Chainlink price volatility drops, bringing transactions to 2020 lows, whales resort to dumping

- Chainlink price fell from the 2023 high at $8.5 and crashed by nearly 20% to trade below $7.

- Whales holding 100,000 to 1 million LINK have shed nearly $30 million worth of their supply in the past month.

- Investors participation going down has brought down the volume of transactions conducted to a two-year low.

-637336005550289133_XtraLarge.jpg)

Chainlink price, after days of sideways movement, failed to initiate a recovery, reinforcing the bearish outlook of its large wallet holders. Most of the investors are going back to being inactive, which in turn is having a drastic impact on the on-chain transactions.

Chainlink price needs a boost

Chainlink price, at the time of writing, slipped below the $7 mark extending the downfall that began in mid-April. Over the last three weeks, the altcoin has declined by nearly 20% and is not showing any signs of imminent recovery either, raising concerns for the network.

LINK/USD 1-day chart

This concern is the result of investors pulling back after the Chainlink price failed to rally up to November 2022 highs of $9, closing the year-to-date high at $8.5. As the cryptocurrency began charting red candlesticks, investors' participation also started fading.

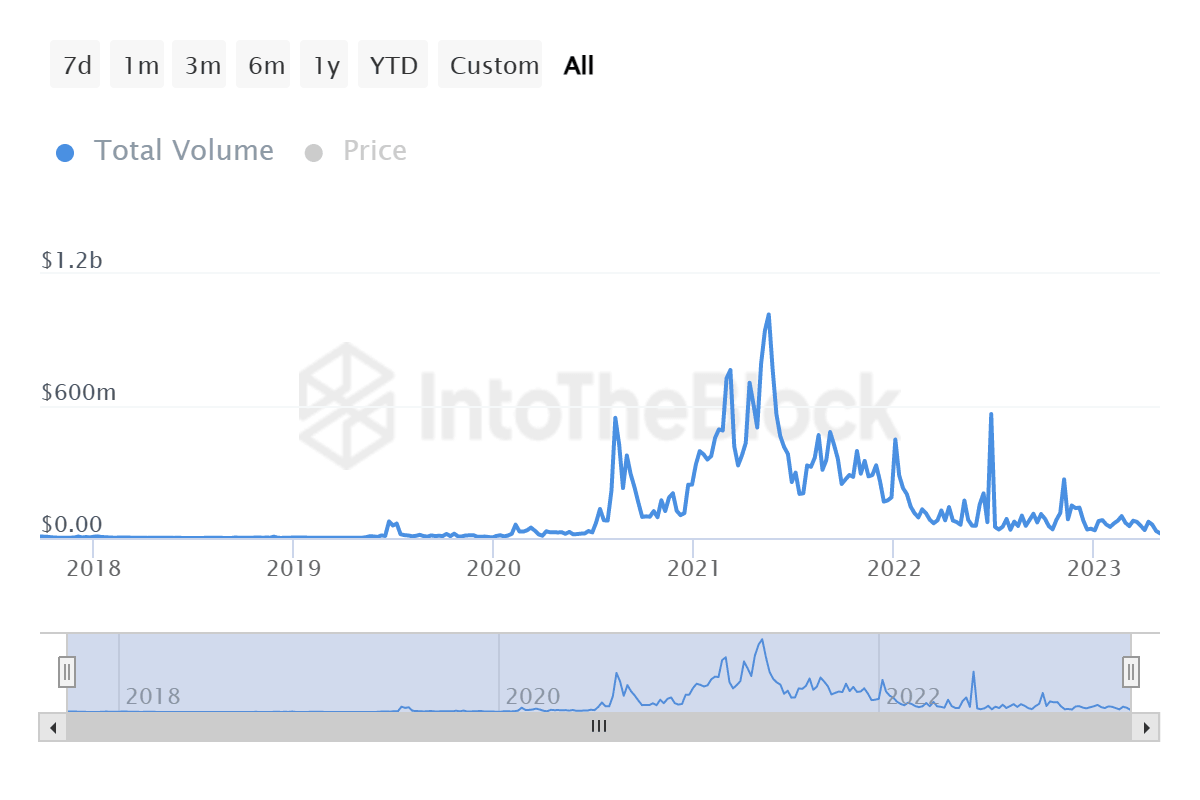

With declining participation came the fall in on-chain transactions, and as a result, the daily volume fell to a two-year low of $21.24 million – figures that were last noted in April 2020.

