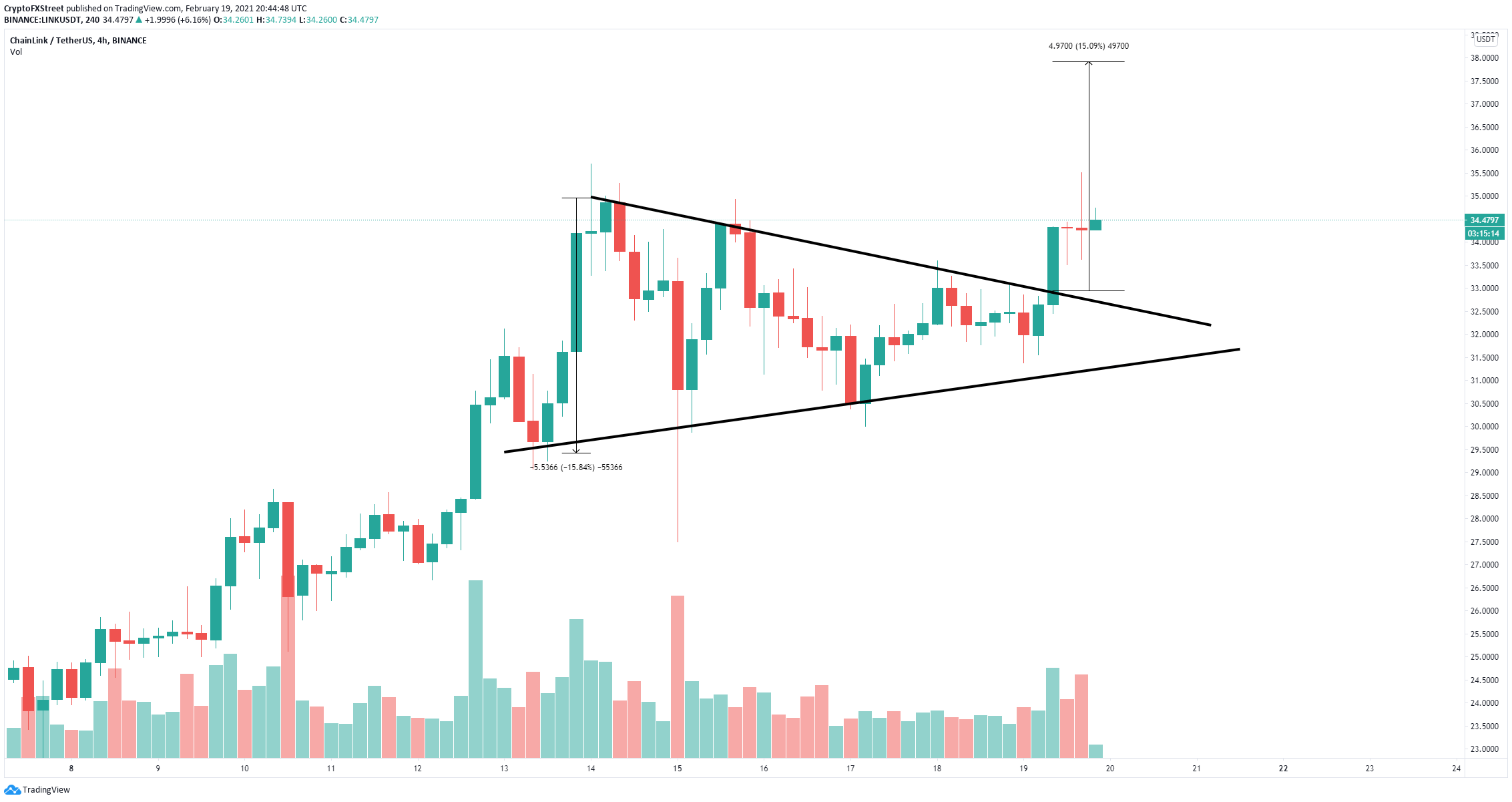

- Chainlink price had a significant breakout from a symmetrical triangle pattern.

- The digital asset has a price target of $38 in the long-term.

- Large Chainlink holders have taken profits from their positions.

Chainlink price just had another significant breakout towards $35.5, almost beating the all-time high of $35.69 established on February 14. Nonetheless, the bullish momentum continues as LINK aims for $38 in the long-term.

Chainlink price on the verge of a 10% move

Chainlink had a breakout from a symmetrical triangle pattern on the 4-hour chart with a price target of $38. After a brief pause at $35.5, it seems that LINK is ready to resume the bullish momentum.

