Coinbase removes ‘backed by US dollars’ claim for USDC stablecoin

USD Coin (USDC), Circle’s dollar-pegged stablecoin, seemingly lost one of its biggest competitive advantages over its main rival, Tether (USDT).

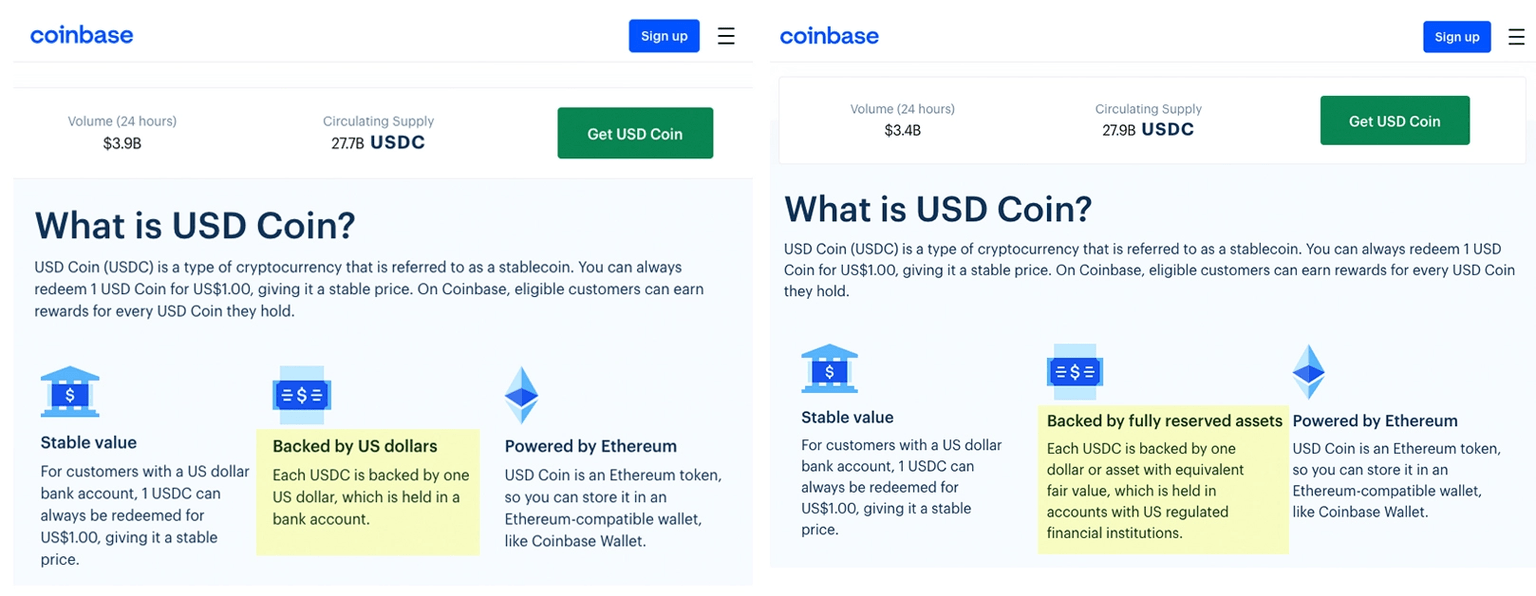

Major crypto exchange Coinbase made an important change on the USD Coin page on its website following an audit that revealed that not all of USDC’s reserves were held in cash. This ran contrary to the previous statement that “each USDC is backed by one U.S. dollar held in a bank account.”

Coinbase visitors are now greeted with a statement that says USDC is “backed by fully reserved assets” when they enter the USD Coin webpage. This new claim states:

“Each USDC is backed by one dollar or asset with equivalent fair value, which is held in accounts with US regulated financial institutions.”

Coinbase changed the promotional material for USDC. Source: Bloomberg

USD Coin stands as the eighth-largest cryptocurrency with a total market capitalization of over $28 billion. USDC is also the second-largest stablecoin after Tether, which has almost $63 billion in total assets, according to its latest Consolidated Reserves Report.

Since its inception, USDC has soared as a stablecoin fully backed by United States dollars. On the other hand, Tether has found itself in hot water with regulators on more than one occasion due to undisclosed commercial paper accounting for almost half of USDT’s total reserves.

However, an audit by multi-national tax advisory firm Grant Horton showed that 61% of USDC’s reserves were held in cash and cash equivalents, while 9% of the reserves were held in commercial paper. The audit report defines cash as deposits at banks and Government Obligation Money Market Funds, while cash equivalents are defined as securities with an original maturity less than or equal to 90 days.

The report revealed the USDC reserves include Yankee certificates of deposit and U.S. Treasuries and certainly are not “fully backed by U.S. dollar held in a bank account.” According to Bloomberg, the wording for the USD Coin on the website was changed the day the mainstream media contacted Coinbase about the report and related marketing material.

Coinbase spokesperson Andrew Schmitt reiterated to reporters that each USDC is backed by $1 or asset with equivalent fair value:

“Users can always redeem 1 USD Coin for US$1.00. We have added additional detail to our website for customers to understand more about USDC reserves.”

Circle, the company that oversees USDC in partnership with Coinbase under The Centre Consortium, recently announced its plans to become a full-reserve national digital currency bank in the United States. Circle CEO Jeremy Allaire said the company is willing to operate under regulators’ supervision and risk management requirements.

As part of the announcement, he said that USDC will grow to “hundreds of billions of dollars in circulation” continuing to support high-trust economic activity and will become a popular tool in financial services and internet commerce applications.

Coinbase did not immediately respond to Cointelegraph’s request for comment.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.