- Chainlink price has been stuck under the $7 mark for more than three weeks now.

- LINK holders are some of the biggest losers in the market, with nearly 500K addresses currently underwater.

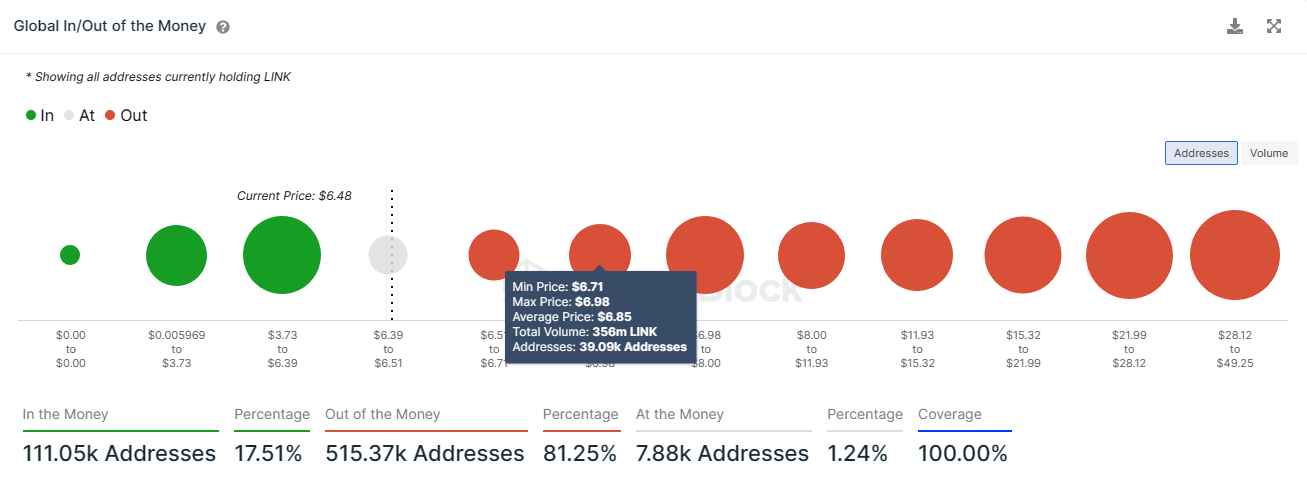

- A demand wall at $6.85 worth over $2.3 billion awaits, breaching which could spell recovery for LINK.

Chainlink price is following the broader market cues like many of the other altcoins in the market. However, one distinct factor of this cryptocurrency network is that the ratio of investors at a loss is far higher than those in profits, making a recovery more crucial for LINK.

Chainlink price needs to hit this level

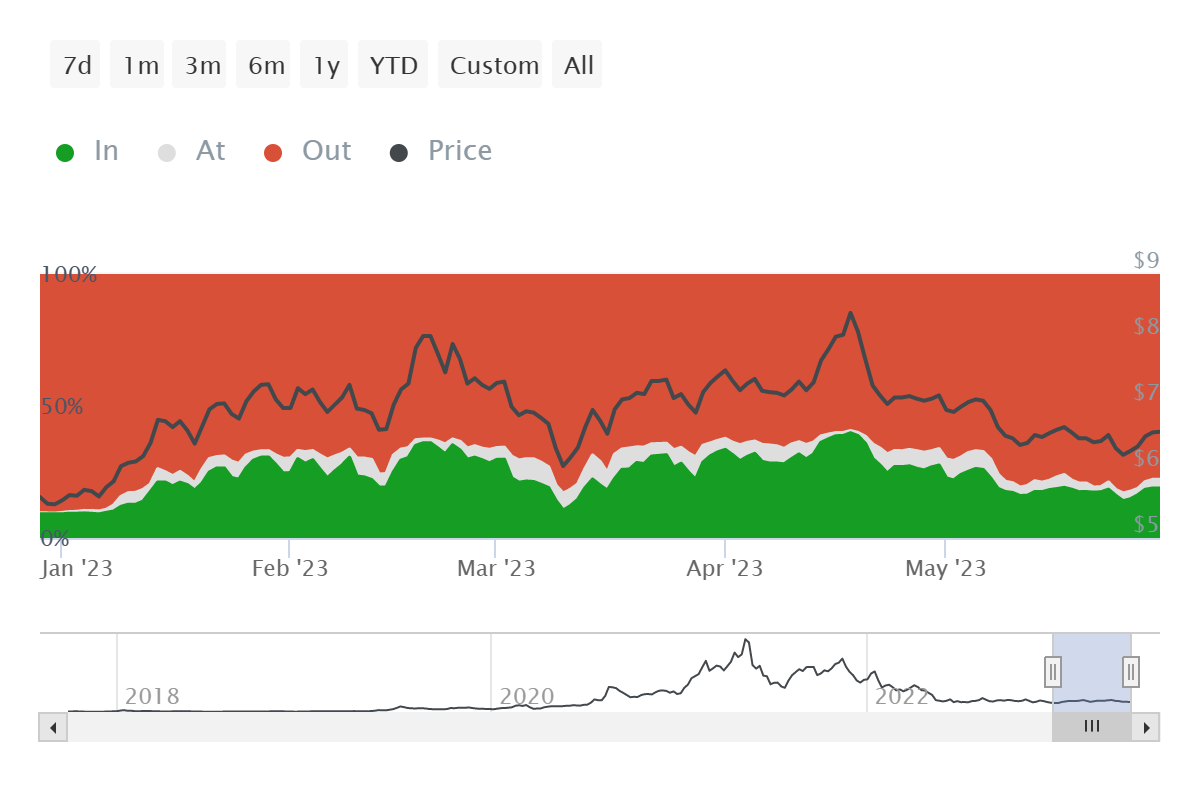

Chainlink price, trading at $6.46, has failed to recover back above $7 following the early May crash. Being stuck under it for nearly three weeks now, the altcoin has left many of its investors desperate for a recovery. These LINK holders happen to be some of the biggest losers in the crypto market, as the majority of them are currently underwater.

LINK/USD 1-day chart

At the time of writing, about 78% of the 623K addresses are sitting in losses awaiting a trigger that could potentially make their supply profitable again.

Chainlink investors at a loss

This trigger would come only when Chainlink price is able to rally by nearly 6% and hit the $6.85 mark. The reason this price level is crucial for LINK is that a demand wall worth $2.3 billion stands here. Some 40K addresses that bought about 356 million LINK tokens at an average of $6.85 stand to make money once the altcoin crosses the aforementioned mark.

Chainlink GIOM

Generally, such events tend to be bullish triggers for an asset, which is critical for Chainlink price right now, as failure in doing so could result in investors exiting the market.

Beyond acting as a catalyst for initiating a buying spree, a rise to $6.85 would also provide Chainlink price with some much-needed support. This price level is just above the 50-day Exponential Moving Average (EMA), which is an important technical indicator.

Sustaining it as a support floor would allow LINK to have a shot at breaching the $7 level and eventually hit the 200-day EMA at $7.10. A daily candlestick close above the latter would bring Chainlink price to April levels and also support the eventual recovery of the mid-April 17% crash.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Price Forecast: BTC misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

$18 billion in Bitcoin and Ethereum options expire today: Market braces for big moves

A record-breaking $18 billion in Bitcoin and Ethereum options expire today, sparking anticipation of sharp market moves and potential volatility.

Crypto.com launches US trust company for digital asset custody

Crypto.com launches a US trust company to offer digital asset custody services, marking a major step in its North American expansion strategy.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.