Chainlink Price Prediction: LINK poised to hit $20 as Open Interest rises by 104%

- Chainlink price has seen a 54% rise in the span of 12 days, enabling a breach of the 17-month-old resistance level.

- Rising use cases have resulted in increased revenue, which, combined with Chainlink’s treasury, has imbued bullishness in the investors.

- This is evident in the total LINK Futures Open Interest, which shot up by 104% in less than two weeks.

Chainlink price has emerged as one of the best-performing assets in the past couple of days, which has led its investors to believe a further increase is imminent. Consequently, a sudden shift in tone has been observed in the derivatives market, which makes LINK an important asset going forward.

Chainlink price could explode

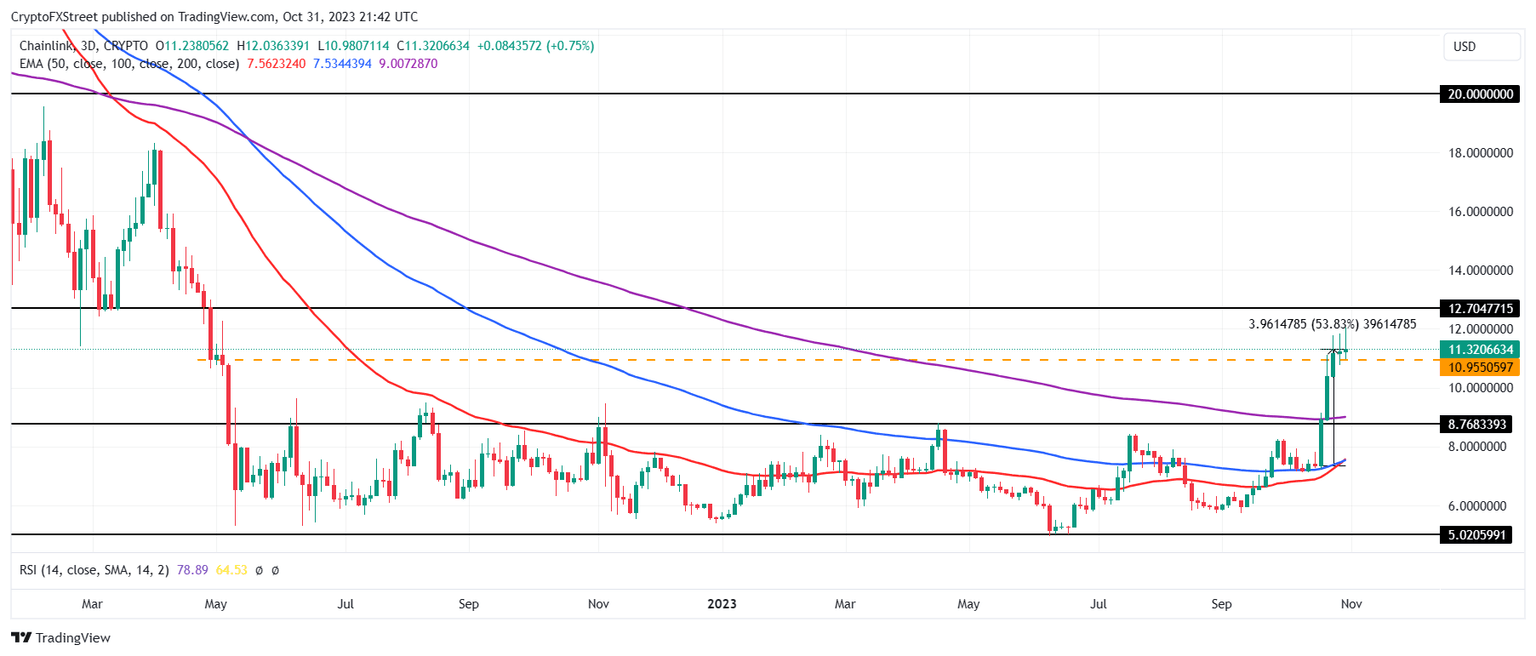

Chainlink price trading at $11.32 has noted a rise of nearly 54% in less than two weeks. This rally has not only reignited the demand for LINK in the market but also helped it breach a crucial barrier that had the token trapped for over 17 months. Since May 2022, LINK has made multiple attempts and failed to flip $8.76 into a support zone, but following such a long consolidation, a rally was due.

Investors have been holding out this opinion, even suggesting that Chainlink price is not done rising and that there is room for another 77% increase. This rally would send LINK to $20, although the likeliness of the same happening depends on multiple factors that could only be satisfied during a bull market.

Nevertheless, the drive to see Chainlink price hit this mark will increase the demand, pushing the value of the altcoin beyond the $12.70 resistance level.

LINK/USD 3-day chart

But on the off chance that the broader market cues fail to justify the hype, LINK could lose the support of $10.95 and slip back down to $8.76. This former 17-month-old barrier rests slightly below the 200-day Exponential Moving Average (EMA), and losing either of these would completely invalidate the bullish thesis on a macro timeframe.

Demand for Chainlink is surprisingly high

The reason why a bullish outlook seems more probable is the evidence present on-chain. One of the best measures of an asset’s demand is the amount of money poured into it in the derivatives market. In the case of LINK, the Futures Open Interest (OI) recently rose to $308 million.

This is a 104% increase from the previous average of $151 million, which suggests that LINK is on traders’ watchlist. While this does not determine whether the increased OI reflects long or short contracts, based on recent events, the likeliness of Longs exceeding shorts is higher.

Chainlink Futures Open Interest

Furthermore, Chainlink is one of the most well-funded blockchain companies in the crypto industry. Beyond the token holding a market capitalization of $6.3 billion, Chainlink also has the fifth-largest Treasury value worth over $800 million.

Plus, the increased use cases of Oracles have resulted in the protocol bringing in higher revenue. Over the past month, the total fees collected on the chain hit $180,000, while the total revenue generated surpassed $110 million.

Chainlink accrues fees and rewards through several methods:

— Jake Pahor (@jake_pahor) October 30, 2023

• CCIP

• Keepers

• Requests

• VRF V1

• VRF V2

In the past 30d, Chainlink has generated:

• $180k in fees

• $111k in revenue

This places it at the top among other oracles and 71st overall according to DeFiLlama. pic.twitter.com/Js28PyQvf3

This speaks to the potential of the asset in the market, which could be enough to push Chainlink price to $20 during a bull market.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.