Chainlink transaction volume

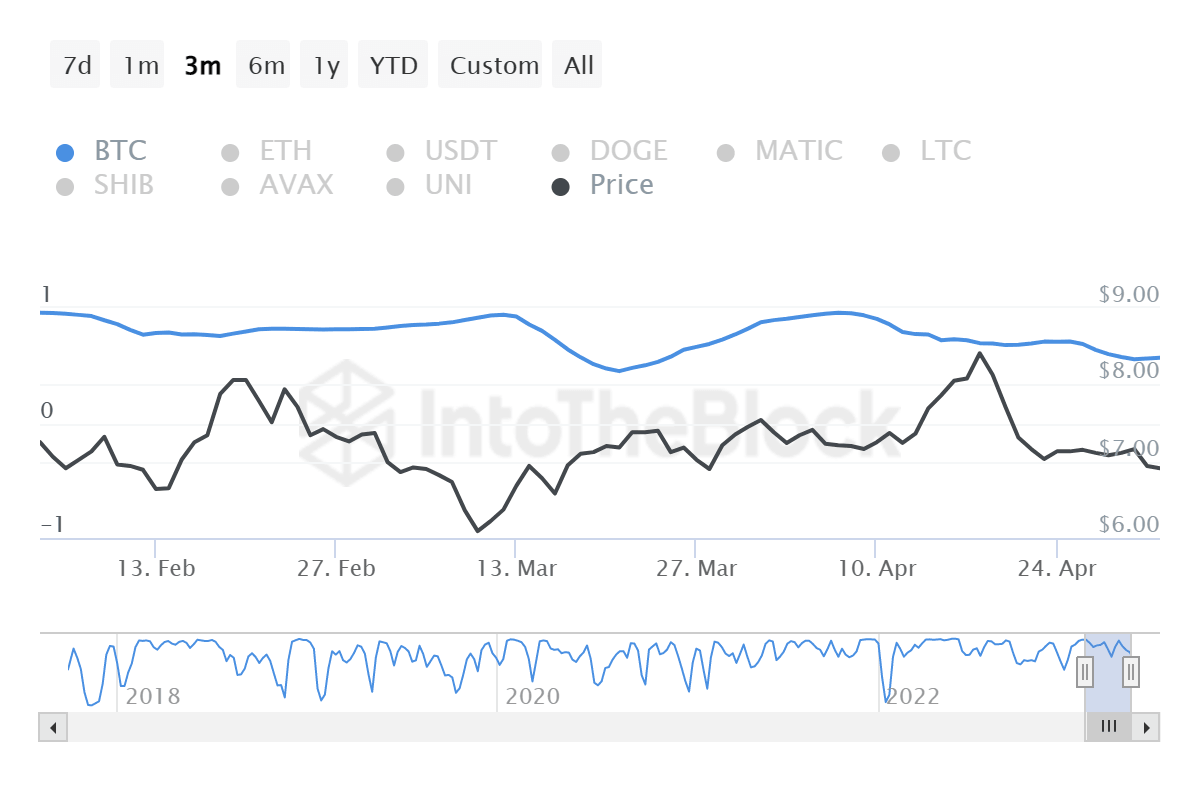

One of the reasons behind this decline is the lack of volatility which is the by-product of a declining correlation with Bitcoin. The correlation, falling from 0.9 at the beginning of April to 0.5 at the time of writing, suggests that the altcoin failed to capitalize on the end-of-April rally that BTC witnessed.

Chainlink-Bitcoin correlation

Thus if Chainlink price volatility climbs back from the monthly lows, it could make LINK susceptible to uncontrolled swings but also give the altcoin a chance to restart a recovery. This is crucial for the altcoin as it is actively losing its whales' confidence, which has been shedding since Q2 began.

Between the second week of April and May 3, a total of almost 5 million LINK worth nearly $35 million has been shed by the addresses holding anywhere between 100,000 to 1 million LINK.

Their supply has decreased from 109 million to 104 million LINK, which is being picked up by smaller wallet holders. The cohort that has a balance of 10,000 to 100,000 LINK has accumulated more than 2 million LINK in the same duration bringing their total holding to 75 million LINK.

Chainlink whales activity

However, since the whales have not essentially dumped their supply aggressively, there is a potential that the cohort might have been minimizing losses or taking profits. Considering the amount of LINK unloaded by these addresses, there is potential that they could accumulate again if the altcoin exhibited signs of sustainable recovery.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B16.54.00%2C%252003%2520May%2C%25202023%5D-638187304666982472.png&w=1536&q=95)