Chainlink price would need to cross this critical barrier to jump to $8

- Chainlink price rallied by nearly 11% in the span of 72 hours to trade at $7.36.

- Testing the three-month high of $8.27 might be on the cards if bulls pull through.

- If LINK loses the critical support of $6.77, the bullish thesis would be invalidated.

-637336005550289133_XtraLarge.jpg)

Chainlink price has had a disappointing run since the beginning of the year, but the altcoin might be beginning to change its ways. If the bullish narrative anticipated over the next few trading sessions plays out, LINK might be well on its way to reclaiming the losses it witnessed three months ago.

Chainlink price set up for a rise

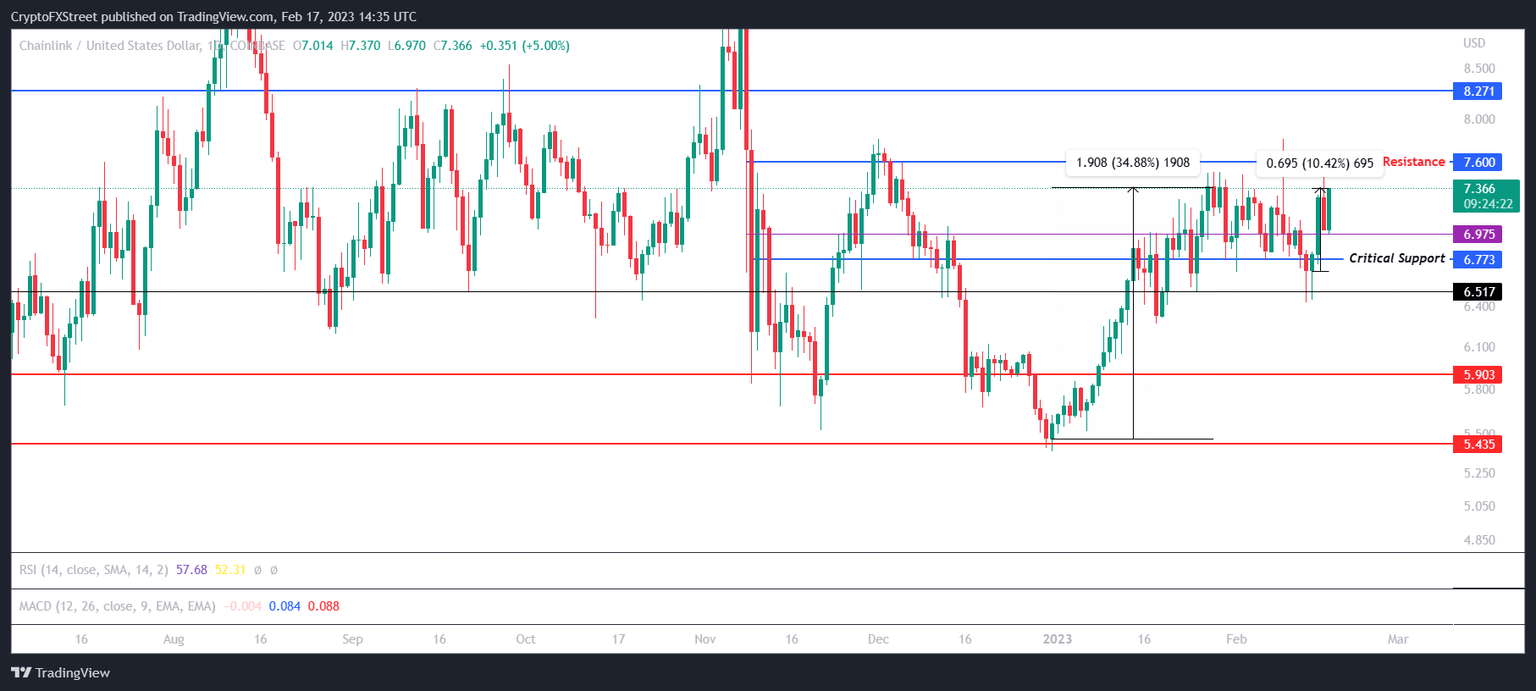

Chainlink price noted some increase over the last three days as the altcoin rose by 10% from $6.68 to trade at $7.36 at the time of writing. With the broader market cues led by Bitcoin appearing to be bullish, LINK is also expected to leverage the potential positive momentum and chart an increase toward $8.

Chainlink price is nearing the critical resistance at $7.60, and as indicated by MACD and RSI, the altcoin might be able to breach through it. The Moving Average Convergence Divergence (MACD) highlights a possible bullish crossover taking place. The MACD line (blue) is in convergence with the signal line (red), and if it crosses over it, LINK would be facing a bullish momentum.

Similarly, on the Relative Strength Index (RSI), the indicator can be seen in the bullish zone above the 50.0 neutral mark. Using this line as support and bouncing off of it will ensure Chainlink price stays in the bullish zone.

Chainlink MACD and RSI

This would give Chainlink price the push it needs to breach the critical resistance at $7.60 and flip it into support. In doing so, LINK would be able to leverage the momentum and rally to tag the three-month high of $8.20, registering a 13% increase.

LINK/USD 1-day chart

However, if the bullish narrative fails and bears take control of the wheel, Chainlink price loses the immediate support of $6.97, and a decline toward the critical support at $6.77 is possible. Losing this support would invalidate the bullish thesis and also leave LINK vulnerable to a crash of 20%, to $5.90.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.