Coinbase Layer 2 BASE battles yet another rugpull after BALD, SwirlLend exploited by attackers

- DeFi lending platform SwirlLend on BASE has been rugged and the total volume of assets locked dropped from $784,300 to $49,200.

- The protocol’s deployer bridged Ethereum and USDC from BASE to the ETH blockchain.

- Coinbase’s Layer 2 scaling solution-based LeetSwap DEX and BALD meme coin were recently exploited by the project’s deployer.

Coinbase’s Layer 2 BASE recently made headlines for its mainnet launch and rollout. Interestingly, the project suffered a rugpull before its launch, when meme coin BALD was exploited by its deployer through a DEX based on BASE called LeetSwap.

While LeetSwap managed a partial recovery of its funds, users who bridged their assets to the BALD liquidity pool lost their holdings. BASE is now faced with yet another rugpull. SwirlLend, a DeFi lending protocol, has also been rugged, as reported by blockchain security experts at PeckShield.

Also read: BALD rug pull wipes out 90% of value, hitting Base DEX LeetSwap: A timeline of events

Coinbase Layer 2 BASE-based DeFi protocol suffers rugpull

Coinbase Layer 2 BASE has amassed $167.74 million in total value of assets locked on its chain. While BASE continues to gain popularity among market participants, a DeFi lending protocol on the Layer 2 chain suffered a rugpull earlier today.

A rugpull is an exploit in which a developer or deployer of the project suddenly shuts down and leaves victims or investors scrambling while they bridge assets locked in the project. A recent instance of a rugpull on BASE was the LeetSwap-based liquidity pool for BALD, a meme coin that amassed nearly $100 million in market capitalization within 48 hours of its launch.

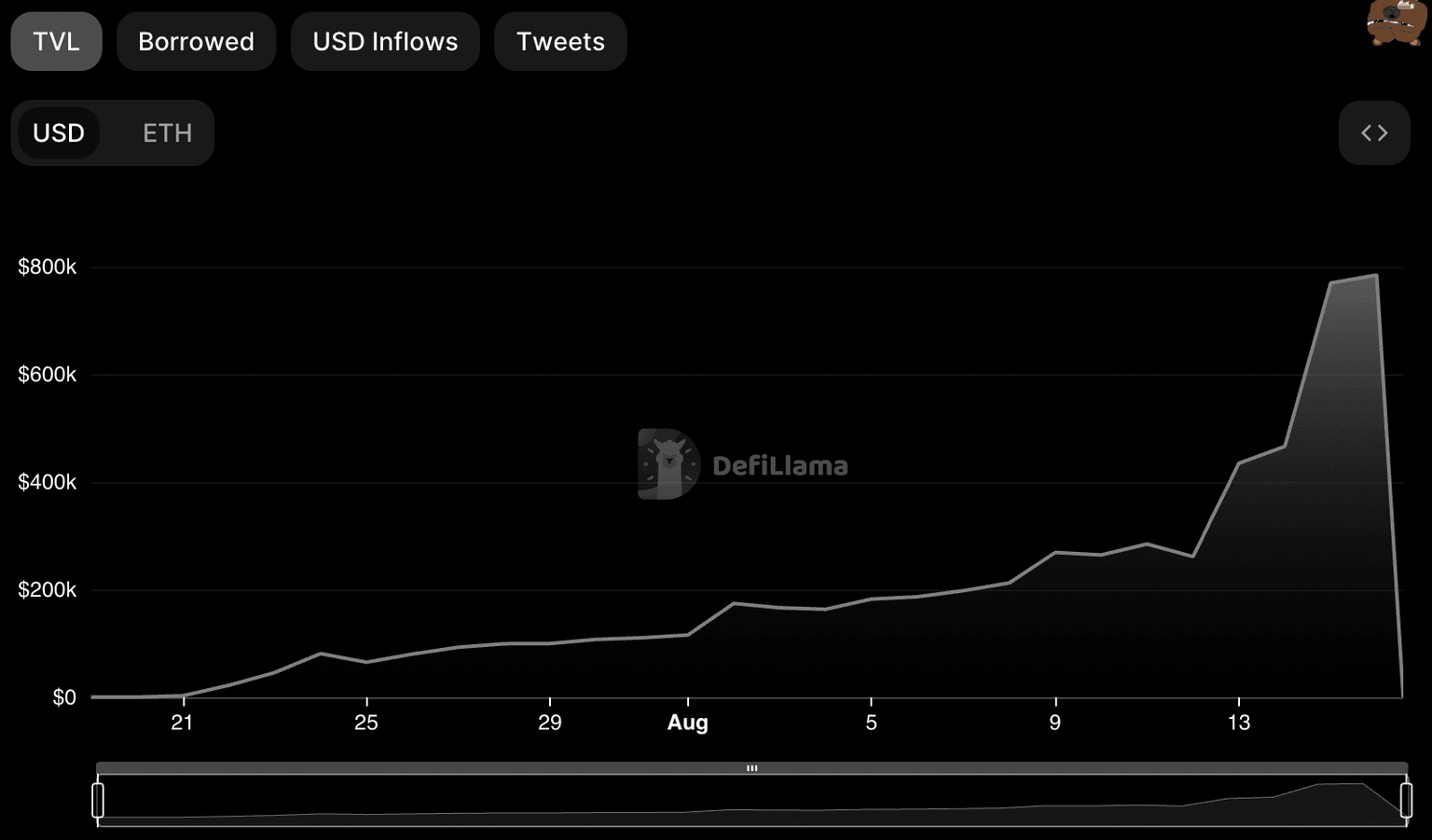

PeckShield, a blockchain security firm, identified the exploit and reported that the total value of assets locked in SwirlLend has dropped from $784,300 to $49,200.

TVL decline on SwirlLend

Moreover, the deployer has bridged nearly $289,500 worth of Ether and USDC tokens from Coinbase’s BASE to the Ethereum blockchain.

SwirlLend rugpull as reported by PeckShield

The deployer pulled 140.68 ETH and 32,600 USDC tokens. Another 92 Ether is held on the BASE chain.

Investors are left with no resort to retrieve lost funds as the deployer erased the social media platform of SwirlLend. Swirlend wasn't immediately available to respond to requests for comment.

The project originally had an account on X, formerly Twitter. The deployer has deleted the project’s accounts on X, Telegram, Discord, GitHub and taken down the website, with no means left to contact the exploiter.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.