Chainlink whales continue their accumulation spree after LINK’s 40% rally, why?

- LINK price has inflated by 40% in the under three weeks and shows no signs of stopping.

- Chainlink whales holding 10,000 to 1,000,000 LINK continue to scoop LINK tokens.

- The oracle token could see a potential drawdown if holders decide to cash out unrealized profits.

Chainlink (LINK) price created a bottom in early September and triggered a massive rally that is still ongoing. There were signs of accumulation from whales before this uptrend kickstarted, but despite this extended rally, these investors are still scooping up LINK tokens.

Also read: Chainlink and Australia’s ANZ Bank issue AUD-stablecoin to successfully test interoperability

Chainlink whales remain busy

Chainlink whales began adding LINK to their holdings on August 30. Specifically, the wallets holding 10,000 to 100,000 LINK started to swell. Quickly thereafter, wallets holding 100,000 to 1,000,000 LINK tokens followed suit.

Between September 17 and September 30, the second cohort of whales’ holdings went from 78.3 million to 82.5 million LINK tokens, denoting a massive uptick in their accumulation.

LINK Supply Distribution

Read more: Chainlink price might face a correction before it can climb back to 2023 highs

While the Chainlink whales continue to accumulate for the long term, investors need to pay close attention to short-term holders. According to Santiment’s 30-day Market Value to Realized Value (MVRV) indicator, the profits of investors that purchased LINK in the last month are sitting at a 19% profit.

Over the last year, LINK price has hit several dead ends when this indicator was in the 14% to 20% range. Since the short-term holders are sitting on unrealized profits, the chances of another drawdown are likely.

While the pullback could be minor, investors need to be cautious of a sustained yet deep correction.

LINK MVRV 30-day chart

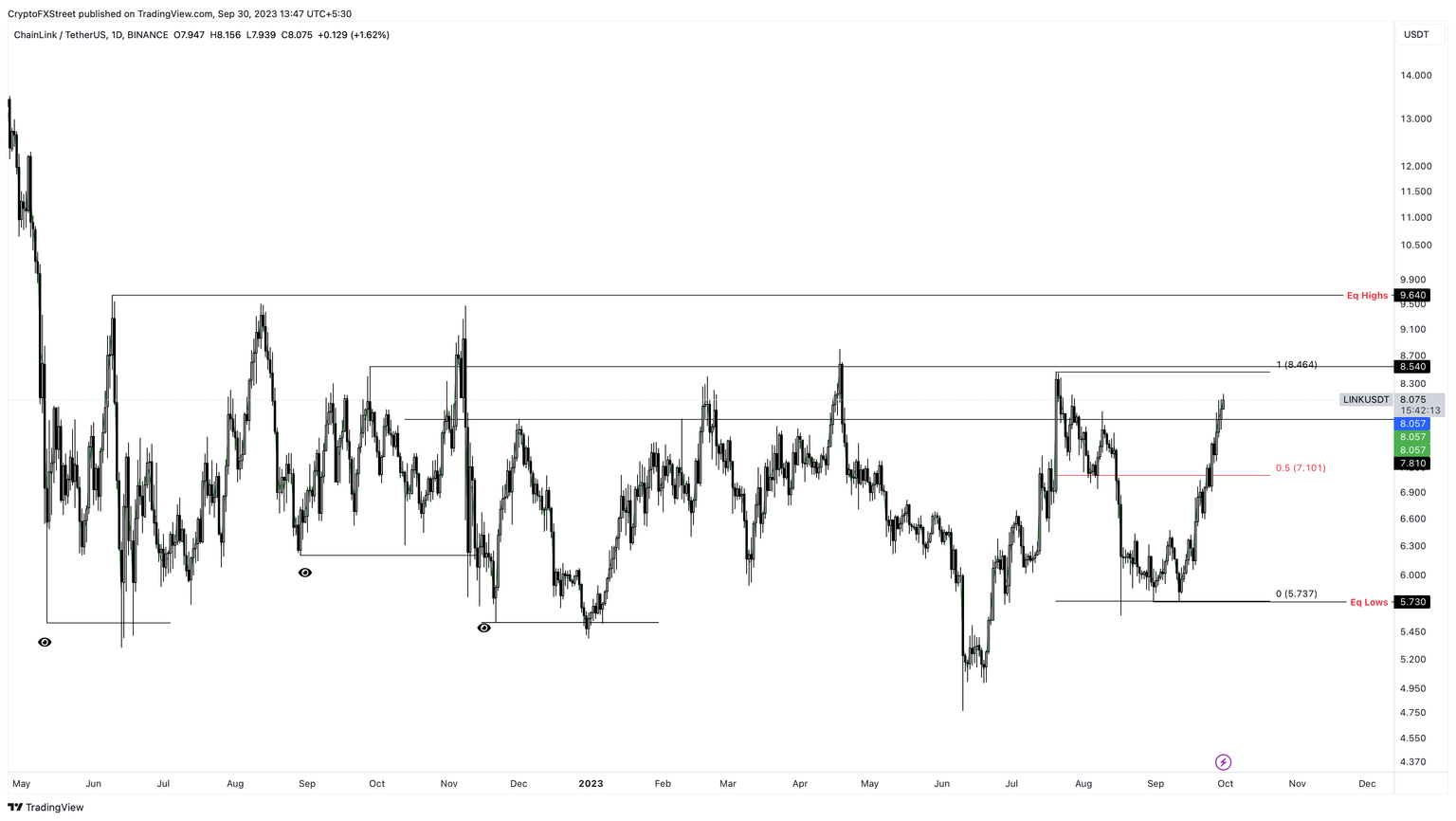

LINK price has inflated by 40% in the last 18 days and shows no signs of slowing down. A continuation of the uptrend could see the altcoin eye a sweep of the $8.45 hurdle. In a highly bullish case, it could collect the buy-side liquidity resting above $9.64.

LINK/USDT 1-day chart

But the short-term outlook as noted by the 30-day MVRV indicator, is flashing a potential sell signal. Therefore, traders need to be extremely cautious shorting LINK.

Also read: Chainlink outperforms altcoins in September with dwindling exchange supply

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520%5B14.14.06%2C%252030%2520Sep%2C%25202023%5D-638316629496084604.png&w=1536&q=95)

%2520%5B14.58.00%2C%252030%2520Sep%2C%25202023%5D-638316629704473059.png&w=1536&q=95)