The United States House Committee on Financial Services will hold a hearing on April 19 to discuss stablecoins’ position as a means of payment and whether the ecosystem needs supporting legislation.

The committee issued a memorandum to announce an upcoming hearing titled: “Understanding Stablecoins’ Role in Payments and the Need for Legislation.” The hearing will include information collected by various federal government agencies over the last year.

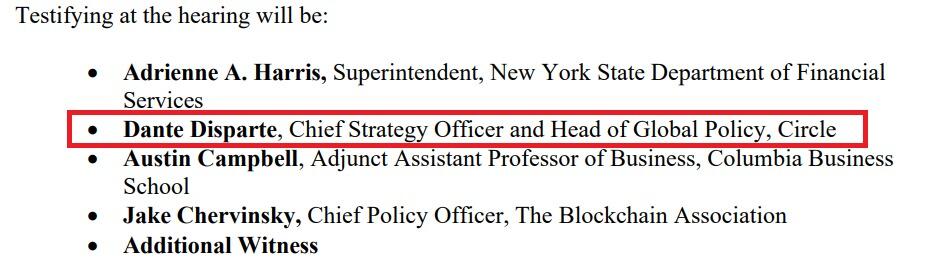

List of individuals testifying at the upcoming House Financial Services Committee hearing. Source: house.gov

Participants testifying at the hearing include Circle’s chief strategy officer and head of global policy, Dante Disparte. Last month, on March 11, Circle’s in-house stablecoin offering, USD Coin, depegged from the U.S. dollar after it revealed it had $3.3 billion of funds stuck at the collapsed Silicon Valley Bank (SVB).

2/ Like other customers and depositors who relied on SVB for banking services, Circle joins calls for continuity of this important bank in the U.S. economy and will follow guidance provided by state and Federal regulators.

— Circle (@circle) March 11, 2023

However, following a bailout of SVB depositors by the U.S. government, USDC repegged its value to the U.S. dollar. During this timeline, hackers managed to gain access to Disparte’s Twitter account and started promoting fake loyalty rewards to long-time users of USDC.

The upcoming committee hearing will focus on various stablecoins and their use in the payments landscape. Moreover, the committee will explore the need for stablecoin legislation depending on their underlying collateral structures.

Just days before the upcoming hearing, a draft bill providing a framework for stablecoins in the United States was published in the House of Representatives document repository.

Draft of the bill, including stablecoin regulations. Source: docs.house.gov

Speaking about the draft bill, Circle’s CEO Jeremy Allaire said, “There is clearly the need for deep, bi-partisan support for laws that ensure that digital dollars on the internet are safely issued, backed and operated.“

As Cointelegraph reported, the draft further allows the U.S. government to establish standards for interoperability between stablecoins.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Ripple update: XRP shows resilience in recent crypto market sell-off

Ripple's XRP is up 6% on Tuesday following a series of on-chain metrics, which reveals investors in the remittance-based token held onto their assets despite the wider crypto market sell-off last week.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

Six Bitcoin mutual funds to debut in Israel next week: Report

Six mutual funds tracking the price of bitcoin (BTC) will debut in Israel next week after the Israel Securities Authority (ISA) granted permission for the products, Calcalist reported on Wednesday.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.