Chainlink Price Prediction: LINK could double its market value if it overcomes this weekly barrier

- Chainlink price is confronting the weekly supply zone between $16.221 and $18.080 since November 6.

- LINK could race to the $34.000 psychological level if it managed to overcome the supply barrier.

- A break and close below $13.330 support level on the weekly timeframe would invalidate the bullish thesis.

-637336005550289133_XtraLarge.jpg)

Chainlink (LINK) price remains trapped within a weekly supply barrier for almost two full months, confronting a critical barrier that will play a pivotal role in the next directional bias for the cryptocurrency.

Also Read: Chainlink prioritizes Real World Asset Tokenization in 2024, LINK price eyes comeback to $16

Chainlink poised for double-digit gains if this level is breached

Chainlink (LINK) price is confronting the supply zone, extending between $16.221 and $18.080, with the barrier holding since November 6. To confirm the continuation of the uptrend, the Ethereum-based network must record a candlestick close above the midline of the order block at $17.163 on the weekly timeframe.

The Relative Strength Index (RSI) shows that momentum is still rising, as it remains inclined to the north. Similarly, the Awesome Oscillator (AO) remains well in the positive territory showing the bulls are leading the market.

Enhanced buyer momentum could see Chainlink price flip the weekly supply zone into a bullish breaker before a possible extension, with the next logical target being the $34.000 psychological level.

LINK/USDT 1-week chart

On-chain metrics supporting Chainlink bullish outlook

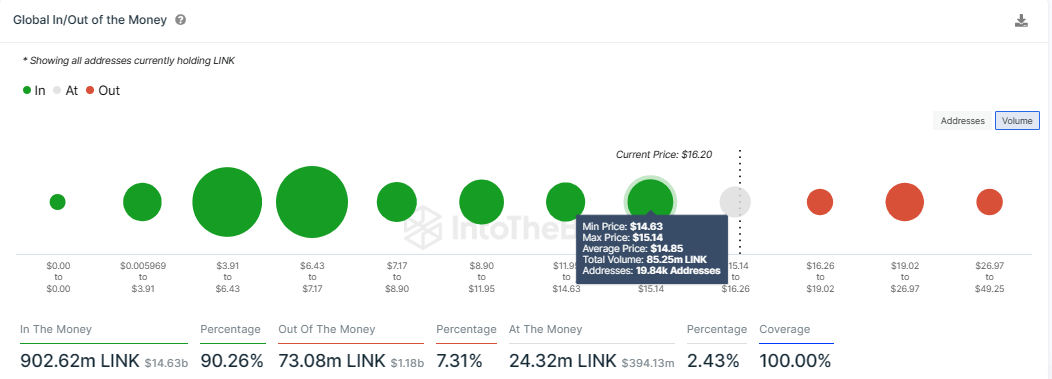

On-chain aggregator IntoTheBlock’s Global In/Out of the Money (GIOM) metric shows that Chainlink price has more robust support downward than it faces upward resistance. The first line of defense lies between $14.630 and $15.140 where 19,840 addresses hold approximately 85.25 million LINK tokens bought at an average price of $14.850.

The metric also shows that at current rates, 90.26% of LINK holders are sitting on unrealized profit (in the money), while only 7.31% of token holders suffer unrealized losses (out of the money). Meanwhile, 2.43% of LINK holders are breaking even (at the money).

As long as there are more holders in the profit, the upside potential will remain alive even as the market anticipates a bullish 2024 that is only days away.

LINK GIOM

Behavior analytics platform Santiment also supports the bullish thesis with its daily active addresses metric showing consistent climb between December 17 and December 29, moving from 3274 to 5324. This represents a 63% climb representing a significant increase in the number of unique addresses involved in LINK-related transaction.

The Tether (USDT) market capitalization and the active stablecoin deposit metrics are also rising, suggesting a continuous flow of fresh capital into the LINK market, interpreted as an intention to buy.

LINK Santiment: Active stablecoin deposits, USDT market cap, daily active addresses

On the flip side, if the supply zone continues to hold as resistance, Chainlink price could drop, potentially losing the immediate support at $13.330. A decisive candlestick close below this level on the weekly timeframe would invalidate the bullish outlook.

In the dire case, the slump could see Chainlink price descend further, going as low as the $8.912 support, below which it would fold back into the consolidation phase. In the extreme case of a sell-off, LINK market value could extend a leg lower, below the $5.565 support floor to potentially collect the buy-side liquidity that resides underneath.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B00.53.08%2C%252029%2520Dec%2C%25202023%5D-638393978186629145.png&w=1536&q=95)