Compound Price Prediction: COMP strong buy signal could push it towards $170

- COMP is currently trading at $152 and has established a double bottom.

- The digital asset is down 44% since its all-time high at $276.5.

Compound was one of the most successful DeFi projects to hit the market, jumping towards $1 billion in market capitalization just days after getting listed. Compound is still ranked 41st, and bulls are looking for a clear breakout to the upside.

COMP/USD 12-hour chart

On the 12-hour chart, the TD sequential created a strong buy signal right after COMP price managed to defend $145, a support level established on September 6. The price formed a clear double bottom, which is also considered bullish. Similarly, the RSI has also defended the same level.

IOMAP Chart

Not only that, but the Bollinger Bands are getting squeezed significantly, indicating that a big move might happen soon. Unfortunately, the IOMAP chart shows little support between $151 and $140, which means that a bearish breakout would be devastating for COMP and could bring the digital asset down to $110.

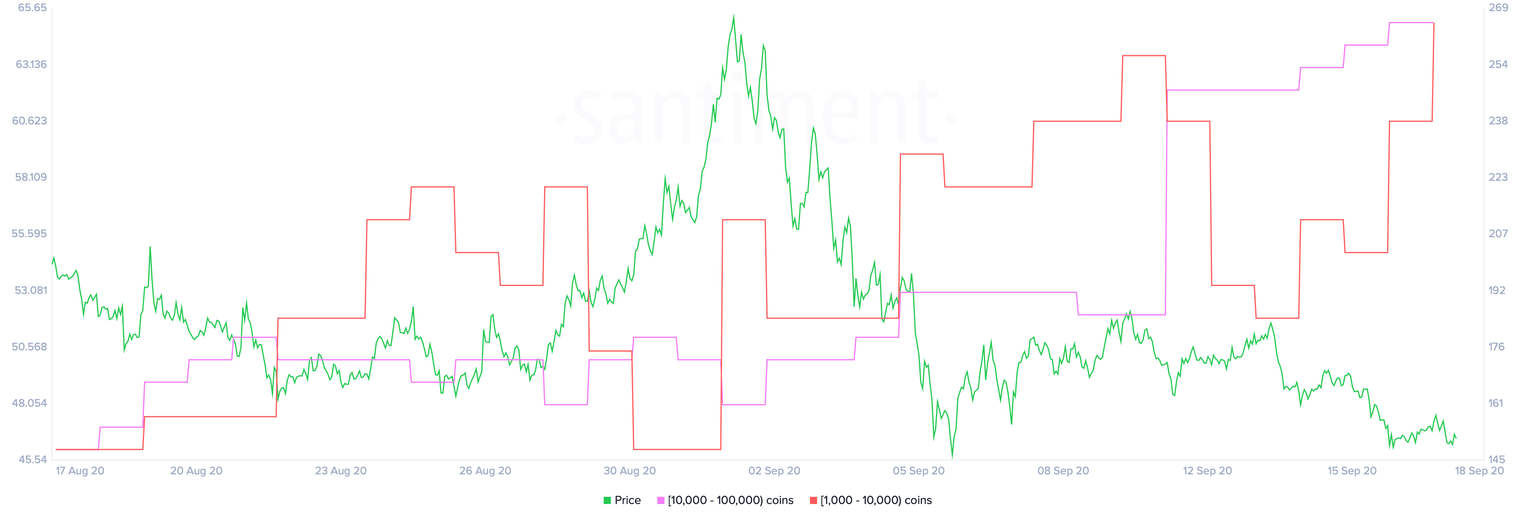

If the buy signal gets a continuation move, the next most significant resistance cluster is found at $168. It's worth noting that COMP whales have continued buying coins even though prices have been declining since the all-time high on September 1. This indicates long-term strength and huge interest in the digital asset.

COMP/USD 4-hour chart

After holding another double bottom at $147, bulls are ready to bounce towards the next most crucial short-term resistance at $159.6. A clear breakout and close above this level should validate the buy signal on the 12-hour chart.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637359490642992172.png&w=1536&q=95)

-637359494751236856.png&w=1536&q=95)

-637359491314159085.png&w=1536&q=95)