Cosmos price coils up, forecasting ATOM holders at least 15% gains

- Cosmos price undergoes a small fade from short-dated profit-taking.

- ATOM is bound to continue its journey higher with near 15% gain.

- In case bulls trash the bearish handle, expect a 65% explosion higher.

Cosmos (ATOM) price was printing a solid performance last week with a 14% gain in the books on which a few traders profited in ASIA PAC trading on Monday. Although that might give a little bit of stress to traders that are still in, it will pay off soon to stick to the position and keep riding the trend higher. Even if ATOM is not breaking out of the flag formation, at least a 15% gain will be had for those who wait until the upper band is tested.

Cosmos price pennant offers a certain gain of 15% and more

Cosmos price delivered a very bullish signal to markets last week as it booked substantial gains with several other altcoins. Although altcoin season started on the back foot, sentiment seems to have turned since last week and should see some more follow-through this week. Expect more bullish moves higher, certainly by later this week, that would support more upside potential.

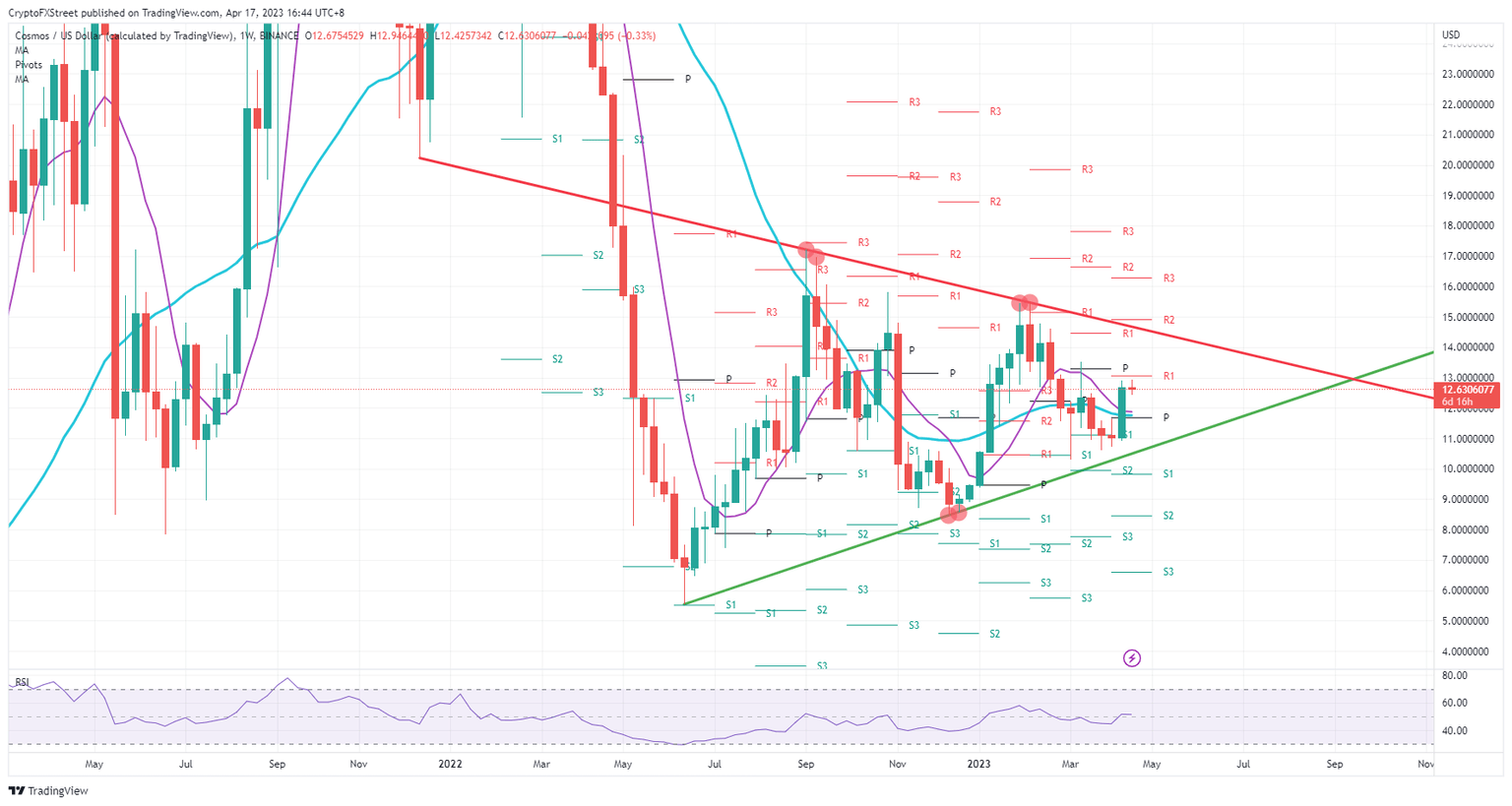

ATOM traders will first watch the red descending trend line near $15 with their monthly R2 resistance level as the second bearish element around that area. It points to a sure win of nearly a 15% gain and will certainly see bulls taking profit around that area. Although if the bullish sentiment can persist, a breakout trade would see a quick run higher toward $20 and bring a full 65% gain along with it.

ATOM/USD Weekly chart

As the pennant is clearly defined, so is the risk to the downside. Should sentiment collapse further under that profit-taking and if the fade enlarges even more, a test near $11 would signal distress to the bulls. After taking losses on their positions, more selling could occur, breaking down the supportive green ascending trend line and seeing a falling knife toward $6 to test the low of June 2022.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.