 50% rally to the next key weekly resistance level at $15.12.

- A weekly candlestick close below the $8.85 support level will invalidate the bullish thesis for ATOM.

Cosmos (ATOM) price has managed to overcome a key weekly hurdle, which suggests a shift in market structure on the higher time frame. Going forward, investors can expect ATOM to start scaling higher and revisit subsequent barriers

Also read: Cosmos Hub founder plans fork, ATOM holders may receive token airdrop

Cosmos price edges closer to an explosive rally

Cosmos price first encountered the $10.08 weekly resistance level in November and faced three rejections. The fourth weekly candlestick, however, managed to produce a decisive candlestick close above it. Despite the initial weakness, ATOM has managed to rally higher and is in a p position to close above this hurdle on the weekly time frame.

If Cosmos price bounces off this level, it could kickstart an uptrend. The Relative Strength Index (RSI) and the Awesome Oscillator (AO) indicators are both above the respective mean levels on the weekly timeframe. The AO indicator has breached the zero level for the first time in nearly 300 days. Hence, this bullish development is likely going to catalyze an explosive move to the upside, especially with the recent flip of a key resistance level.

Retest of the $10.08 level will be a clear buy signal before Cosmos price triggers a 50% move to the next key weekly hurdle at $15.12. In a highly bullish case, Cosmos price could even extend the gains to retest the $21.68 hurdle. This move would bring the tidal gain from 50% to 116%.

ATOM/USDT 1-week chart

While the outlook for Cosmos price is clearly leaning bullish, it is not confirmed yet. Considering Bitcoin’s bullish market structure on the daily timeframe has been broken, a sell-off could be waiting to happen. In such a case, a weekly candlestick close that flips the $8.85 support level into a resistance level will invalidate the bullish thesis for ATOM holders. This development could see Cosmos price visit levels around $7.50.

Also read: Cosmos Price Prediction: ATOM eyes 10% gains amid chatter about a fork

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Tether expands reach with Juventus acquisition and new Bitcoin-native public company launch

Tether announced on Thursday that it had acquired additional shares in Juventus Football Club, bringing its total stake to over 10.12% and representing 6.18% of voting rights. Tether, Bitfinex, SoftBank & Jack Mallers also launch Twenty-One, the first Bitcoin-native public company.

Ethereum Price Forecast: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum (ETH) saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Stacks price eyes $1 amid growing interest in Bitcoin layer-2 protocols' DeFi ecosystems

Stacks (STX) price rises, hitting a new weekly high at $0.90 during the Asian session on Friday. The Bitcoin layer-2 protocol shows bullish resilience, trading at $0.88 at the time of writing, reflecting growing institutional interest in the decentralized finance (DeFi) ecosystem.

Bitcoin's surge to $94,000 shows a mix of macro optimism and shifting investor sentiment: Glassnode

Bitcoin (BTC) traded above $93,000 on Thursday as rumors of US-China tariff easing stirred a rebound in price, sending the percentage of supply in profit at current price levels to 87.3%, 5% above 82.7% recorded in March, according to Glassnode data.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.