- Cosmos retreated from the recent high amid natural correction.

- The sell-off may be limited by the support created by psychological $8.00.

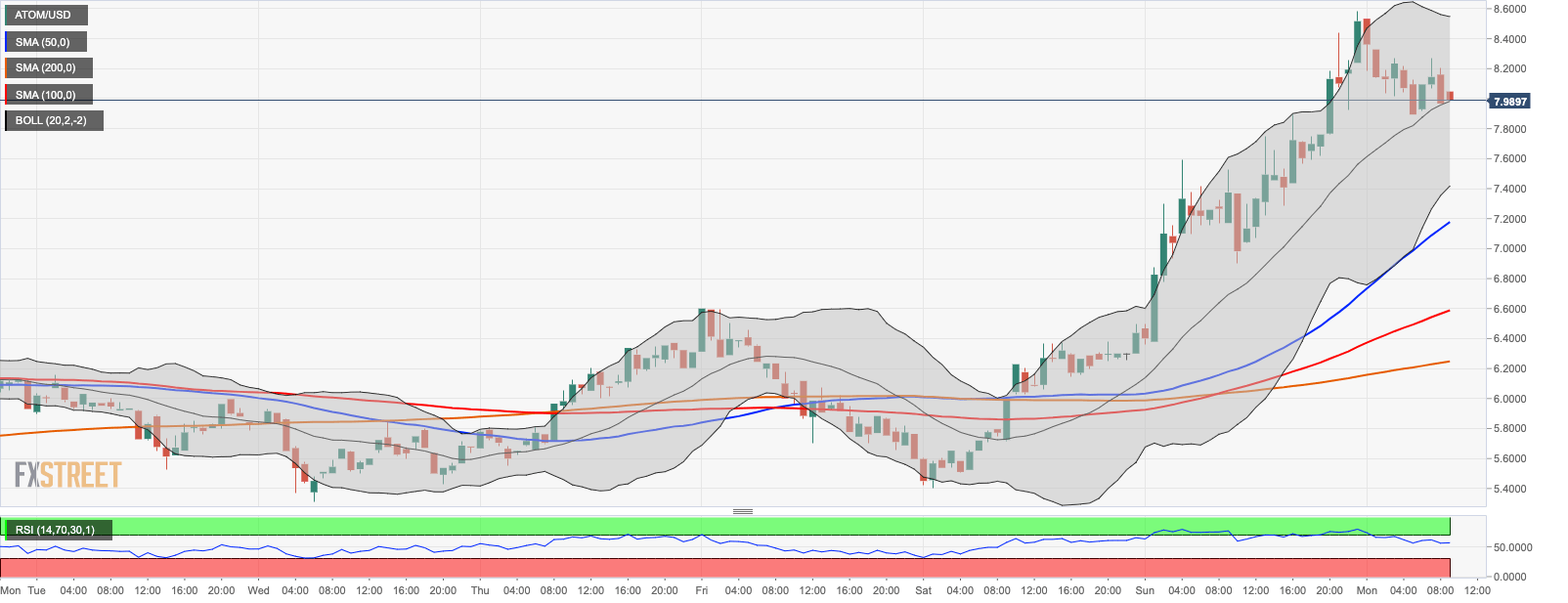

Cosmos (ATOM) is the sixth-largest digital asset with the current market capitalization of $1.64 billion. The coin has gained over 10% in the recent 24 hours to trade above $8.00 at the time of writing. Cosmos has been growing rapidly since the end of the previous week amid strong trading volumes. The coin has increased by over 50% August 22 low of $5.40 and hit the recent high at $8.57 on Sunday, August 23.

ATOM/USD: The technical picture

ATOM retreated from the recent high to test the local support created by the middle line of the 1-hour Bollinger Band located marginally below $8.00. As the FXStreet has already reported, this support is critical for the coin in the short run. Once this barrier gives way, the sell-off may be extended towards $7.00 (1-hour SMA50) and $6.50 (1-hour SMA100). The further decline looks unlikely at this stage as the RSI on the intraday charts stays on the neutral territory and still points upwards.

On the upside, a sustainable move above the recent high is needed for the upside to gain traction. Once it happens, psychological $9.00 will come into focus.

ATOM/USD 1-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ripple's XRP eyes massive rally following spike in key on-chain metric

Ripple's XRP trades near $2.40, up 1% on Monday following a 40% surge in its futures open interest. The surge could help the remittance-based token overcome the key resistance of a bullish pennant pattern.

Crypto Today: Bitcoin taps $100K, AI Tokens surge as Ripple CEO announces US hirings

The cryptocurrency sector valuation increased by $11 billion on Monday to reach an 18-day peak of $3.47 trillion. Bitcoin price crossed the $102,480 mark, on course to print a seventh consecutive green candle.

Solana memecoins to watch in January 2025: Pudgy Penguins, Fartcoin, Ai16z lead the way

Solana memecoins took center stage on Monday, crossing the $22 billion aggregate market cap milestone as the crypto sector's positive start to 2025 enters day six.

Bitcoin reclaims $100K as Calamos announces upcoming launch of first ever downside protection BTC ETF

Bitcoin rallied above $100,000 on Monday following asset manager Calamos' announcement of a 100% downside protection Bitcoin exchange-traded fund to help investors manage their risk.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.