The Golden State of California may be America's most inquisitive state about Bitcoin (BTC) and Ethereum (ETH), new data from CoinGecko has revealed.

In a report shared by CoinGecko, internet users from California accounted for a whopping 43% of all Bitcoin and Ethereum web traffic searches on the crypto tracking website. This is despite the entire state population only accounting for 11.9% of the U.S. population.

Bobby Ong, COO and co-founder of CoinGecko said it was “unsurprising” that California took the crown in the blue-chip cryptocurrency interest, given its place as a “major technological hub.”

California is also home to Silicon Valley — one of the largest technology and innovation hubs in the world.

Among the largest companies situated in Silicon Valley to have invested in blockchain-based applications and crypto startups include Apple, Google, Meta, PayPal and Wells Fargo.

Centralized exchange Coinbase was one of the first major crypto companies to be headquartered in California, despite no longer having a headquarters today. The Graph, Helium, MakerDAO, and dYdX are among some of the latest Web3 projects with a presence in the Golden State.

Many prestigious universities with excellent engineering and technology departments are also located in California, such as Stanford University, California Institute of Technology, and the University of California Berkeley.

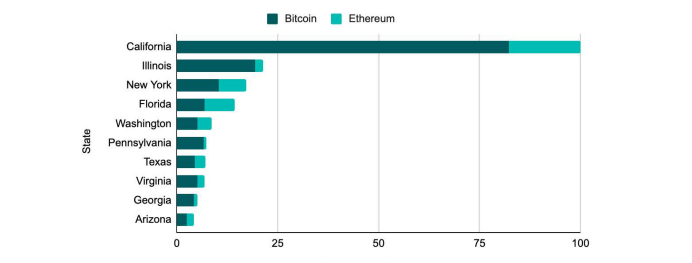

CoinGecko also noted that other states with a strong interest in the two cryptocurrencies include Illinois, New York, Florida, and Washington, followed by Pennsylvania, Texas, Virginia, Georgia, and Arizona.

Top 10 U.S. states with the most Bitcoin and Ethereum web page traffic. Source: CoinGecko

Across the top 20 states, most searches on the website appeared to be weighted toward Bitcoin, however, the data found that four particular states saw more searches for Ethereum than its competitor.

“What’s especially notable is Colorado, Wisconsin, New Jersey, and Florida’s interest in Ethereum over Bitcoin,” explained Ong.

“It remains to be seen how these rankings and market shares will play out in the coming months, with Ethereum’s Merge around the corner.”

The data was collected between May. 2 to Aug. 21, 2022, and only collected web traffic data from the U.S. The data was indexed on a scale of 0 - 100, with 100 representing the highest point of web traffic (California) relative to the other states.

The findings come as a recent Study.com survey revealed that over 64% of U.S.-based parents and college graduates with a sufficient understanding of blockchain technology want crypto to be taught in school classrooms.

On the global scale, the U.S. has shared the top spot with Germany when it comes to crypto-friendly regulation and legislation, sharing the top spot with Germany and beating out Singapore, Australia, and Switzerland, according to crypto data aggregator Coincub.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.