Coinbase-SEC lawsuit unrelated to XRP non-security ruling, executives drop COIN stock like hot cakes

- SEC vs Ripple lawsuit outcome has little bearing on the regulator’s lawsuit against Coinbase.

- Investment bank Berenberg says that Judge Analisa Torres’ decision on XRP may have no relationship with COIN.

- Coinbase executives and institutional investors have consistently shed their COIN stock holdings over the past week.

The SEC vs Ripple lawsuit outcome fueled a bullish sentiment in the crypto community. Experts are arguing that Coinbase is likely to land a win as the regulator’s argument against the platform’s sale of unregistered securities.

Investment banking experts at Berenberg told CoinDesk that this is unlikely and the status of XRP as a non-security in secondary market sales may have little-to-no bearing on the lawsuit against the exchange.

Coinbase executives have recently shed their COIN stock holdings, according to sources of insider trades.

Coinbase shares rallied after court dismissed part of SEC’s case against Ripple

Coinbase (COIN) shares rose by double-digits on Thursday after the verdict of the SEC’s lawsuit against Ripple. Most influencers and experts believe that the SEC’s case against Coinbase is weakened by Judge Analisa Torres’ declaring XRP as a non-security in secondary market transactions.

On the other hand, investment bankers at Berenberg told CoinDesk that the judge’s decision in the SEC vs Ripple case has small weight on the lawsuit against Coinbase. While XRP has been deemed as a non-security in secondary market sales, a complete reading of the ruling reveals that it is considered a security and an investment contract in other transactions, like sales made to institutional investors.

Therefore, it does not help Coinbase’s defense against the SEC. There are tokens trading on the exchange that may be deemed a security under certain circumstances, and this would imply a sale of unregistered securities by the exchange.

Berenberg analysts wrote in their report:

The surge was driven in large part by investors who interpreted Judge Torres’ ruling as representing a rejection of the SEC’s argument in the lawsuit it filed against COIN on June 6 that many of the tokens bought and sold in secondary-market transactions on the company’s exchange are unregistered securities.

Moreover, executives and institutional investors have been consistently shedding their COIN holdings, which raises concern in the community of holders.

Coinbase executives and COIN holders drop the token like hot cakes

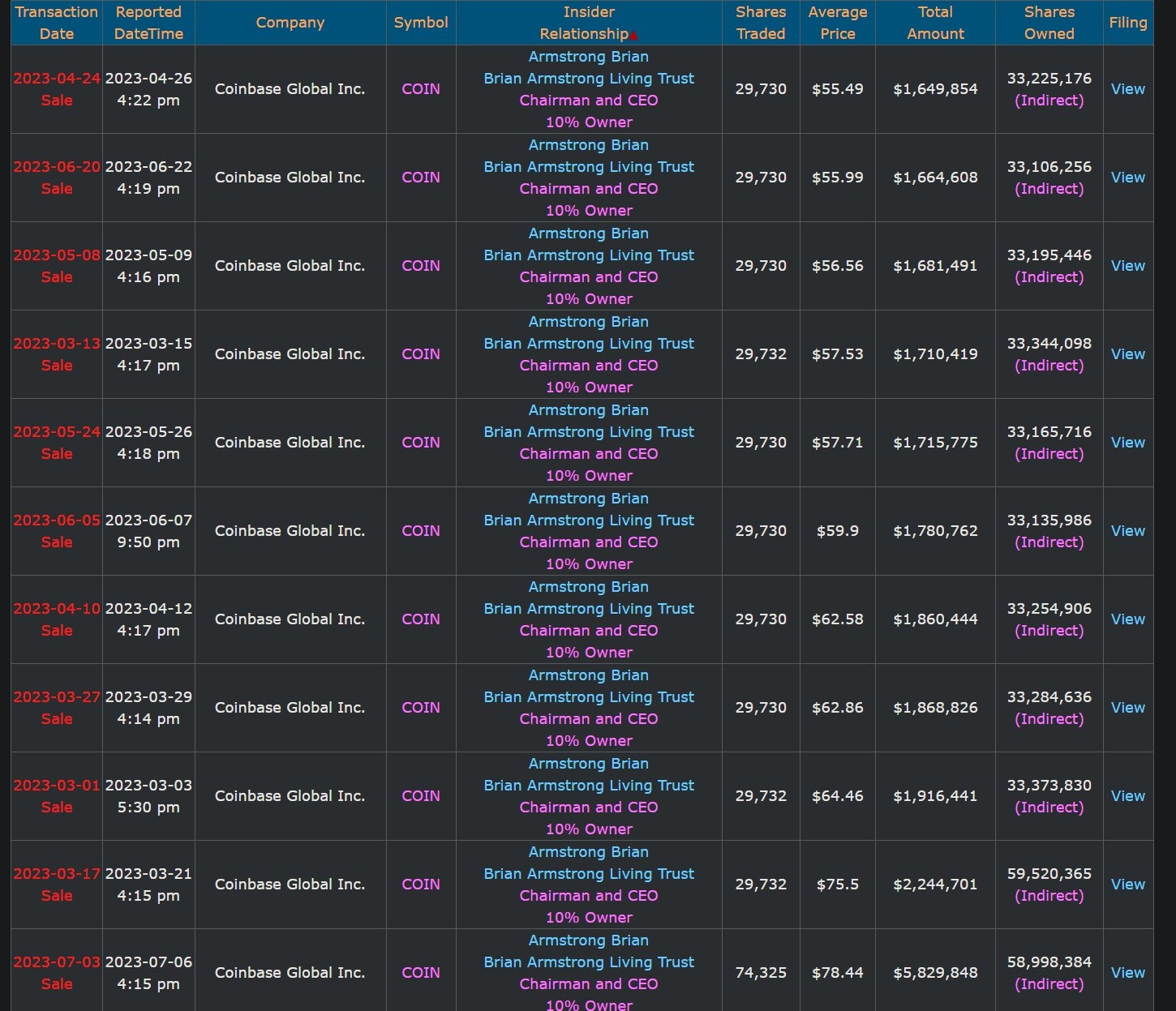

As of July 8, four top executives of Coinbase, including CEO Brian Armstrong, sold over $5.8 million in COIN stock. This was the largest sale of the week.

COIN sales by Brian Armstrong

Moreover, trades by insiders were recorded. The Chief Accounting Officer and others have engaged in sales of COIN, as seen below:

COIN sales by executives

Cathie Wood of ARK Invest sold $12 million in COIN and her institutional fund currently holds 11.03 million COIN shares. These sales by institutional investors fuel the speculation that irrespective of Ripple’s win in the lawsuit, there is a likelihood of a different outcome in the SEC’s legal battle with Coinbase.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.