Cosmos bulls keep defending technical level, pushing price action further upwards

- Cosmos bears keep facing a significant bullish inflow at $27.64.

- ATOM price action can only go one way with this bullish inflow… up!

- Expect a big pop next, from a squeeze by bulls, and a relief rally this Friday.

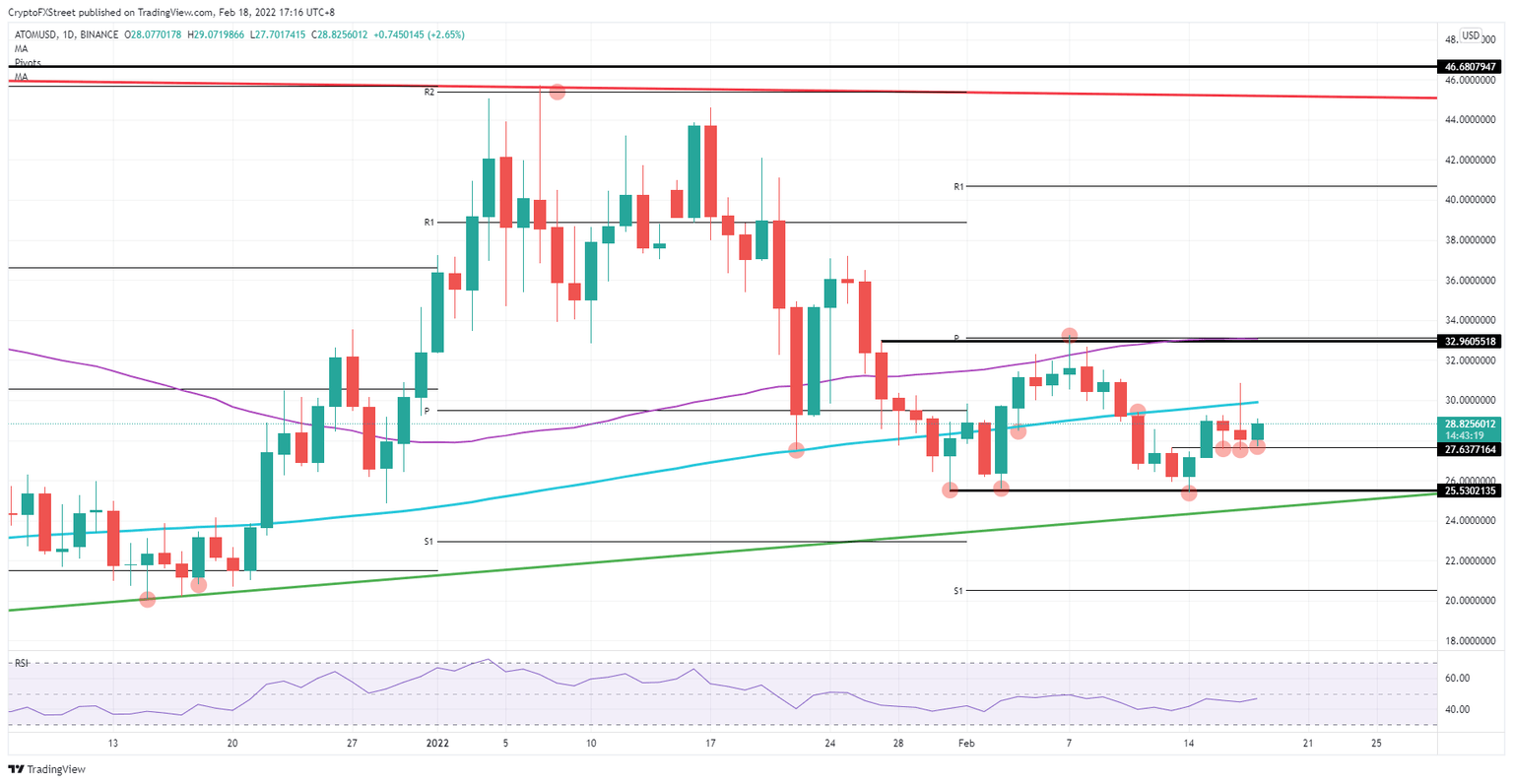

Cosmos (ATOM) price action saw bears’ attempts to push price back to the $25.53 level cut short these past three days as bulls made a firm stance to defend the short-term support level at $27.64. As a relief rally looks to be underway in stock markets this Friday, this can only result in an upward move for ATOM as the trading session will only pick up more speed going deep into US hours. Expect a solid push above the 200-day Simple Moving Average (SMA) with a possible profit target at $32.96.

ATOM poised for 18% returns in the very near term

Cosmos price action looks in great shape as investors only got hit with a small portion of losses to their portfolios as big inflows came in each time $27.64 came on the radar. The buy-side demand was so big that bears were just unable to try and trade below it and hit the cluster of stops placed when bulls entered after the breakthrough on Tuesday. With that said, bears will start to face a shortage of bids as bulls sit on their hands to ramp price action up higher.

As the supply side for bulls dries up, expect them to be forced to start hitting bids higher up, and with that creating a spiral move upwards as bears who tried to go short at $27.64 will now start to feel the pain of mounting losses and begin to buy into ATOM price action to cut their losses. Expect this to be translated in a break above the 200-day SMA at $30.00. From there, it is not a giant leap to try and reach $32.96 where the monthly pivot, the 55-day SMA and a previous high of January 27 all fall in line.

ATOM/USD daily chart

With three tests already, demand will start to fade at $27.64, which would result in a break below it, should bears be able to push price-action back down towards that level again. With that break, it would trigger some profit-taking from bulls who got in from lower levels, leading to a quick descent towards $26.00 with $25.53 coming in – the triple bottom from January 31. Nearing quite rapidly is the green ascending trend line just below, which could make it difficult for bears to go any further.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.