Coinbase Layer 2 BASE beats Arbitrum and Optimism in daily transactions

- Coinbase’s Layer 2 blockchain BASE beat competitors Arbitrum and Optimism to the curb with the highest daily transactions over the past week.

- Coinbase told FXStreet that the exchange is developing an open-source monitoring tool, Pessimism, to tackle the instances of scams and rug pulls on BASE.

- As competition among Layer 2 networks intensifies, BASE continues to attract new users and assets to its blockchain.

Competition among Layer 2 networks intensified with the launch of Coinbase’s blockchain BASE. BASE opened its mainnet for all users on August 9. Since its launch, the Layer 2 chain has amassed a large volume of users and average daily transactions on its blockchain.

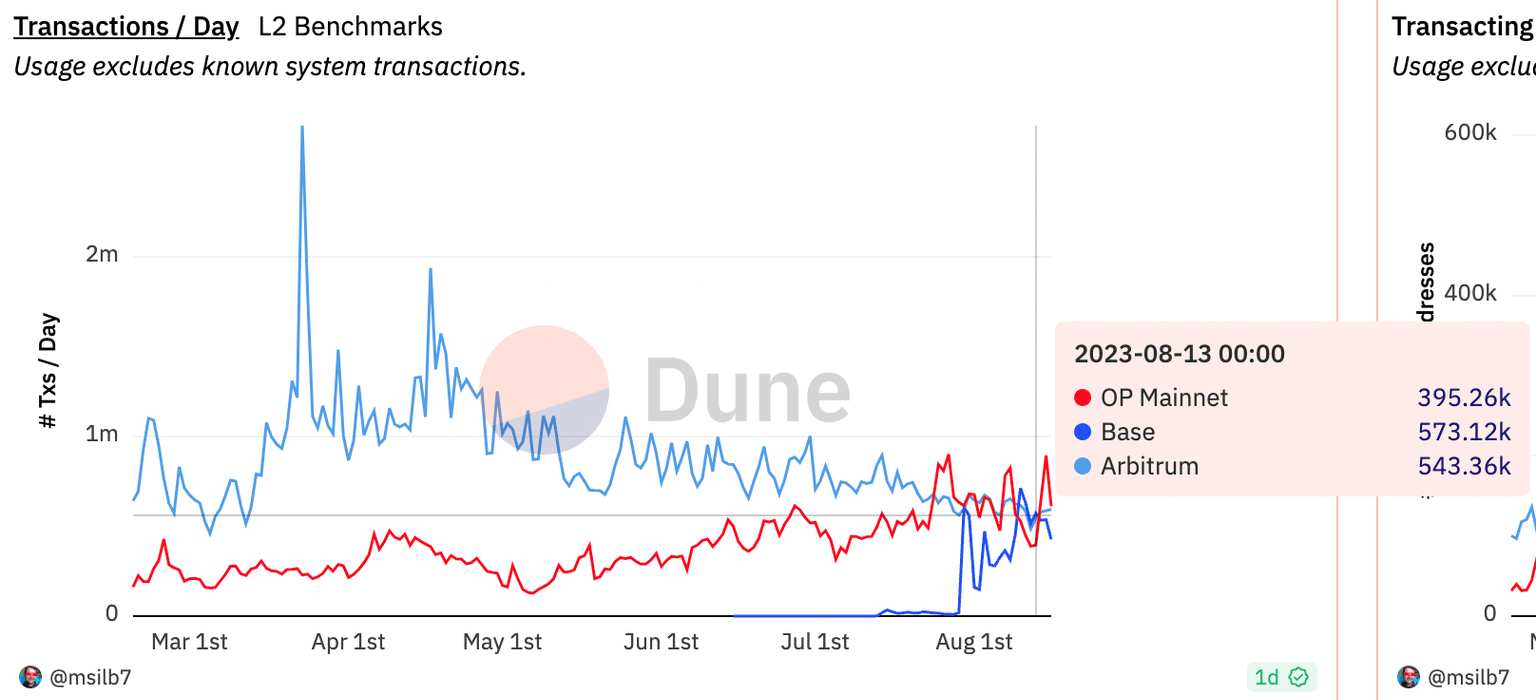

When compared to top Layer 2 blockchains, Arbitrum and Optimism, BASE leads the competition in the number of daily transactions on a seven-day timeframe.

Coinbase’s BASE mainnet kicks Layer 2 competitors to the curb with user activity

Within a week of its mainnet launch, BASE has attracted a large volume of traders and capital to the Layer 2 ecosystem. According to data from crypto intelligence tracker DeFiLlama, BASE has amassed $164.87 million in total value of assets locked on its blockchain.

BASE TVL as seen on DeFiLlama

Alongside a large volume of capital on its chain, BASE boasts of a large number of daily transactions on its network.

When compared to Arbitrum and Optimism, two large Layer 2 protocols, BASE is roughly at the same level in the seven-day moving average of the number of daily transactions. The daily transaction count for BASE, ARB and OP chains, is shown below:

Comparing daily transactions for ARB, OP and BASE chains on Dune Analytics

When comparing transactions per day on the three Layer 2 chains, on August 13, BASE led the three chains with the highest count of transactions, 573,120 while OP and ARB settled at 395,260 and 543,360 respectively.

Comparing transactions/day on OP, BASE and ARB chains on Dune Analytics

Scams on BASE and how Coinbase plans to address them

A leading concern in the crypto ecosystem is the rising number of scam projects on the BASE blockchain. Coinbase told FXStreet that the exchange has a plan to tackle the same. A Coinbase spokesperson said,

Given the permissionless and open nature of Base, we expect to see various types of projects built on the network. We encourage consumers to do their research diligently before participating in any dApp, on Base or any other chain, just as they would on the open internet.

The exchange believes in empowering users with information and tools to avoid losses incurred in the event of such scams as BALD and SwirlLend rug pulls. Find out more here. Therefore, to enhance the security of the entire Ethereum ecosystem, Coinbase is developing Pessimism, an open-source monitoring tool.

Pessimism will provide prompt notification of anomalies in the protocol and network and increase user confidence in projects launched on BASE.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.