Chiliz Price Prediction: CHZ anticipates 50% gains

- Chiliz price recently bounced off a critical support level at $0.473 and eyes a 50% upswing.

- CHZ needs to slice through a significant supply zone that extends from $0.593 to $0.657 to seal its bullish fate.

- A breakdown of the $0.430 support level will signify the start of a new downtrend.

Chiliz price is getting ready for another attempt at a bull rally after facing rejection at an area of resistance.

Chiliz price in a war of attrition

Chiliz price is consolidating inside a range that roughly extends from $0.473 to $0.593 for more than two months. Its latest attempt to escape this confinement failed and led to a 22% retracement.

Now, CHZ seems to be preparing for the next leg up and hopes to blast through the supply barrier that ranges from $0.593 to $0.657. A decisive close above this zone’s upper range will signal that the short-term bearish momentum has faced extinction.

In such a case, Chiliz price could consolidate a while before initiating its next leg to $0.796. All in all, this journey would mean a 50% increase in CHZ’s market value from the current level.

CHZ/USDT 12-hour chart

Investors need to note that the 50% upswing scenario explained above will be possible after a successful breach of the said resistance barrier. Based on IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, $0.539 is the first blockade buyers will encounter.

Here, roughly 6,000 addresses that purchased 610 million CHZ are “Out of the Money.” Hence, these investors who might want to break even could dampen the bullish momentum and prevent it from reaching the resistance supply zone that lies ahead.

CHZ IOMAP chart

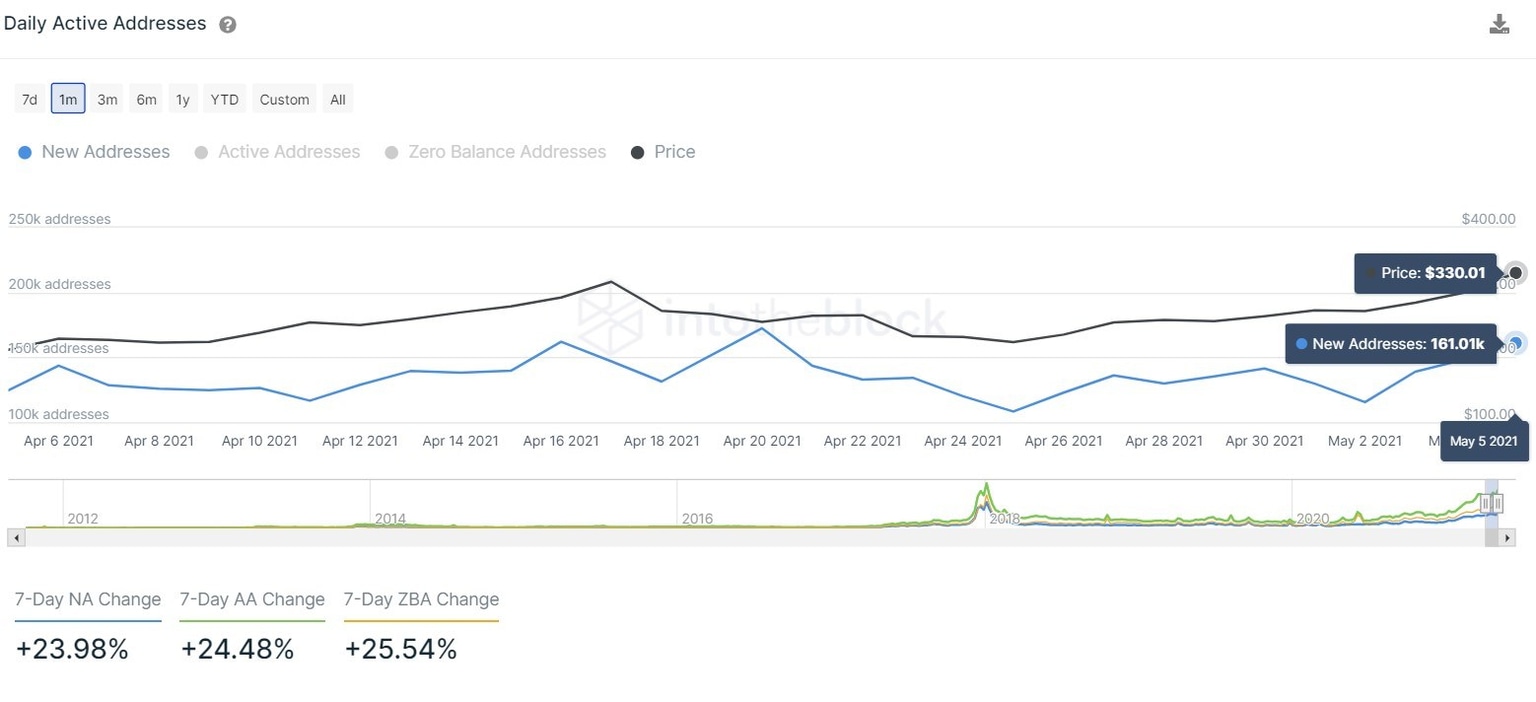

Furthermore, the number of new addresses joining the Chiliz network has decreased from 1,180 to 662. This 43% decline represents that investors are not interested in CHZ at the current price level and are either reallocating their funds or booking profits.

Hence, to sum it up, although CHZ looks primed for an upswing, investors need to exercise caution as on-chain metrics do not back this potential upswing.

CHZ daily new addresses chart

If the Chiliz price produces a decisive 12-hour candlestick close below $0.430, it would invalidate the bullish outlook and put the 6,100 addresses holding 520 million CHZ at $0.494 underwater.

In such a scenario, the increased selling pressure from these investors might push Chiliz price 10% lower to retest the support level at $0.380.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.