- Ethereum price continues climbing above $600 as Coinbase just announced its support for Eth2.

- More than $500 million worth of ETH has been staked inside the Eth2 deposit contract.

Eth2’s phase 0 will launch on December 1 allowing everyone to finally stake their Ethereum coins. Coinbase, one of the largest exchanges in the world, announced its support for ETH2 enabling customers to stake on the exchange itself.

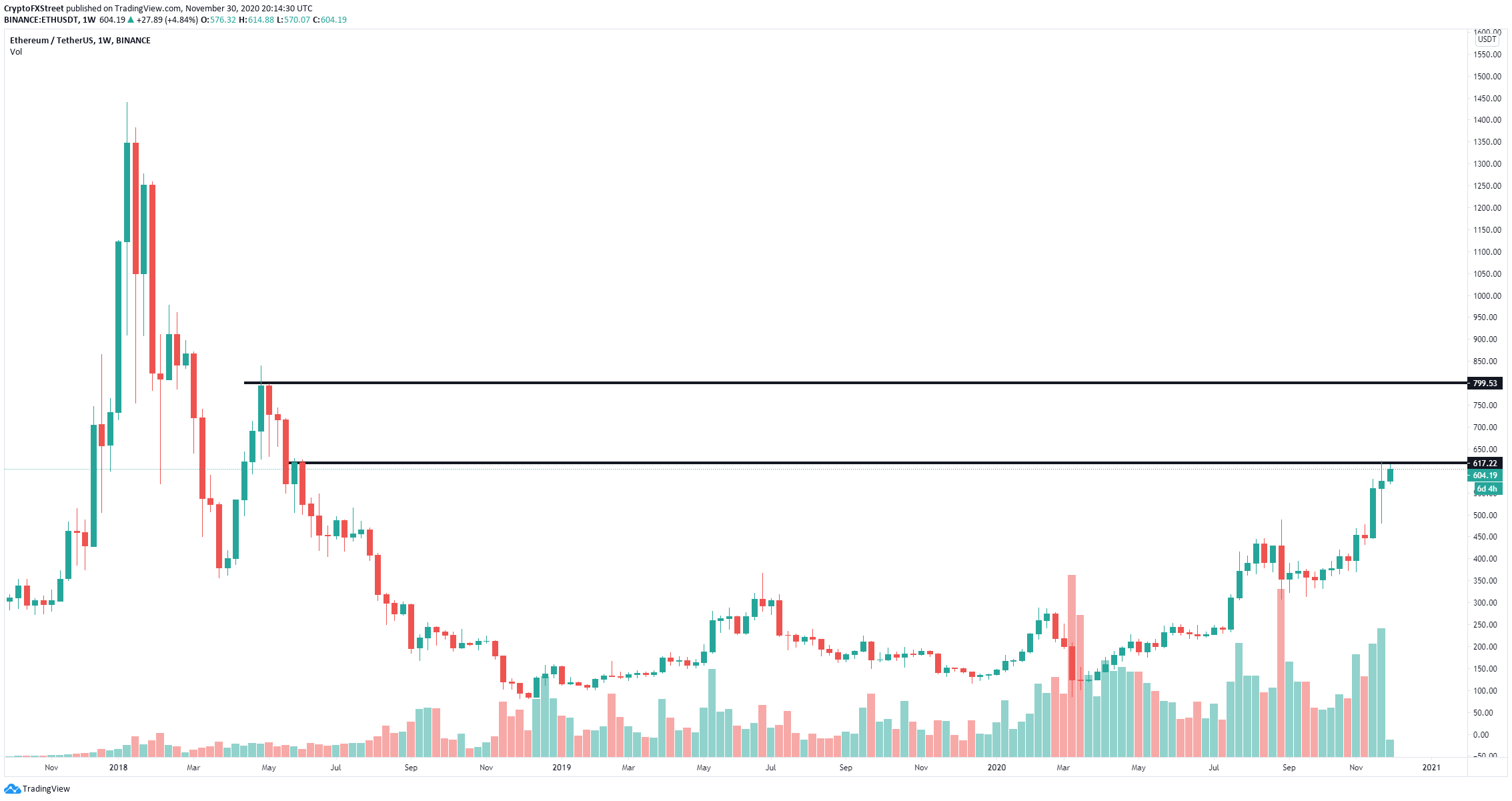

Ethereum price aiming for $800 if buying pressure continues mounting up

Ethereum is currently trading at $604, on the verge of breaking the 2020-high at $623. On the weekly chart, the digital asset seems to be facing only the $623 resistance level before a potential rise to $800.

