Chainlink Price Prediction: Failure to find support could lead to a $5 LINK

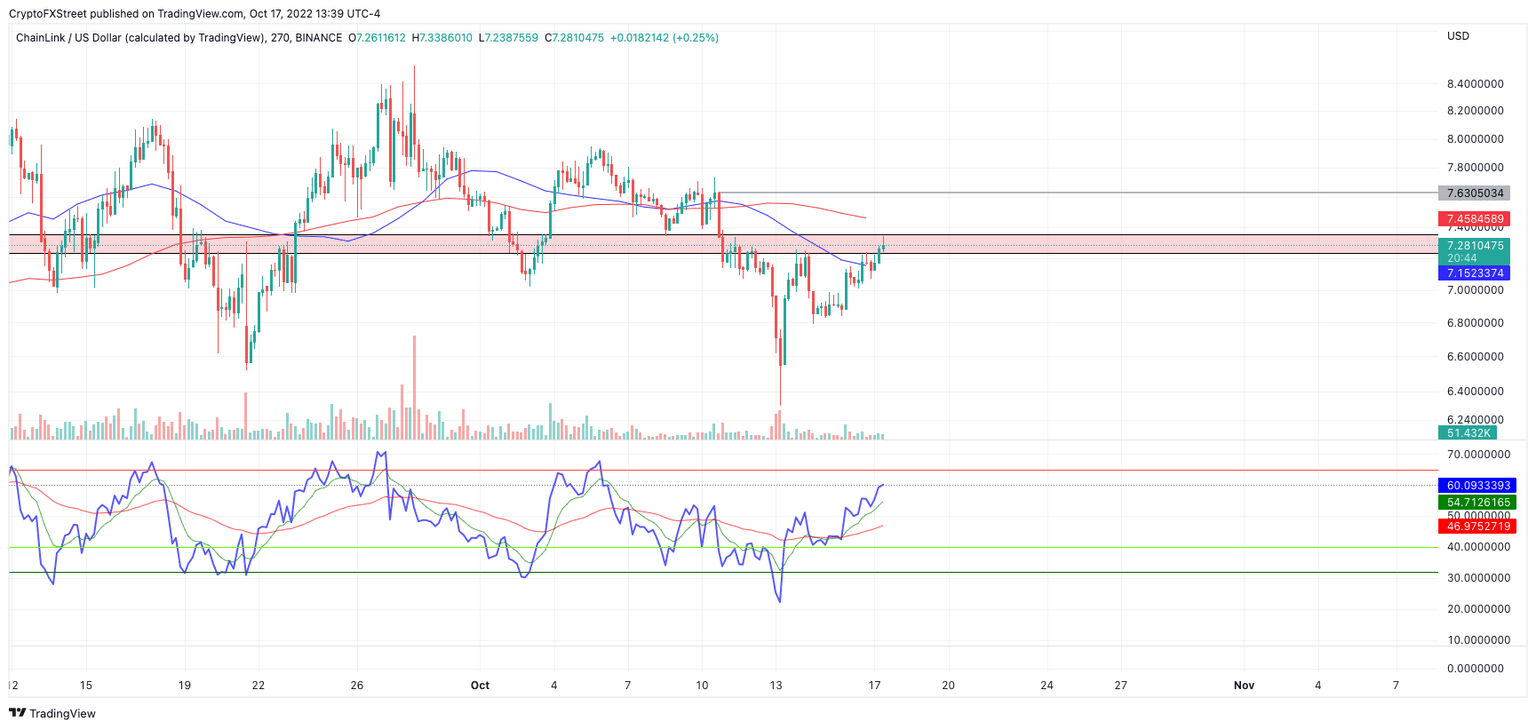

- Chainlink's price is struggling to hurdle a newfound resistant level.

- The Volume Profile Indicator shows bulls gaining ground with shallow hands behind them.

- Invalidation of the bearish thesis is a breach above $7.62.

-637336005550289133_XtraLarge.jpg)

Chainlink price may be in for difficult times. The technicals show multiple reasons to justify bears entering the market soon.

Chainlink price could sweep the lows

Chainlink price is showing evidence of a weakening countertrend rally. The current uptrend retaliation post-weekend decline may be the final move north before a much stronger sell-off ensues.

Chainlink price currently trades at $7.26. The bulls are trying to hurdle a recently flipped support zone, which has become a resistant barrier since the CPI-induced sell-off last week.

LINK/USDT 4-Hour Chart

During the current attempt higher, the bulls have very little volume. The lack of bullish involvement on the Volume Profile Indicator compounds the idea that the recently established September lows at $6.32 are in jeopardy.

The Relative Strength Index shows a bearish divergence between the Friday afternoon high and the current level and is in justifiable territory for sidelined bears to begin negotiating. If the market is genuinely bearish, a plummet toward the psychological $5 level could occur as a result of the lack of strength in the market.

The bulls may be in for a rude awakening if market conditions persist. The bearish thesis will be deemed invalid if the bulls can produce a breach of the thrust candle at $7.62. Doing so could result in a 60% rally towards previously broken support at $15.

In the following video, our analysts deep dive into the price action of Solana, analyzing key levels of interest in the market - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.