Chainlink Price Forecast: LINK ready for 50% breakout if critical support holds

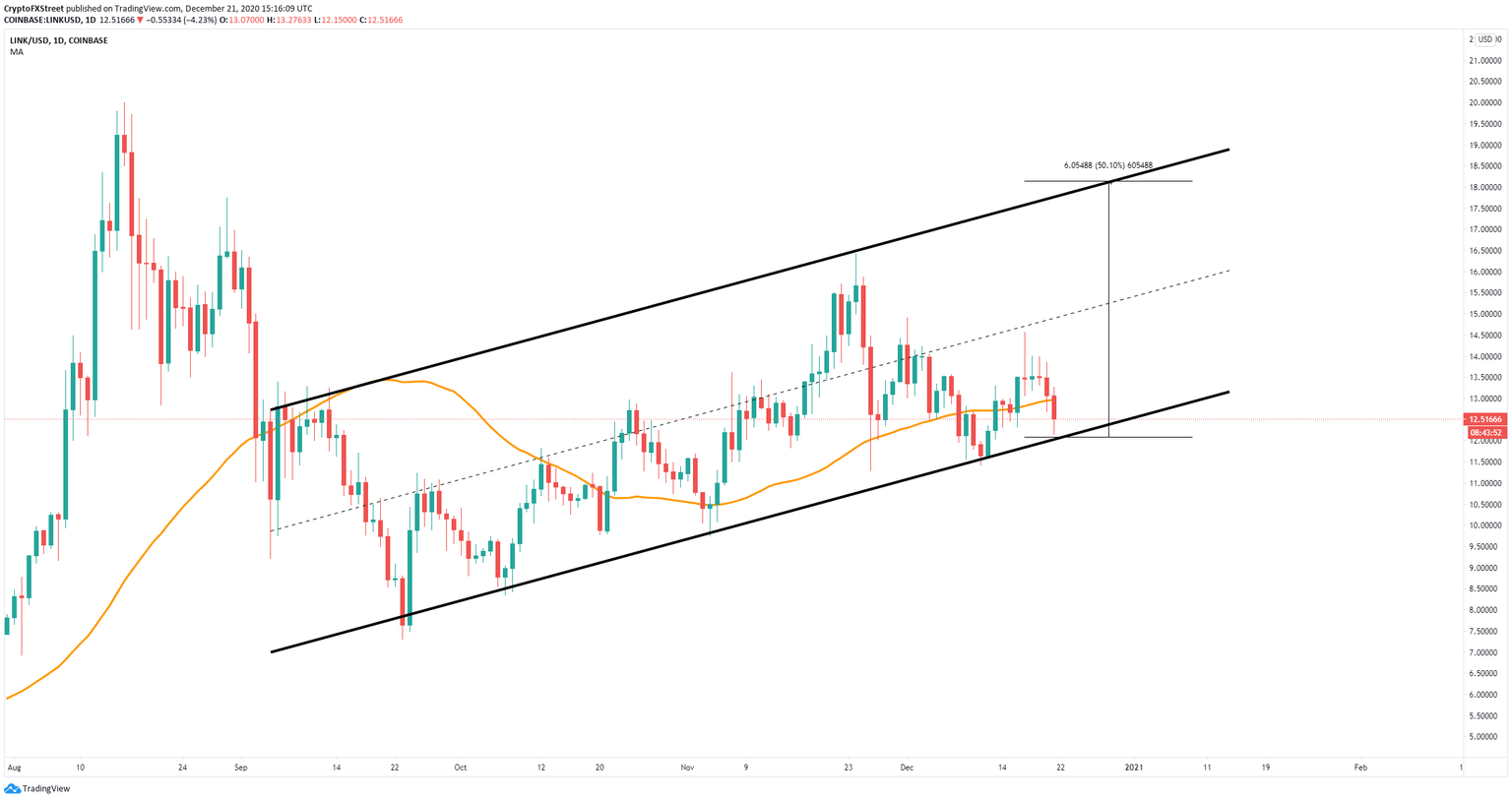

- Chainlink price remains bounded inside an ascending parallel channel on the daily chart.

- Bulls continue defending the lower support, indicating LINK is poised to rebound.

-637336005550289133_XtraLarge.jpg)

Chainlink seems poised to bounce off from a crucial support level if history repeats itself.

Chainlink price targets $18

Despite the recent sell-off from $13.27 to $12.15, LINK bulls remain in control of the daily uptrend. Chainlink price established a higher high at $14.56 and a higher low at $12.31 compared to previous levels. Now, the decentralized oracles token needs to move above the 50-day SMA at $13 to advance further.

