- The Cross-Chain Transfer Protocol (CCTP) will enable transfer of USDC from other blockchain networks to Solana.

- Stablecoins on Solana have reached their highest volume since November 2022, with USDC as the most popular one.

- USDC cross-chain functionality may see more value flowing into the Solana ecosystem.

Solana (SOL) may be set for a potential price rally as Circle will launch its Cross-Chain Transfer Protocol (CCTP) utility on its blockchain on Tuesday. Considering SOL’s recent upsurge in on-chain metrics and the liquidity inflow the CCTP will enable, many believe investors may resume their buying pressure on Solana and its ecosystem tokens.

Solana’s on-chain metrics show growth

Solana has seen tremendous growth in the past month following the crypto bull market and the meme coin mania that sent its price to levels last seen in 2022. The record-breaking highs seen by meme coins like dogwifhat (WIF), Book of Meme (BOME), Slerf (SLERF), etc., sent trading volume on the smart contract blockchain up by more than 350% to $3.42 billion on March 16.

With such increased attention also came a significant rise of nearly 134% in total value locked to $4.67 billion on Tuesday, a two-year high, according to data from DefiLlama.

Read more: Solana Price Prediction: SOL likely to fall another 20% before buyers step in

Circle CCTP may propell SOL’s price

Stablecoins dominate more than half of Solana’s TVL as its DEXs and yield-bearing platforms gain traction. USDC accounts for 71% of these stablecoins as it is currently the most popular asset on Solana.

Even with such a grip on the Solana ecosystem, Circle, the parent company behind USDC, is looking to strengthen its dominance through the launch of its Cross-Chain Transfer Protocol (CCTP) on the blockchain on Tuesday. CCTP helps to facilitate the permissionless transfer of USDC across different blockchain networks through a burning and minting method, according to Circle.

Also read: Solana-based Jupiter posts hefty returns amidst meme coin rally

When CCTP goes live, users can transfer their USDCs from other blockchain networks directly to Solana without going through centralized exchanges or third-party bridges. For example, users could transfer USDC from Ethereum, Polygon, Base, and other CCTP-enabled chains to Solana.

This would "open up a huge pathway for cross-chain stablecoin liquidity," said Jeremy Allaire, CEO of Circle, in an X post. With more liquidity flowing into the Solana ecosystem, combined with many other of its growing on-chain metrics, many investors have expressed opinions that SOL may be set for a price rally. One X user commented “bullish”, while another posted “yuge”.

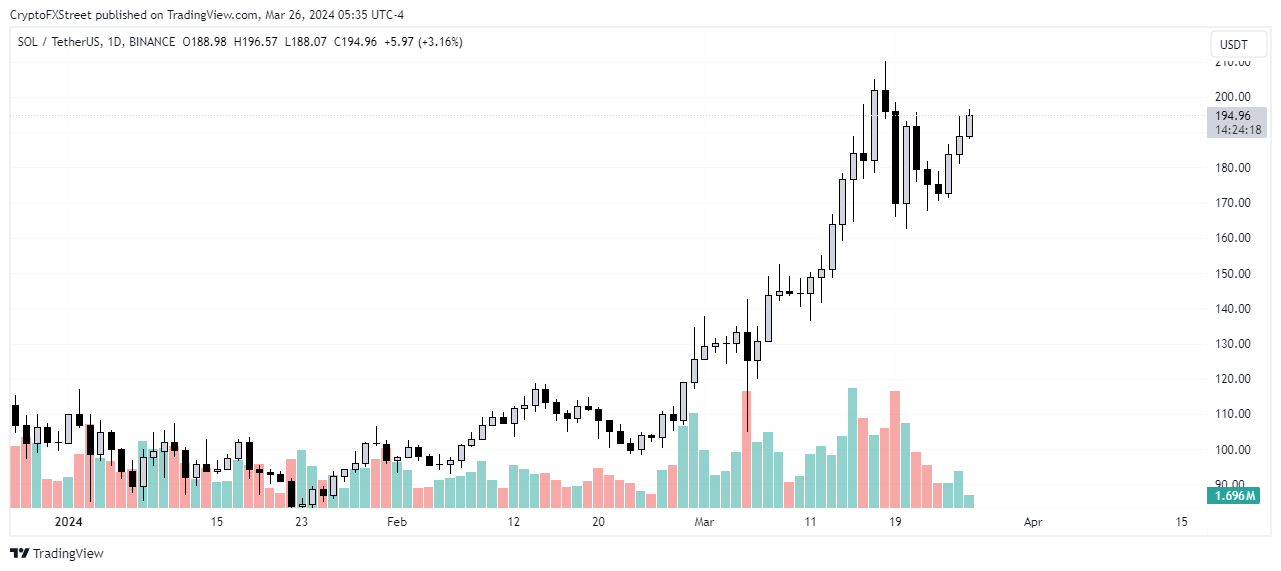

The SOL/USDT daily chart shows that while SOL's price is consolidating, SOL may be set for a rally if it breaks past the recent high of $210 on March 18. This thesis will be invalidated if the price falls below last week's low of $162.51.

SOL/USDT 1-day chart

SOL is trading at $194.15, up 3.0% on the day as of the time of writing.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin consolidates after a new all-time high of $99,500

Bitcoin remains strong above $97,700 after reaching a record high of $99,588. At the same time, Ethereum (ETH) edges closer to breaking its weekly resistance, signaling potential gains. Ripple holds steady at a critical support level, hinting at continued upward momentum.

Sandbox hits fresh yearly high as on-chain metrics reach record highs

The Sandbox continued its rally and hit a fresh yearly high of $0.8680 in the early Asian session on Monday after surging over 121% last week. However, at the time of writing, SAND retraces and stabilizes around $0.7600.

Why is Dogecoin price down today?

Dogecoin (DOGE $0.4243) is retreating after reaching its highest levels since May 2021, suggesting a growing profit-taking sentiment among traders following Donald Trump’s win.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.