Chainlink VRF integration improves as LINK price eyes 30% upswing

- Chainlink price is currently retracing to find a support level that will help catapult the token.

- PolyWhirl integrates Chainlink VRF to secure token burns and decentralize them.

- A breakdown of the $15.04 support level will invalidate the bullish outlook.

-637336005550289133_XtraLarge.jpg)

Chainlink price has seen an impressive run-up over the past week, but it has been able to breach through a crucial supply barrier. The recent pullback stems from an inability to slice through the said resistance zone.

However, the correction provides buyers with another opportunity to do the same.

Verifiable Random Function makes more headway

PolyWhirl, a decentralized private transaction ecosystem, recently announced integrating Chainlink VRF (Verifiable Random Function) on the Polygon blockchain. This move will allow the ecosystem to obtain a tamper-proof, reliable and auditable source of randomness. In doing so, PolyWhirl will be able to autonomise and provide a fair opportunity for buying back WHIRL tokens to burn them via the PolyWhirl protocol fee.

The lead developer of PolyWhirl, Whirl Master, adds,

Chainlink’s VRF is the perfect way to empower our autonomous and decentralised token burns, with complete verifiability of the selected time to ensure fairness for the community.

Another milestone is the integration of the Chainlink price feeds by MyCryptoCheckout, a peer-to-peer cryptocurrency payment gateway. The said feeds will provide the payment platform with tamper-proof, reliable, high-quality price data that is secure and up-to-date.

According to the announcement, this adoption will use the price data for BNB-USD, BTC-USD and ETH-USD.

Chainlink price retraces before heading higher

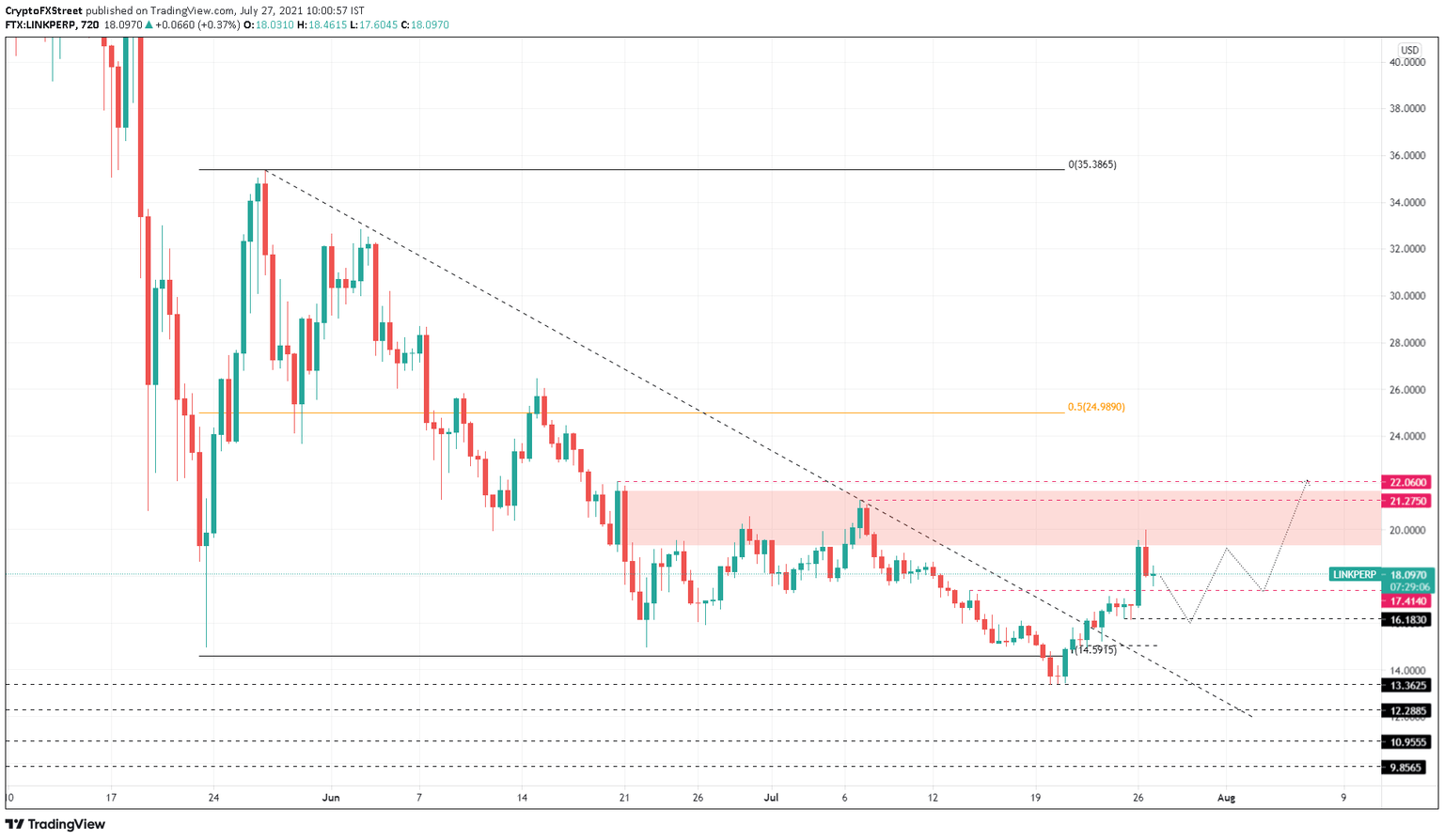

Chainlink price created a supply zone ranging from $19.30 to $21.65 on June 20 as it crashed 32% to $14.98. This resistance area has prevented LINK from rallying four times over the past month.

The recent tussle with this barrier has resulted in an 11% retracement to where it currently stands – $18.10. The correction could extend down to the $16.18 support level before a strong surge in buying pressure is noticed.

Assuming the bullish momentum makes a comeback around $16.18, investors can expect the resulting rally to slice through intermediate barriers and tag $19.30, the lower limit of the supply zone. This move would constitute a 19% upswing and might extend to the resistance levels at $21.27 or $22.06 if the buying pressure continues to push.

LINK/USDT 12-hour chart

While the upswing narrative seems likely, investors should consider the possibility of a move that shatters the support level at $16.18. If such a downswing were to occur, it would indicate a weak buying pressure.

However, if the bearish momentum breaks through the $15.04 demand barrier, it will invalidate the bullish thesis and potentially trigger a sell-off to the July 20 swing low at $17.38.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.