Chainlink Price Prediction: LINK could reach $25 if this critical resistance level is broken

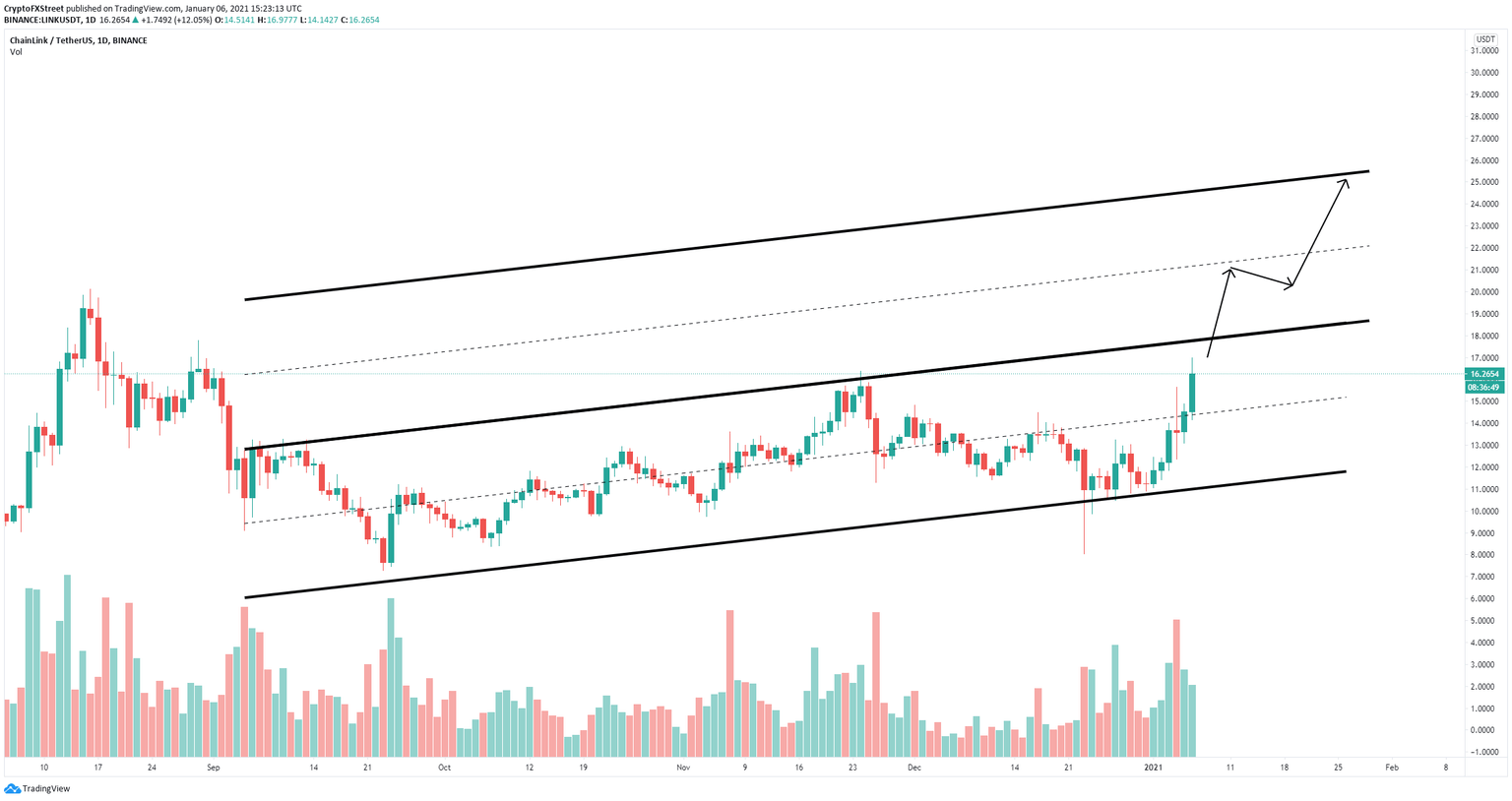

- Chainlink price has formed another daily ascending parallel channel.

- A breakout above the crucial resistance level at $18 can quickly push LINK towards $25.

- The digital asset could face a short-term pullback before a breakout.

-637336005550289133_XtraLarge.jpg)

Chainlink had a massive drop on December 23, 2020, from a high of $12.86 to a low of $8. However, bulls managed to buy the dip and pushed LINK towards $13.24 within the next week. The current price of the digital asset is $16.3.

Chainlink price could hit $25 but might face a short-term correction

Chainlink price is up 110% since the dip to $8 on December 23. LINK has established a new ascending parallel channel on the daily chart and it’s close to the upper trendline resistance level at $18.

LINK/USD daily chart

LINK has established and confirmed a daily uptrend and aims to crack the resistance point at $18. A breakout above this level can quickly drive Chainlink price towards $22 and eventually to the $25 price target.

LINK IOMAP chart

The In/Out of the Money Around Price (IOMAP) chart shows practically no resistance ahead in comparison to the support below, adding credence to the bullish outlook.

LINK/USD 9-hour chart

However, the TD Sequential indicator has just presented a green ‘8’ candle on the 9-hour chart, which should be followed by a sell signal. Confirmation of the call could push Chainlink price towards $13.27, which is a strong support level according to the IOMAP chart.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.