Coinbase stock 2023 returns pass 400% as COIN beats tech giants, Bitcoin

Bitcoin (BTC $42,964) exchange Coinbase is witnessing a stock renaissance as maximum 2023 gains for COIN pass 400%.

COIN/USD 1-week chart. Source: TradingView

COIN becomes top crypto pick for 2023

Data from Cointelegraph Markets Pro and TradingView shows the United States’ largest crypto trading platform hitting 20-month highs this week.

Coinbase and Bitcoin have risen in tandem in 2023, but as the yearly close approaches, the exchange’s performance looks to be increasingly in a league of its own.

The company’s COIN stock reached $162 on Dec. 19, surpassing the 4.

Now, traders are eyeing even more upside continuation as markets count down to the potential approval of the first U.S. spot Bitcoin exchange-traded fund (ETF).

narrative violation

— Nemo (@thecaptain_nemo) December 12, 2023

coinbase stock has almost 3x’d this year and was a better buy than NVIDIA pic.twitter.com/PPlb27nJ5n

Compared even to the largest altcoin, Ether (ETH $2,215), Coinbase has outperformed, with ETH/USD up around 85% since the start of the year.

ETH/USD 1-week chart. Source: TradingView

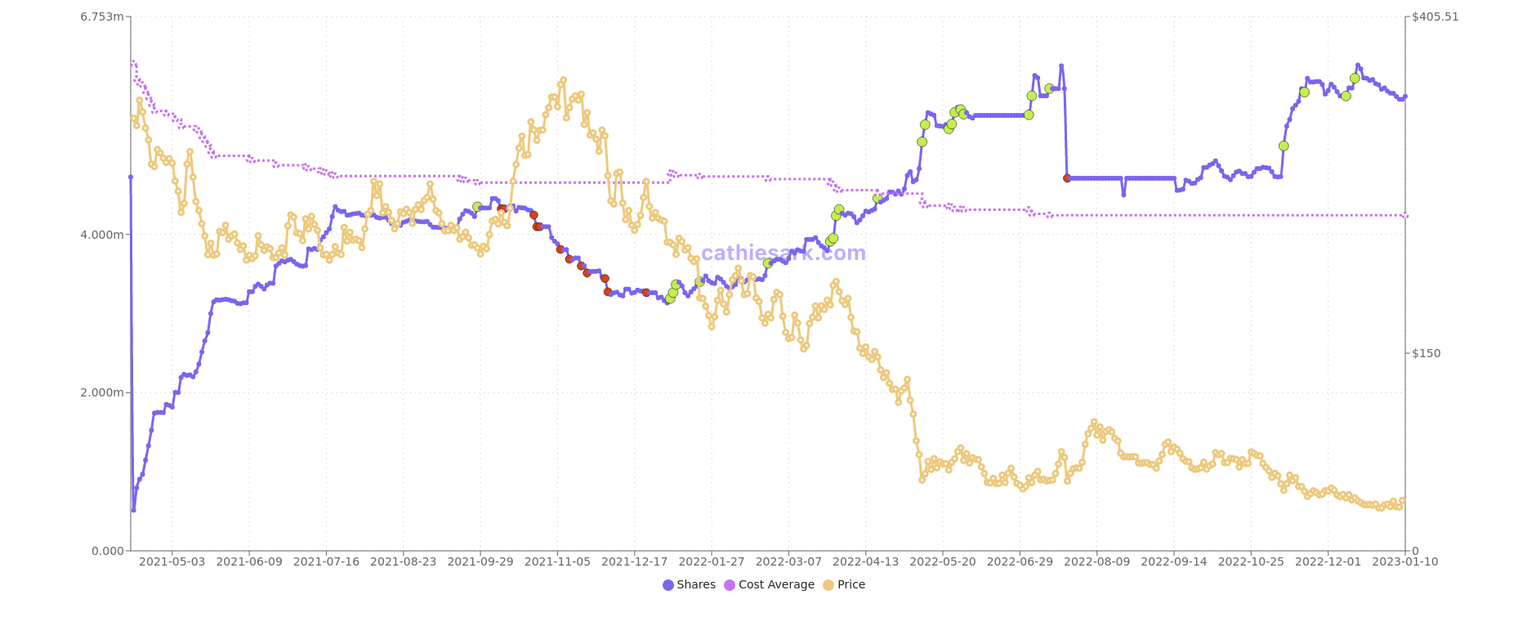

Some — notably investment giant ARK Invest — have reduced exposure as COIN climbs. According to data from the official website of ARK CEO Cathie Wood, COIN holdings in the firm’s ARK Innovation (ARKK) ETF have dropped around 11% in December alone.

The holdings, while still ARKK’s largest component, remain significantly beneath its aggregate cost basis of just under $255.

ARK Invest COIN holdings chart. Source: Cathie’s ARK

Armstrong: Anti-crypto is “bad politics”

Coinbase CEO Brian Armstrong nonetheless believes that the only way is up for crypto in 2024.

This week, the firm joined several U.S. crypto players in a fundraising move worth nearly $80 million to support “pro-crypto” U.S. election candidates.

“I think it’s time to make sure that people know being anti-crypto is just bad politics in D.C.,” he told CNBC in an interview on Dec. 19.

Armstrong referenced other current hurdles for Coinbase, including a rejection of a rule-making collaboration from the regulator in charge of greenlighting the ETF, the U.S. Securities and Exchange Commission.

“Coinbase has a role to play in all aspects of the value chain here,” he summarized about the exchange’s appeal in a post-ETF environment.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.