Citi to trade Bitcoin futures following regulatory approval amid skyrocketing institutional interest

- Citigroup is looking to trade CME Bitcoin futures once it receives regulatory approval.

- A source familiar with the crypto derivatives market said that the bank is recruiting talent to join its digital asset team in London.

- The banking giant has seen skyrocketing interest in the leading cryptocurrency since August last year.

Citigroup is preparing to begin offering Bitcoin futures while awaiting regulatory approval for a cryptocurrency trading desk in the United Kingdom.

Citi to offer Bitcoin futures amid accelerating interest in BTC

According to an anonymous source who spoke to CoinDesk, Citi is waiting to receive regulatory approval to begin trading Bitcoin futures on the Chicago Mercantile Exchange (CME).

Under the consideration of regulatory frameworks and supervisory expectations, the bank has been careful in its approach to offer cryptocurrency-related services. The source revealed that the bank is considering digital asset products, including futures, for its institutional clients.

The second source that spoke with the media outlet said that Bitcoin exchange-traded notes (ETNs) were coming next following the approval to trade CME Bitcoin futures.

Citi is also hiring traders to work with Bitcoin futures to be a part of the crypto team in London, according to CoinDesk. However, the bank rejected parts of the report, stating that the firm’s claims of starting a crypto team in the UK and explore Bitcoin ETNs were inaccurate.

In May, the banking giant was considering launching cryptocurrency trading, custody and financing services due to the accelerating interest in the new asset class from institutional clients since August 2020.

At the time, Itay Tuchman, the head of foreign exchange at Citigroup, said that the bank was in no rush to launch crypto services and will only start offering products when it is confident that it benefits clients and is approved by regulators.

Wall Street banks have been warming up to the leading cryptocurrency, just as Bitcoin price has recently surpassed $50,000. Goldman Sachs started to offer its clients exposure to the bellwether digital asset through non-deliverable forwards, allowing them to bet on the BTC short-term price direction.

Bitcoin price to retest reliability of $46,000

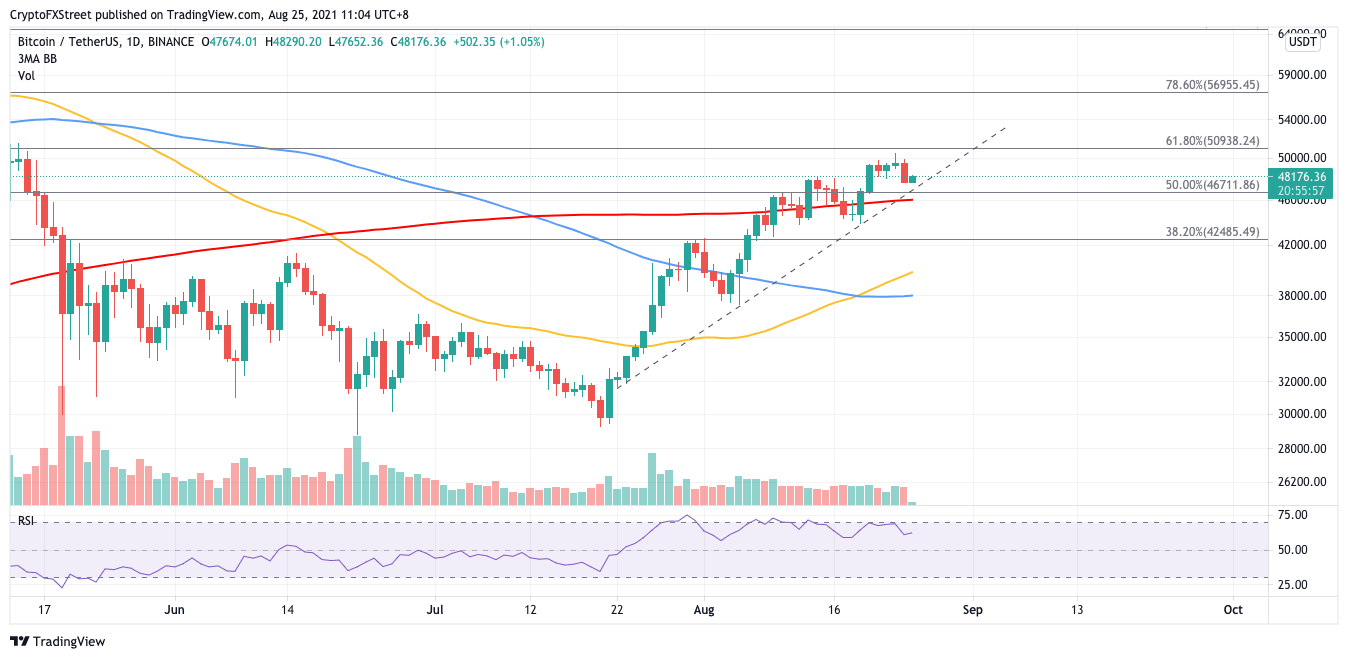

Bitcoin price is retracing after its swing high at above $50,000 on August 23. The leading cryptocurrency could correct to retest critical levels of support before resuming its uptrend.

The bellwether cryptocurrency will discover support on the diagonal trend line, coinciding with the 50% Fibonacci extension level at $46,711. Should Bitcoin price lose this level of interest, BTC may fall slightly lower to tag the 200-day Simple Moving Average (SMA) at $46,002.

If selling pressure increases, this may force Bitcoin price to fall further to tag the 38.2% Fibonacci extension level should the bulls retreat.

BTC/USDT daily chart

Given the strength of the previous areas of defense, lower levels are not expected due to the bullish momentum.

On the flip side, Bitcoin price was met with resistance at $49,776 before attempting to break above its swing high at $50,515. If BTC can tackle these obstacles, the bellwether cryptocurrency could tag the 61.8% Fibonacci extension level at $50,938 next.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.