Chainlink Price Prediction: LINK continues its 20% rally to record levels after a pullback

- Chainlink price continues its climb despite a 13% correction on February 10.

- A decisive close above the $27 resistance level could catapult LINK to a new all-time high at $32.

- On-chain data suggests increasing whale activity providing a bullish confirmation to the incoming rally.

-637336005550289133_XtraLarge.jpg)

Chainlink announced on February 10 that its feeds can now fetch Foreign Exchange [FX] prices that are highly secure and tamper-proof. These FX prices can be combined with DeFi allowing developers to create and offer a range of products that are available only in the traditional finance sector.

This move could be the first step to potentially onboard FX markets that have an average daily volume of $7 trillion onto DeFi.

Chainlink price targets a new all-time high of $32

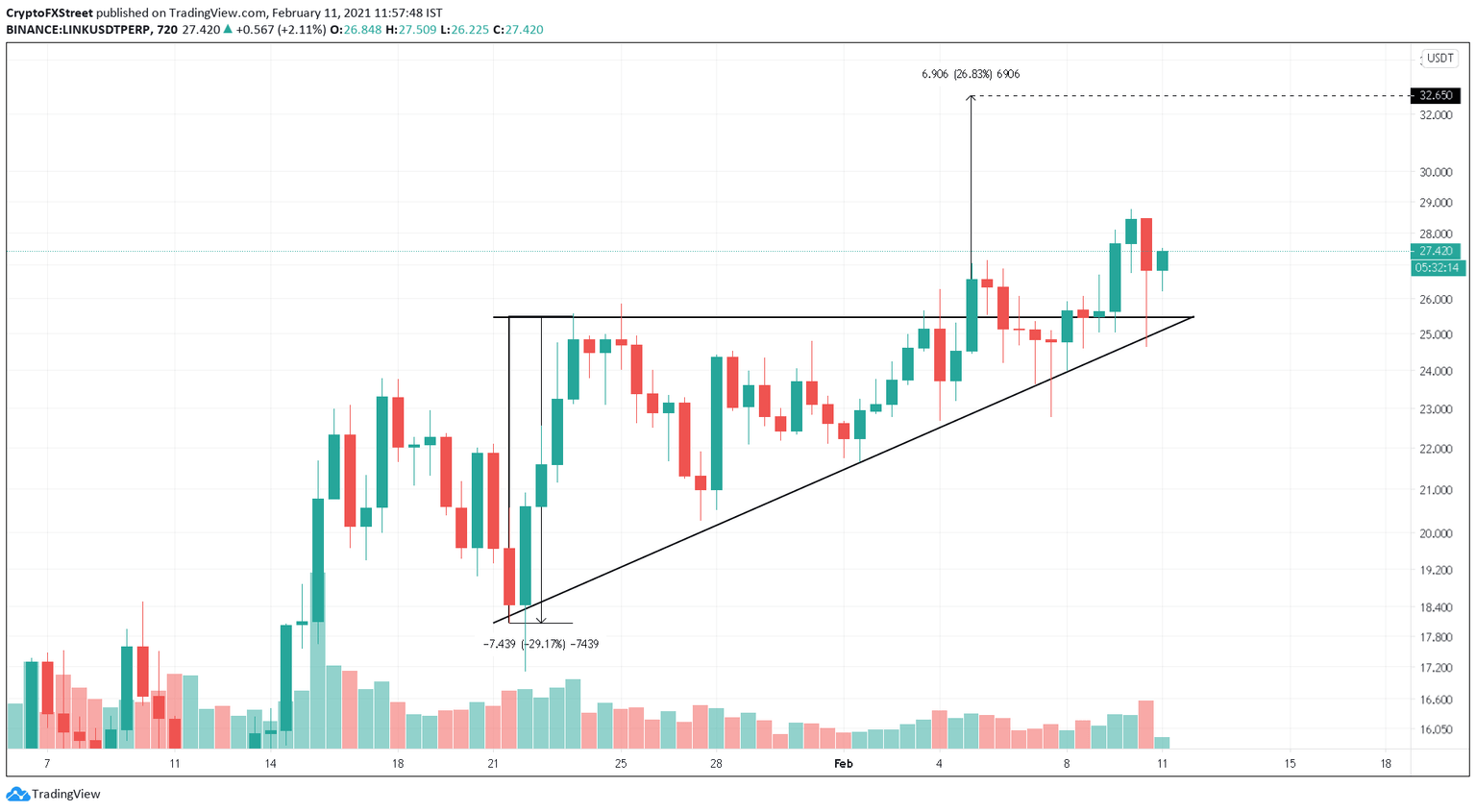

Chainlink price closed above an ascending triangle on February 5 and hence predicted a 30% upswing from this continuation pattern. Despite the market-wide correction, LINK's rally to an all-time high is still intact, with an updated target of 20%.

LINK/USDT 4-hour chart

The bullish thesis holds when looking at IntoTheBlock's In/Out of the Money Around Price (IOMAP) model. This on-chain metric shows a minor resistance barrier at $27, where 440 addresses bought 435,000 LINK. Hence, a decisive close above this level on the 4-hour confirms the oracle token's climb to new highs.

Chainlink IOMAP chart

Sentiment's Whale holders distribution metric clocked a 4% uptick in the number of whales holding 1 million to 10 million LINK. This accumulation indicates whales' investment interest in Chainlink around the current price levels.

Therefore an increased buying pressure could easily push the LINK above the immediate resistance at $27 and catapult the token to new highs.

%2520%5B09.24.53%2C%252011%2520Feb%2C%25202021%5D-637486389436365925.png&w=1536&q=95)

Chainlink Whale Holders Distribution chart

Despite the mounting buying pressure behind Chainlink, investors must remain cautious due to the high volatility of this digital asset. A sudden sell-off that sends LINK below the triangle's x-axis at $25.5 will invalidate the bullish thesis and lead to a steep correction.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.