Chainlink price to provide sell opportunity before LINK continues its 20% crash

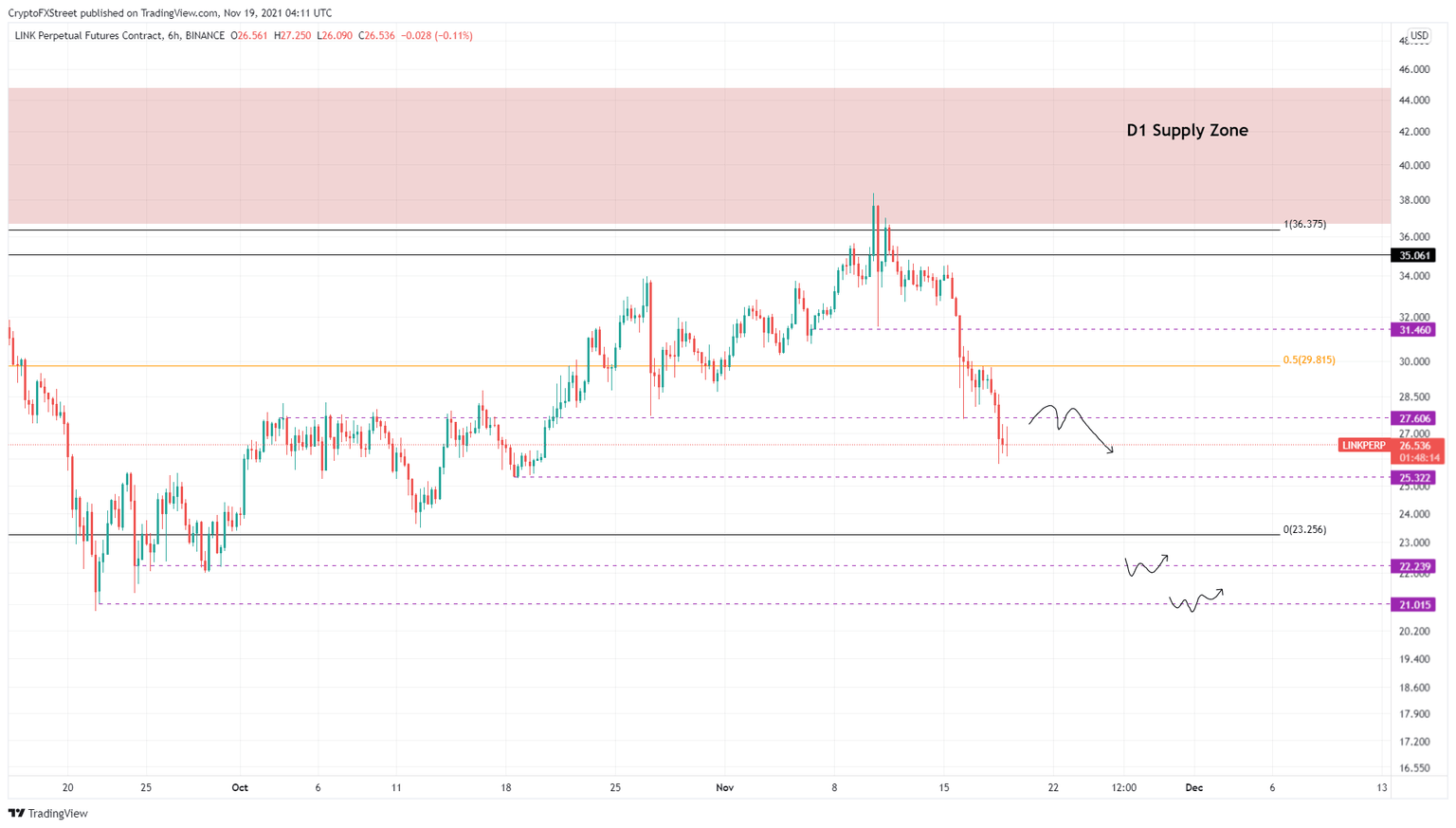

- Chainlink price has slipped past a crucial support level at $29.82, indicating a start to a steeper correction.

- LINK might provide trapped investors a chance to offload at the $27.61 resistance barrier before heading to $22.24.

- A daily close above $31.46 will invalidate the bearish thesis.

-637336005550289133_XtraLarge.jpg)

Chainlink price has seen a massive descent over the past week, and from the looks of it, the bearish regime has a higher probability of continuing. With the big crypto showing weakness, altcoins, including LINK, are likely correct to stable support levels.

Chainlink price prepares for more losses

Chainlink price pierced the 1-day supply zone, ranging from $36.70 to $44.76 on November 10, but failed. This development led to a 31% correction to where LINK currently trades, at $26.54. During this downswing, Chainlink price has not only sliced through the $31.46 support floor but also the 50% retracement level at $29.82.

Since the crypto market looks like it is crumbling under immense selling pressure, market participants can expect Chainlink price to continue going lower. However, investors can expect a relief bounce to retest the $27.61 or $29.82 resistance barriers. This move will allow the buyers to offload their holdings.

A failure to flip these hurdles into support levels will confirm the bearish thesis and trigger Chainlink price to crash 20% to $22.24. This downswing will indicate that LINK will shatter the range low at $23.26.

In some cases, the correction could extend to $21.02, indicating a 24% drop from $27.61.

LINK/USDT 6-hour chart

On the other hand, if Chainlink price produces a daily close above $29.82, it will hint that the buyers are trying for a comeback. However, a confirmation of this upswing and the invalidation of the bearish thesis will arrive after LINK produces a higher high above $31.46.

In this case, LINK could continue its ascent and retest the $35.06 resistance barrier.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.