Chainlink price rise to $20 may be compromised by several technical indicators

- Chainlink price is currently aiming to hit $20 after breaking out of an ascending parallel channel.

- Several indicators are showing potential bearish signs in the short-term.

-637336005550289133_XtraLarge.jpg)

On November 21, Chainlink had a significant breakout above an ascending parallel channel with a lot of continuation from a low of $13.6 to a peak at $16.39 established on Tuesday. However, some bearish signs might stop LINK from climbing higher.

Chainlink facing a lot of selling pressure in the short-term

Despite the massive breakout of the ascending parallel channel, the TD Sequential indicator has just presented a sell signal on the daily chart for the first time since August 8, a validated signal.

LINK/USD daily chart

Additionally, it seems that Chainlink price got significantly rejected from the peak at $16.39, dropping to a low of $14.94 and currently trading at $15.47. The digital asset could be looking at a re-test of the upper boundary of the channel at $14.4.

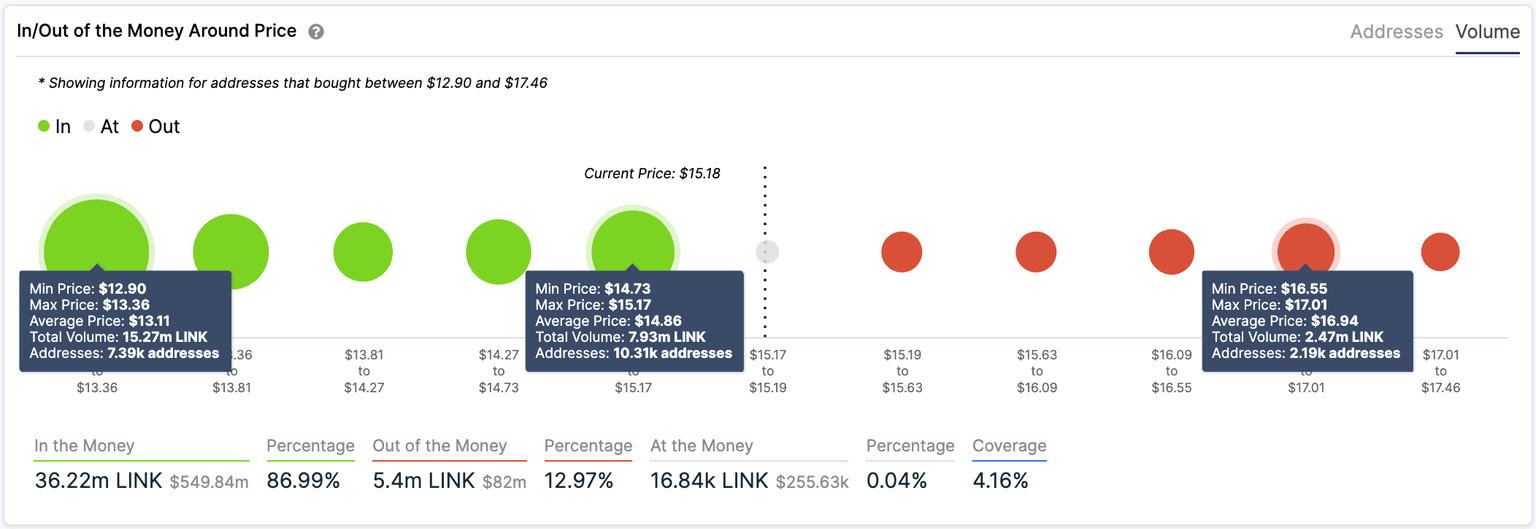

The In/Out of the Money Around Price (IOMAP) chart suggests something similar if selling pressure continues mounting. The most significant support area seems to be located between $14.73 and $15.17, where 10,310 addresses purchased close to 8 million LINK coins.

LINK IOMAP chart

A breakdown below this area can drive Chainlink price towards the next area between $12.9 and $13.39. On the other hand, there seems to be very little resistance to the upside. The initial price target after the breakout of the ascending parallel channel was around $20. The IOMAP chart shows a small resistance area between $16.55 and $17.01.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.