If LINK price closes above the 50-day SMA, it will aim for an initial price target of $15.2 which is where the channel's middle trendline sits. Slicing though this hurdle could see it aim for the pattern's upper boundary at $18.

LINK/USD daily chart

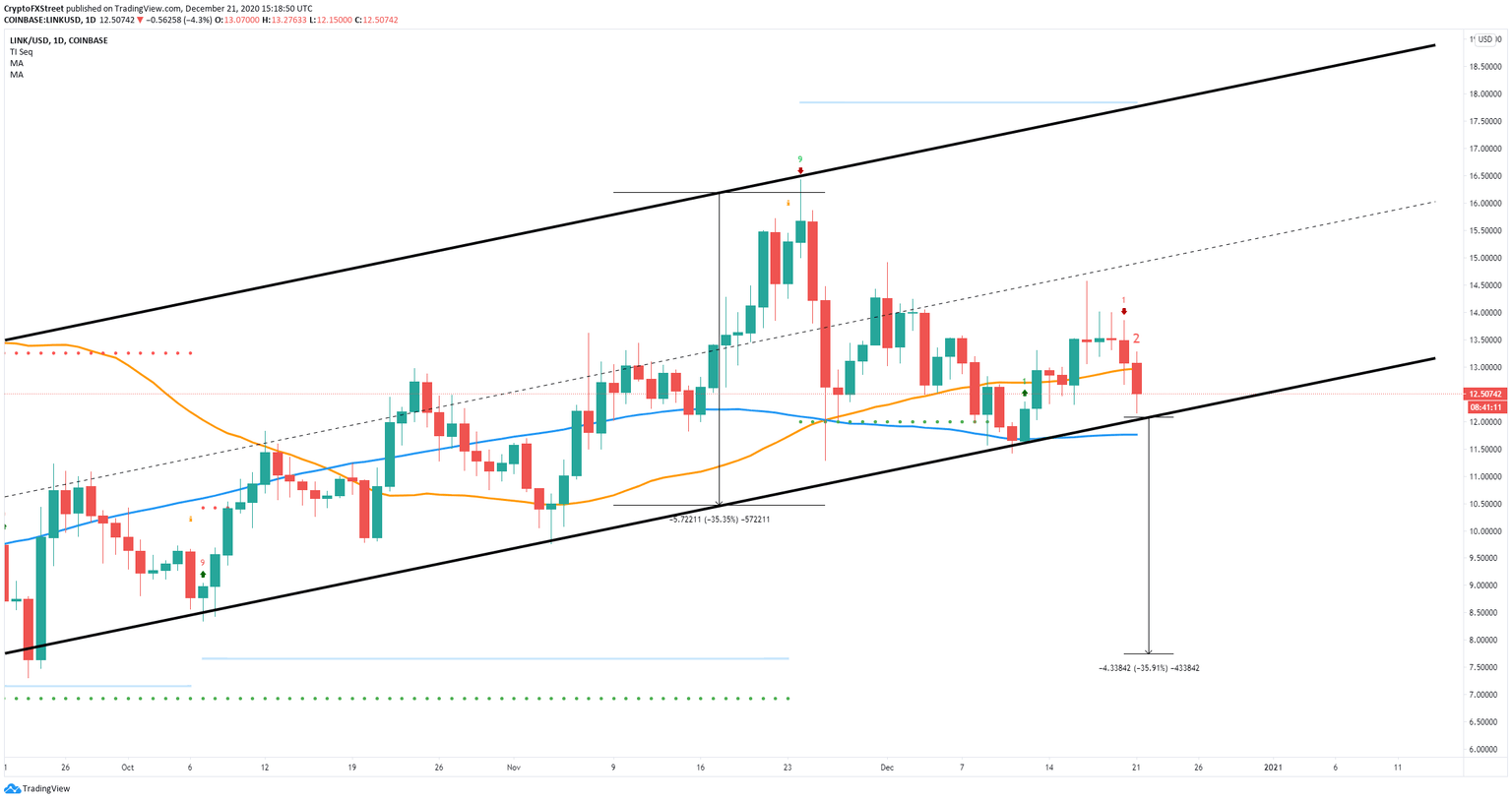

Nonetheless, the TD Sequential indicator recently presented a sell signal on LINK's daily chart.

The bearish formation appears to have been validated as a red two candlestick has emerged. The TD setup anticipates another two daily candlesticks correction that could see Chainlink price test the 100-day SMA for support before it rebounds to the targets previously mentioned.

LINK/USD daily chart

It is worth noting that a breakdown below the critical support level at $12 may invalidate the optimistic outlook. If this were to happen, Chainlink price can drop by more than 30% towards $7.74.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.