LINK/USD 4-hour chart

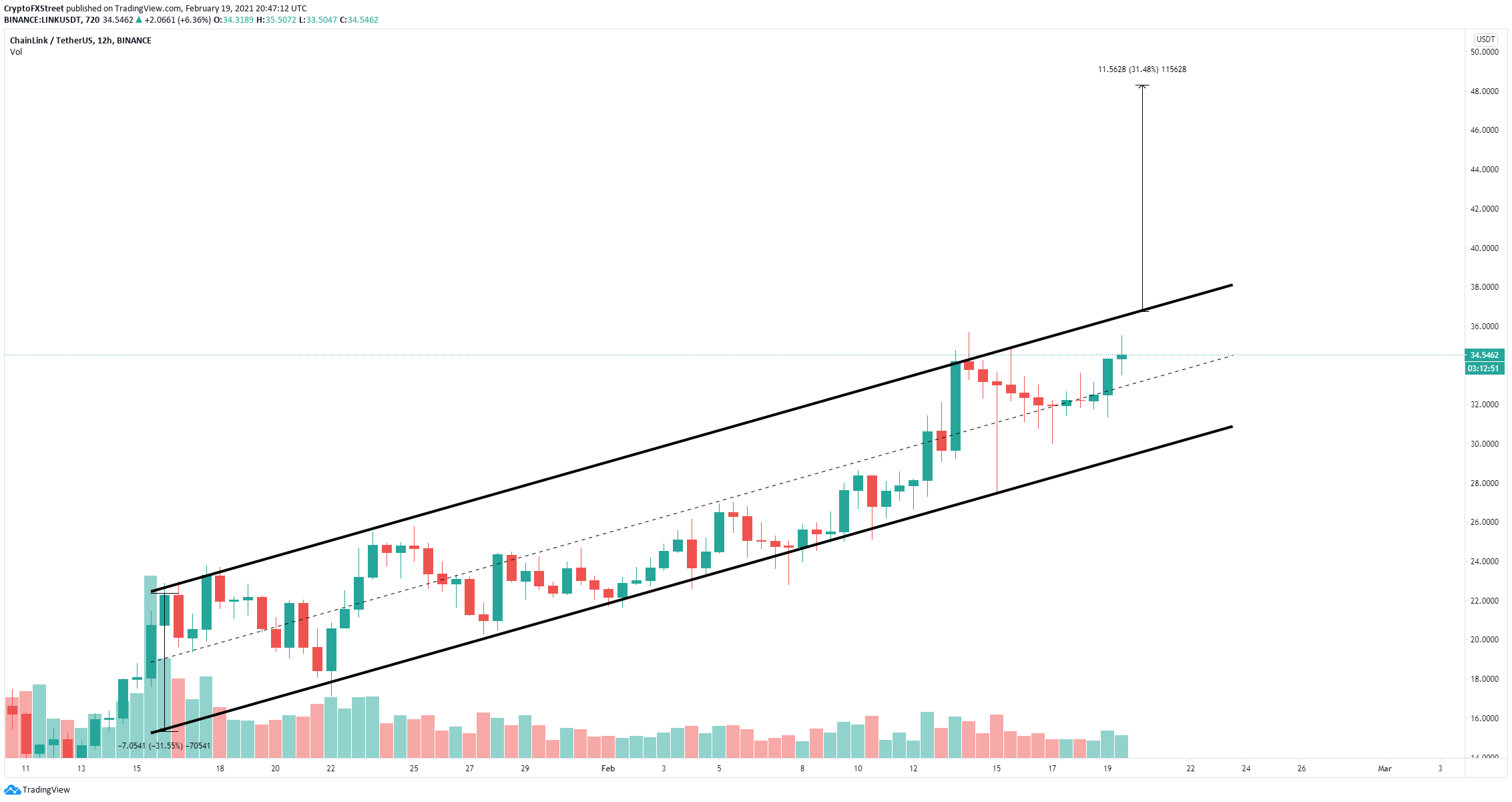

In the longer-term, Chainlink could be aiming for more. On the 12-hour chart, the digital asset remains contained inside an ascending parallel channel with a resistance trendline located at $36.67. A breakout above this point has the potential to drive Chainlink price towards $48.3.

LINK/USD 12-hour chart

However, the concentration of whales holding Chainlink has significantly diminished in the past two weeks. Large holders with 100,000 to 1,000,000 LINK ($3,500,000 to $35,000,000) have exited the network, from a peak of 283 holders on February 3 to 262 currently.

LINK Holders Distribution chart

This metric indicates that whales have been taking profits as they probably expect the digital asset to see a pullback eventually.

