Chainlink ready to break the internet, is CCIP a global open-source standard?

- Crypto analyst believes Chainlink is a top three cryptocurrency and Cross Chain Interoperability Protocol (CCIP) is the global standard.

- Chainlink has a big head start over other cryptocurrencies and altcoins, with its massive adoption.

- Chainlink price could revisit its August high of $9.52, the sentiment among analysts is bullish.

-637336005550289133_XtraLarge.jpg)

Chainlink is one of the top three altcoins according to proponents and analysts who evaluated the altcoin and its Cross Chain Interoperability Protocol (CCIP). Jon Melillo, a crypto analyst and trader revealed his bullish outlook on Chainlink.

Also read: Analyst predicts massive crypto breakout by midweek in Bitcoin and Ethereum

Chainlink traders make a move, LINK ranks as top purchased coin

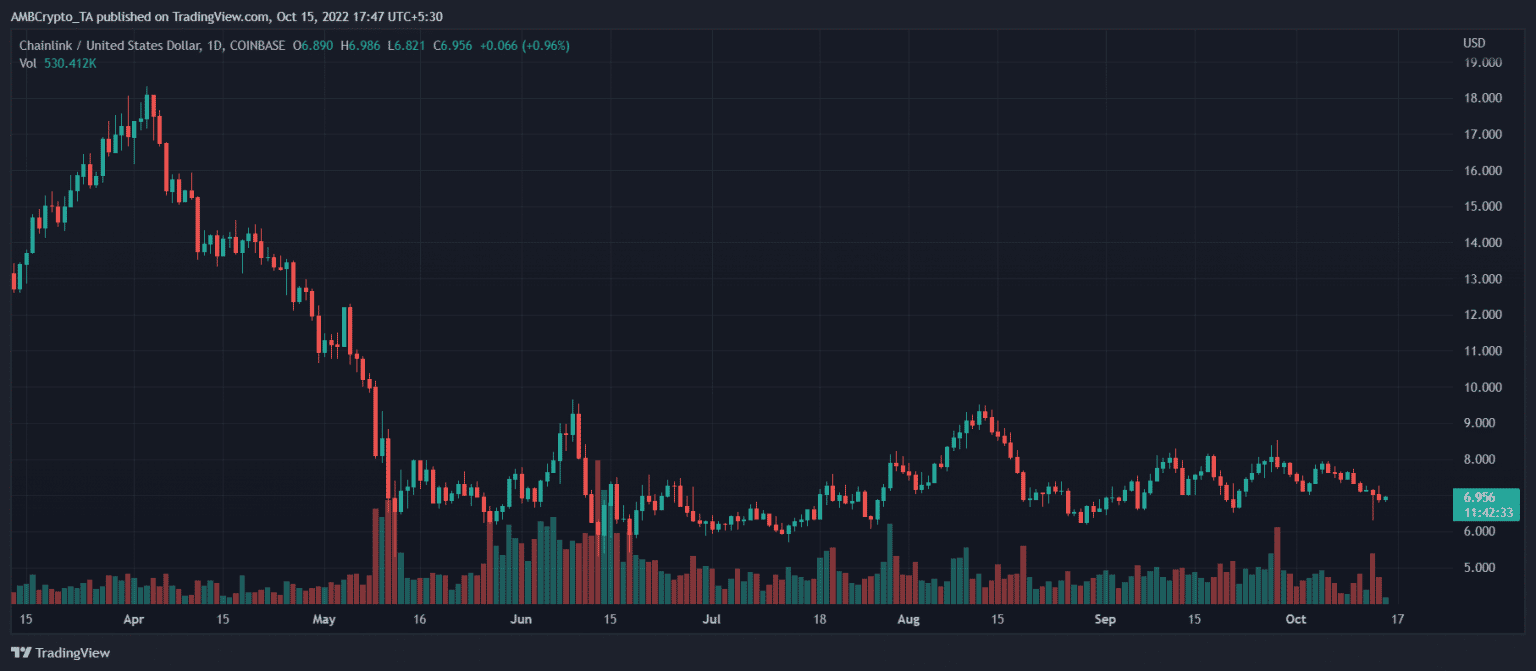

Chainlink price is trading between $6 to $8 and analysts believe the altcoin is in the accumulation zone. Based on data from Santiment, an on-chain data provider, Chainlink’s social dominance, a measure of the altcoin’s popularity among traders has climbed considerably.

Chainlink’s social dominance

Benjamin Cowen, a leading analyst and the founder of Into TheCryptoverse (ITC) stated that Chainlink could outperform Bitcoin. Cowen believes Chainlink is currently in the accumulation phase and the altcoin could outperform once the bull market resumes.

Part of the reason analysts are so bullish is that Chainlink is a top choice among analysts and developers to enable smart contracts and secure data sharing. Jon Melillo, crypto analyst and trader believes Chainlink CCIP will create a global open source standard that will allow blockchains to interoperate with each other. In this way smart contracts, programmed procedures, from different blockchains will be able to send commands to each other and enable the movement of tokens between chains. CCIP gives developers the ability to generate a smart contract on Ethereum, use defi protocols on other chains, and send a payment on a hyperledger payment system.

Analysts believe Chainlink price could hit August high

Analysts at AMBCrypto evaluated the Chainlink price trend and predicted a run up to the altcoin’s August high of $9.52. Chainlink could witness more volatility than usual in the ongoing bear market, compared to the rather calm sideways movement witnessed by LINK’s price in July.

LINK/USD price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.