ETH/USD weekly chart

Coinbase intends to enable customers to stake ETH2 and convert them into ETH coins and vice-versa. These features will be available starting in early 2021 for all eligible jurisdictions. The announcement is adding more credence to the bullish outlook for Ethereum price.

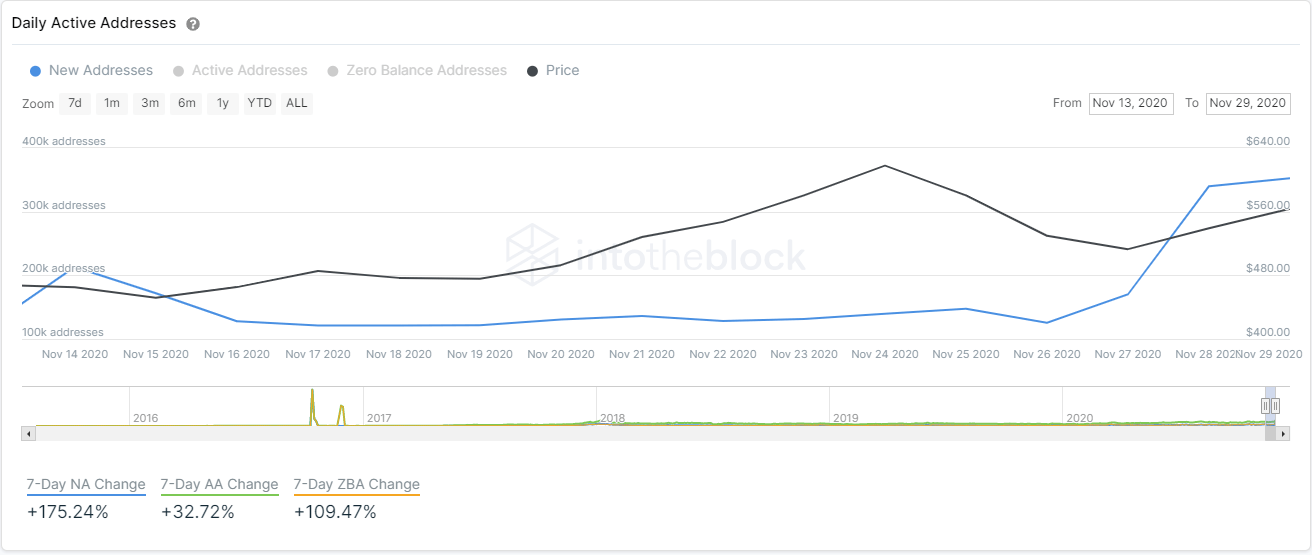

ETH New Addresses chart

Additionally, it seems that the number of new Ethereum addresses has seen a massive spike on November 27 from 170,250 to a current high of 352,640 per day. This is a significant growth showcasing the interest in the digital asset.

In our latest technical analysis of Ethereum, we discussed the potential bullish price targets on the way up. It seems that a breakout above $624 would quickly push Ethereum price to the 1.618 Fib level at $720 on the 4-hour chart.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Cardano Price Forecast: Sign of robust bullish reversal emerges despite dwindling DeFi TVL volume

Cardano rebounds to test resistance at $0.69 as technical indicator flashes a buy signal. A minor increase in the derivative Open Interest to $831 million suggests growing trader interest in ADA.

Crypto Today: Bitcoin's downside risks escalate as BTC spot ETF outflows extend

The cryptocurrency market is consolidating losses after starting the week amid high volatility. Bitcoin attempted to steady the uptrend above $106,000 but lost steam, resulting in a reversal to $105,204 at the time of writing on Tuesday.

Bitcoin falls below $106,000 as risk-off sentiment persists

Bitcoin price faces rejection around its $106,406 resistance level on Tuesday, hinting at a potential correction ahead. Market sentiment sours as growing Israel-Gaza tensions weigh on riskier assets, such as BTC.

Coinbase asset roadmap adds Ethena, ENA targets $0.34 breakout before listing

Ethena records its fourth consecutive positive day, signaling increased bullish momentum. Coinbase announces the addition of Ethena to the asset roadmap, making it tradable on the platform soon.

Bitcoin: BTC dips as profit-taking surges, but institutional demand holds strong

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.