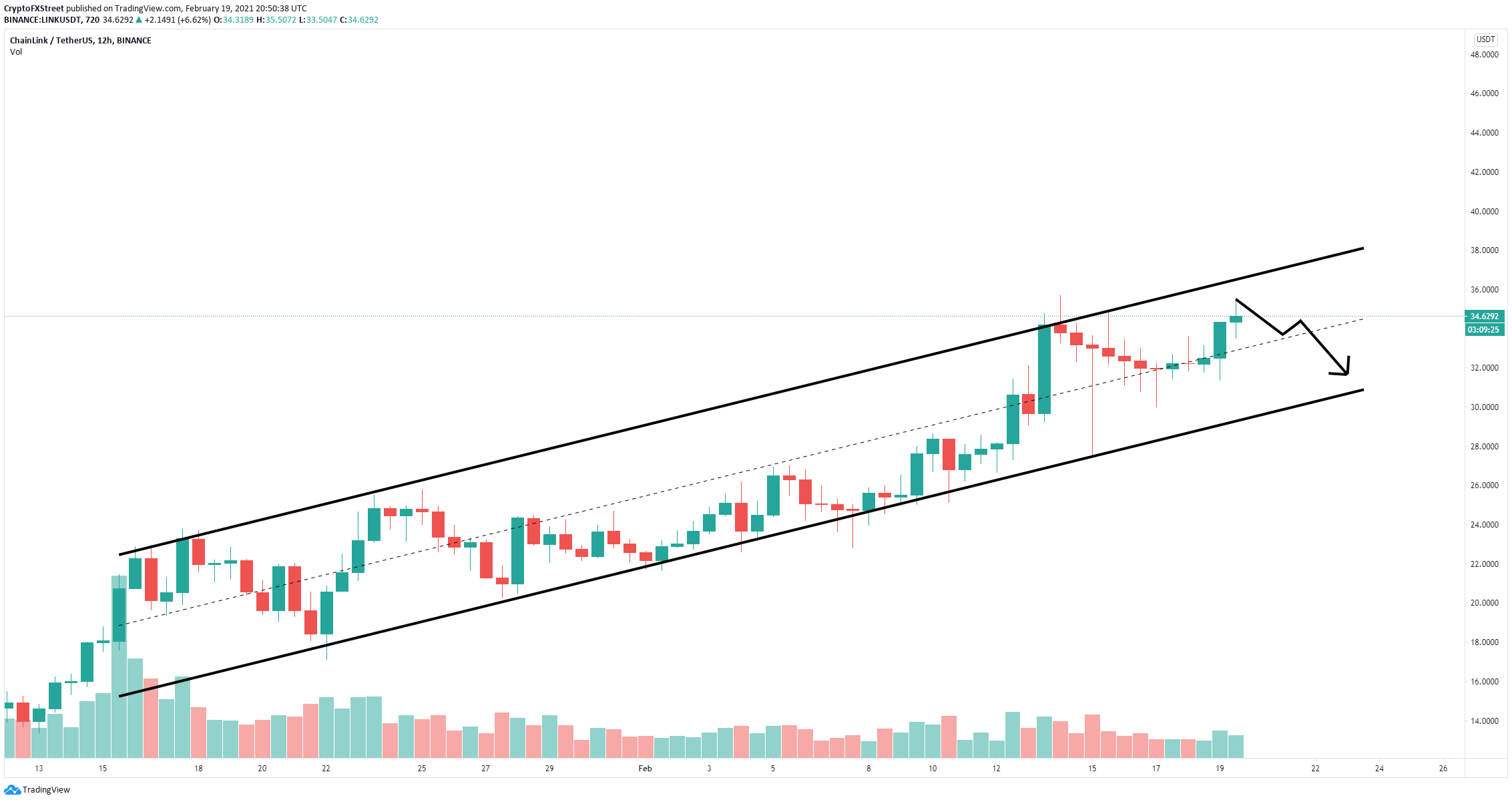

LINK/USD 12-hour chart

A rejection from the upper trendline of the ascending parallel channel at $36.6 would push Chainlink price down to $31.6, which is the lower boundary of the pattern.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP Price Prediction: How Ripple's alignment with the $18.9T tokenization boom could impact XRP

Ripple (XRP) approached the critical $2.00 level during the Asian session on Friday after a minor correction the previous day reinforced higher support at $1.95.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH show weakness while XRP stabilizes

Bitcoin (BTC) and Ethereum (ETH) prices are hovering around $80,000 and $1,500 on Friday after facing rejection from their respective key levels, indicating signs of weakness. Meanwhile, Ripple (XRP) broke and found support around its critical level.

Can Trump's tariff pause and declining inflation keep Bitcoin afloat? Experts weigh in

Bitcoin (BTC) dived below $80,000 on Thursday despite US Consumer Price Index (CPI) data coming in lower than expected and President Donald Trump's 90-day reciprocal tariffs pause on 75 countries.

Bitcoin miners scurry to import mining equipment following Trump's China tariffs

Bitcoin (BTC) miners are reportedly scrambling to import mining equipment into the United States (US) following rising tariff tensions in the US-China trade war, according to a Blockspace report on Wednesday.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[21.48.30,%2019%20Feb,%202021]-637493647139890705.png)