Chainlink price on the verge of a new all-time at $33 high if this pattern turns bullish

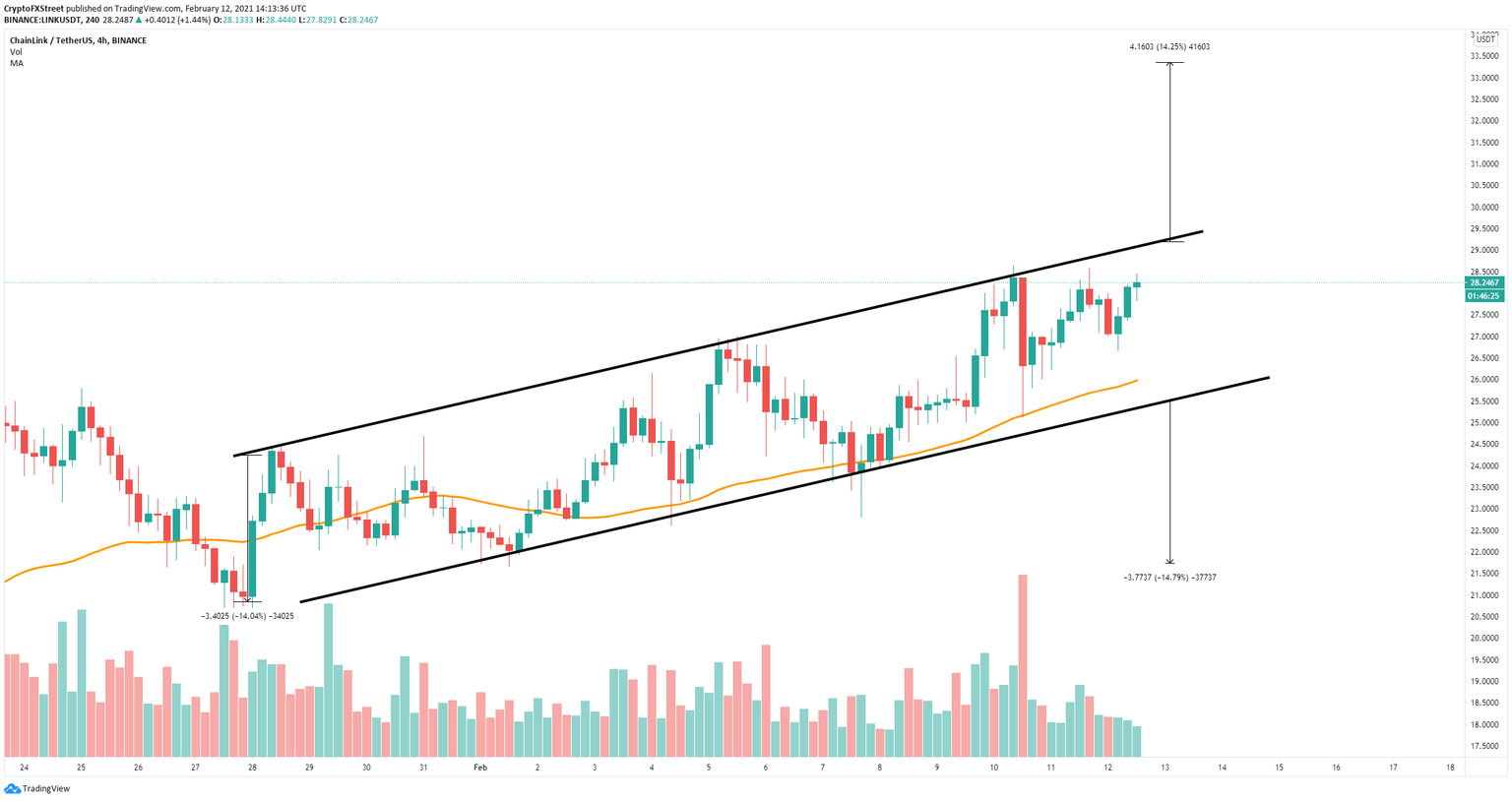

- Chainlink price is currently contained inside an ascending parallel channel on the 4-hour chart.

- The digital asset is close to a new all-time high above $28.6.

- The bullish momentum indicates that a breakout is more likely for LINK.

-637336005550289133_XtraLarge.jpg)

Chainlink has topped out at around $28.4 three times in the past 48 hours. This resistance level is stopping the digital asset from reaching new all-time highs. However, the bullish momentum remains strong and a breakout above $29 would quickly drive Chainlink price up to $33.

Chainlink price faces one critical resistance level before new all-time highs

On the 4-hour chart, Chainlink has formed an ascending parallel channel with the upper resistance trendline at $29. A breakout above this point would quickly drive Chainlink price up to $33.

LINK/USD 4-hour chart

However, before the breakout, LINK bulls also face a key resistance level at around $28.4, which has rejected the price three times in the past two days. Climbing above this point decisively would push the digital asset to $29 and into a potential breakout.

On the other hand, another rejection from $28.4 can push Chainlink price down to the lower boundary of the pattern at $26, which coincides with the 50-SMA support level. Losing this key support point would drive Chainlink price down to $21.7, a 15% move calculated by using the height of the parallel channel as a reference point.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.